A cross-border arrangement becomes reportable only if certain characteristics or features are present, referred to as ‘hallmarks.‘ Since most EU Member States have transposed definitions of hallmarks into their domestic mandatory disclosure regime in line with DAC6, we will provide an overview in which we outline the different hallmarks as defined in DAC6.

Main Benefit test

Please note that some hallmarks are linked to the Main Benefit test. This means that certain hallmarks only make an arrangement reportable if it passes that Main Benefit test, which is fulfilled if it is reasonable to conclude that the main benefit or one of the main benefits of an arrangement is obtaining a tax advantage. This will be the case if such a tax advantage is more than merely incidental.

The following categories of hallmarks will be discussed below:

Category A: generic hallmarks linked to the Main Benefit test;

Category B: specific hallmarks linked to the Main Benefit test;

Category C: specific hallmarks related to cross-border transactions (some linked to the Main Benefit test);

Category D: specific hallmarks concerning automatic exchange of information and beneficial ownership; and

Category E: specific hallmarks concerning transfer pricing.

A cross-border arrangement becomes reportable only if certain characteristics or features are present, referred to as ‘hallmarks.‘ Since most EU Member States have transposed definitions of hallmarks into their domestic mandatory disclosure regime in line with DAC6, we will provide an overview in which we outline the different hallmarks as defined in DAC6.

Main Benefit test

Please note that some hallmarks are linked to the Main Benefit test. This means that certain hallmarks only make an arrangement reportable if it passes that Main Benefit test, which is fulfilled if it is reasonable to conclude that the main benefit or one of the main benefits of an arrangement is obtaining a tax advantage. This will be the case if such a tax advantage is more than merely incidental.

The following categories of hallmarks will be discussed below:

Category A: generic hallmarks linked to the Main Benefit test;

Category B: specific hallmarks linked to the Main Benefit test;

Category C: specific hallmarks related to cross-border transactions (some linked to the Main Benefit test);

Category D: specific hallmarks concerning automatic exchange of information and beneficial ownership; and

Category E: specific hallmarks concerning transfer pricing.

