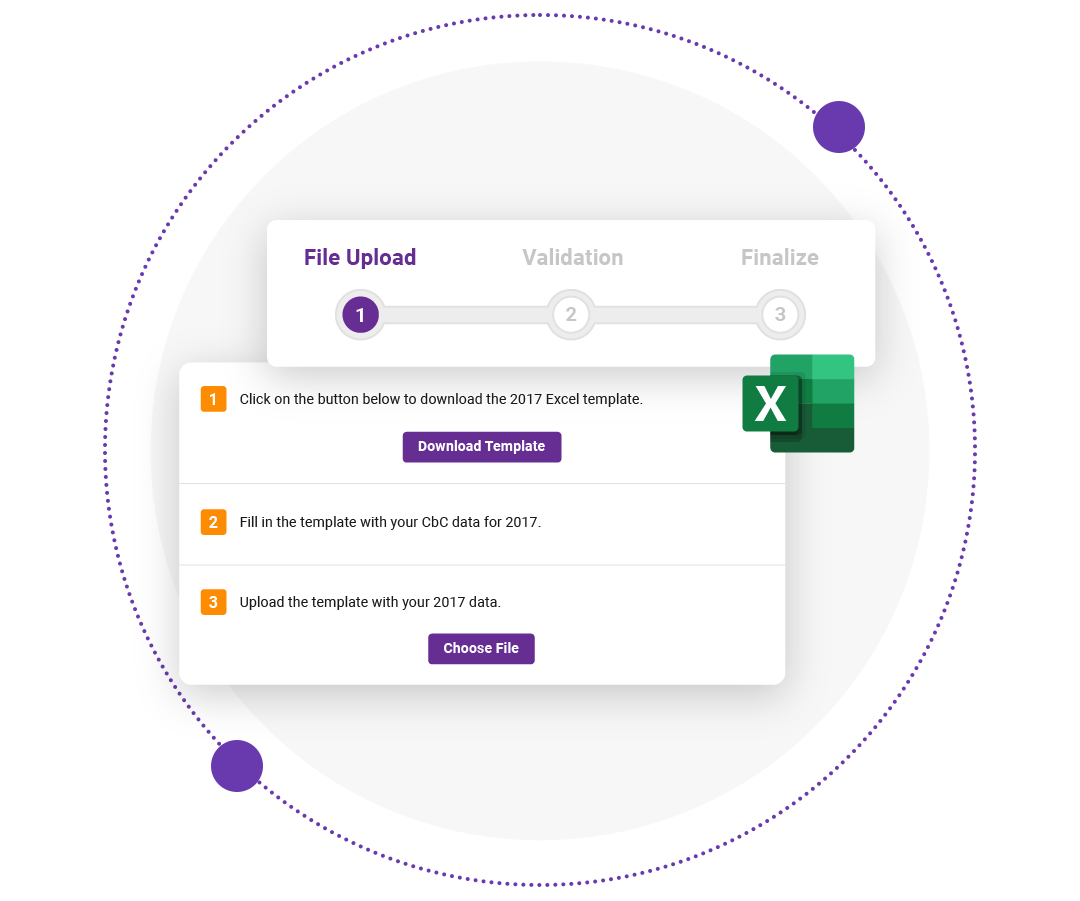

Country-by-Country Reporting in 3 easy steps

TPcbc is the best way to perform your country-by-country Excel conversions and XML reporting. Save valuable time and money by getting started today!

Yearly updated OECD template in MS Excel

TPcbc offers a fully encrypted environment and comes with yearly updated and compatible OECD Country-by-Country Reporting (CbCR) templates (MS Excel-based), to be completed by and for the reporting company. The CbCR template contains the financial data, address, and the performed functions for every entity within a multinational.

- All the data in TPcbc is fully encrypted

- OECD compliant Country-by-Country Reporting templates updated yearly

- Versions available for 20+ OECD countries

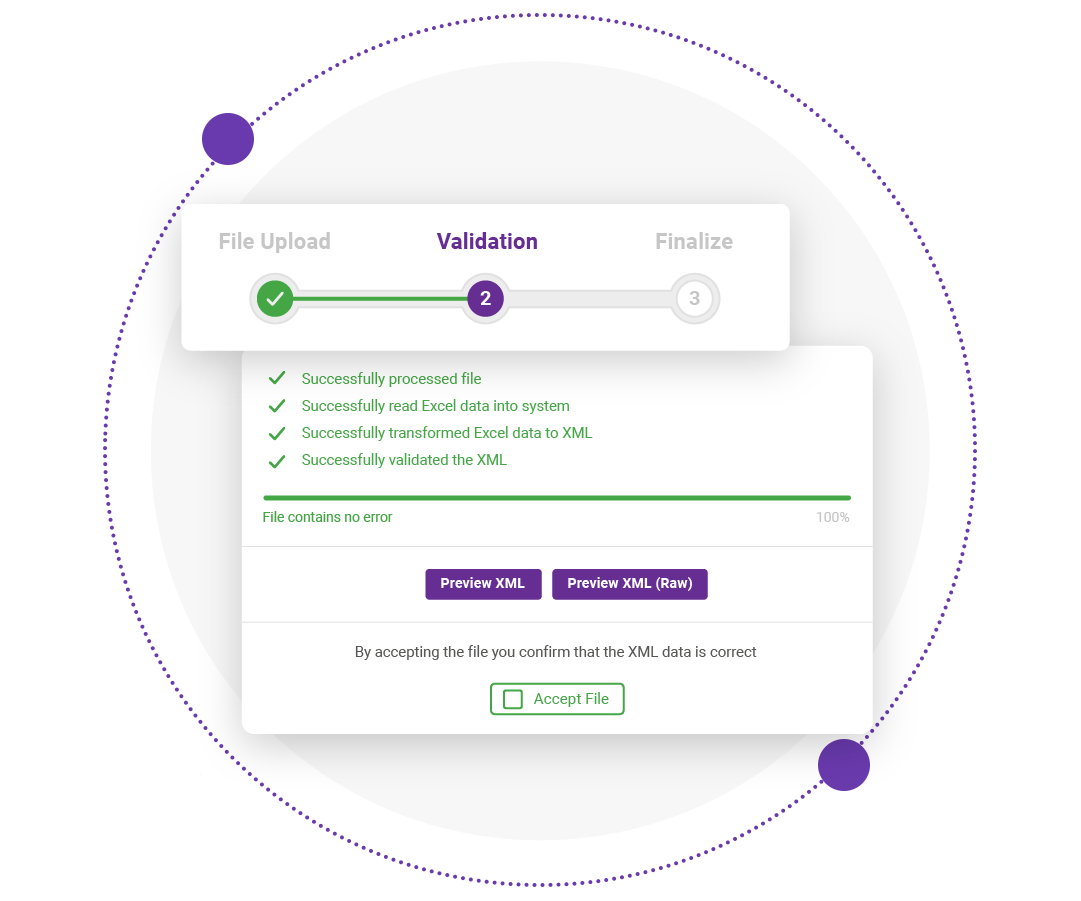

Preview the validated data and create exports in an XML format

The solution validates the completed CbCR template and highlights any missing information or data entered in an incorrect format. Once the template has been validated, TPcbc then converts the validated template into an XML format.

- Validation of missing data or information entered in the wrong format

- Convert the template into an XML format