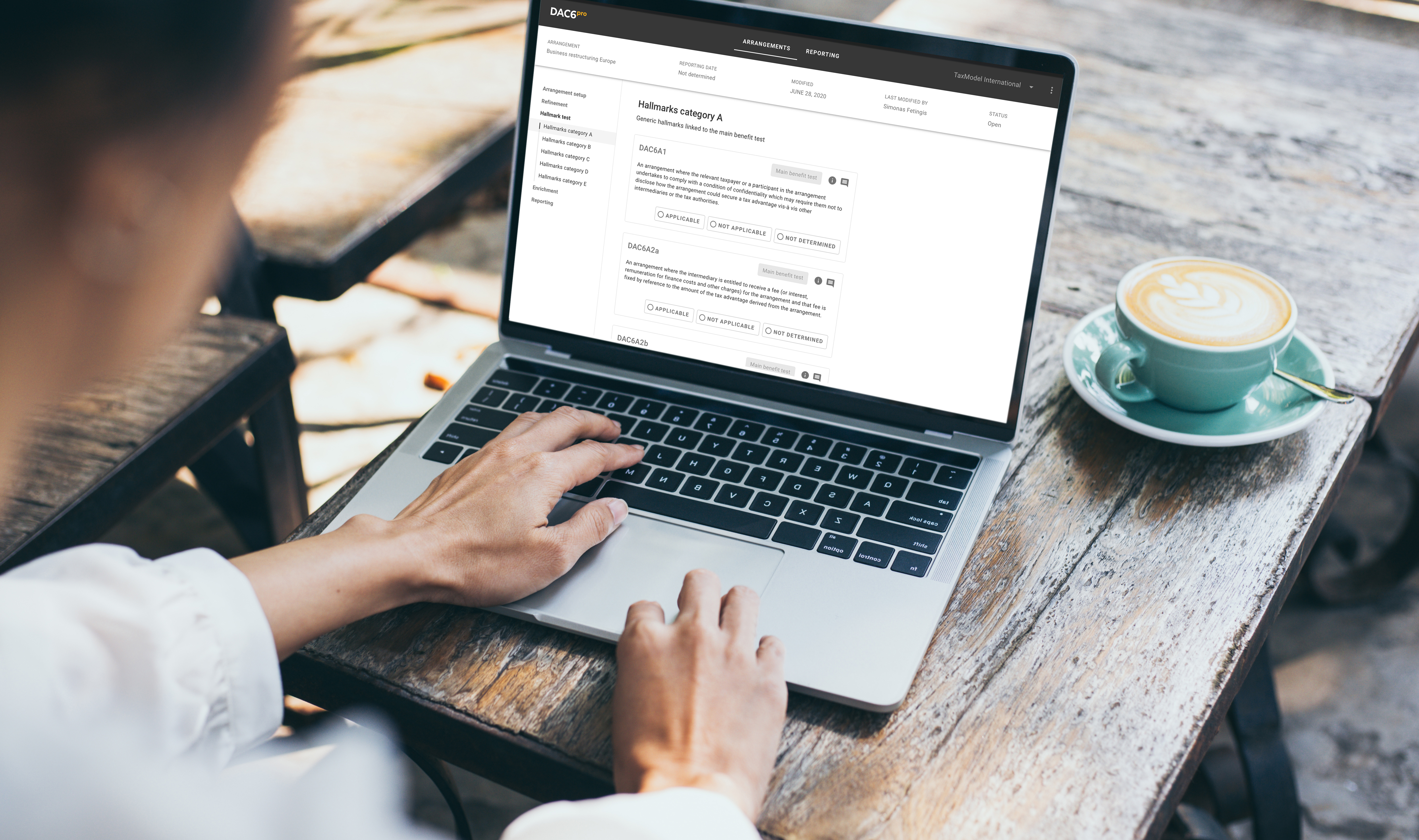

Category A: Generic hallmarks linked to the Main Benefit test

- A.1 Confidentiality clauses where the taxpayer undertakes to comply with a condition of confidentiality which requires not to disclose how a tax advantage could be secured

- A.2 Performance-based remunerations for the intermediary that depends on the realization of a tax benefit or the amount of tax advantage realized from the arrangement

- A.3 Standardized documentation/structure allowing market-ready implementation for more than one (other third) taxpayer without any essential adjustments

Category B: Specific hallmarks linked to Main Benefit test

- B.1 Acquiring a loss-making company in a series of steps planned to end the main business activity and use the losses to reduce taxes, such as by a cross-border transfer to another jurisdiction or by the acceleration of the use of those losses

- B.2 Conversion of income into capital resulting in revenue being converted into lower-taxed income or a tax exemption

- B.3 Circular transaction resulting in the round-tripping of funds which results in an offsetting or canceling effect

Category C: Specific hallmarks related to cross-border transactions (some linked to Main Benefit test)

- C.1 Deductible payments between two or more related parties (≥25% group ownership in associated enterprises), including at least one of the following conditions:

- C.1a: the recipient has no tax residency in any jurisdiction

- C.1b-i: the recipient is a tax resident in a jurisdiction that imposes no corporate income tax or at the rate of (almost) zero + Main Benefit test

- C.1b-ii: the recipient is a tax resident in a black-listed third-country jurisdiction that is considered non-cooperative by the EU or OECD

- C.1c: the payment benefits from a full exemption in the jurisdiction where the recipient resides for tax purposes (objective exemption regarding the payment) + Main Benefit test

- C.1d: the payment benefits from a preferential tax regime in the jurisdiction where the recipient is a tax resident such as a patent box regime + Main Benefit test

- C.2 Multiple depreciation regarding deductions for the same asset depreciation are effectively claimed in more than one jurisdiction

- C.3 Multiple relief from double taxation regarding the same income item or capital claimed in more than one jurisdiction

- C.4 Significant valuation differences regarding a transfer of assets

Category D: Specific hallmarks about the automatic exchange of information / beneficial ownership

- D.1 Undermining of reporting obligations under EU legislation on automatic exchange of financial account information

- D.2 Non-transparent legal or beneficial ownership chains using persons, legal arrangements or structures that (a) do not carry on a substantive economic activity nor substance, (b) are incorporated, managed, resident controlled or established in any jurisdiction of residence of one or more of the beneficial owners of the assets held, and (c) where beneficial owners within the meaning of Directive (EU) 2015/849 are unidentifiable.

Category E: Specific hallmarks concerning Transfer Pricing

- E.1 Unilateral safe harbor rules that would exempt taxpayers from certain transfer pricing obligations or allow for certain pricing which is deemed to be at arm‘s length by default

- E.2 Transfer of hard-to-valuable intangibles due to the absence of a reliable comparable and difficulty in predicting the level of ultimate success at the time the transaction occurred

- E.3 Intragroup cross-border transfer of functions/risks/assets resulting in a decrease of EBIT of ≥ 50% during the first three years post-transfer (compared to the situation of no transfer)

Questions?

If you have any questions about DAC6, the hallmarks or the main benefit test, then schedule easily a meeting with one of our experts here.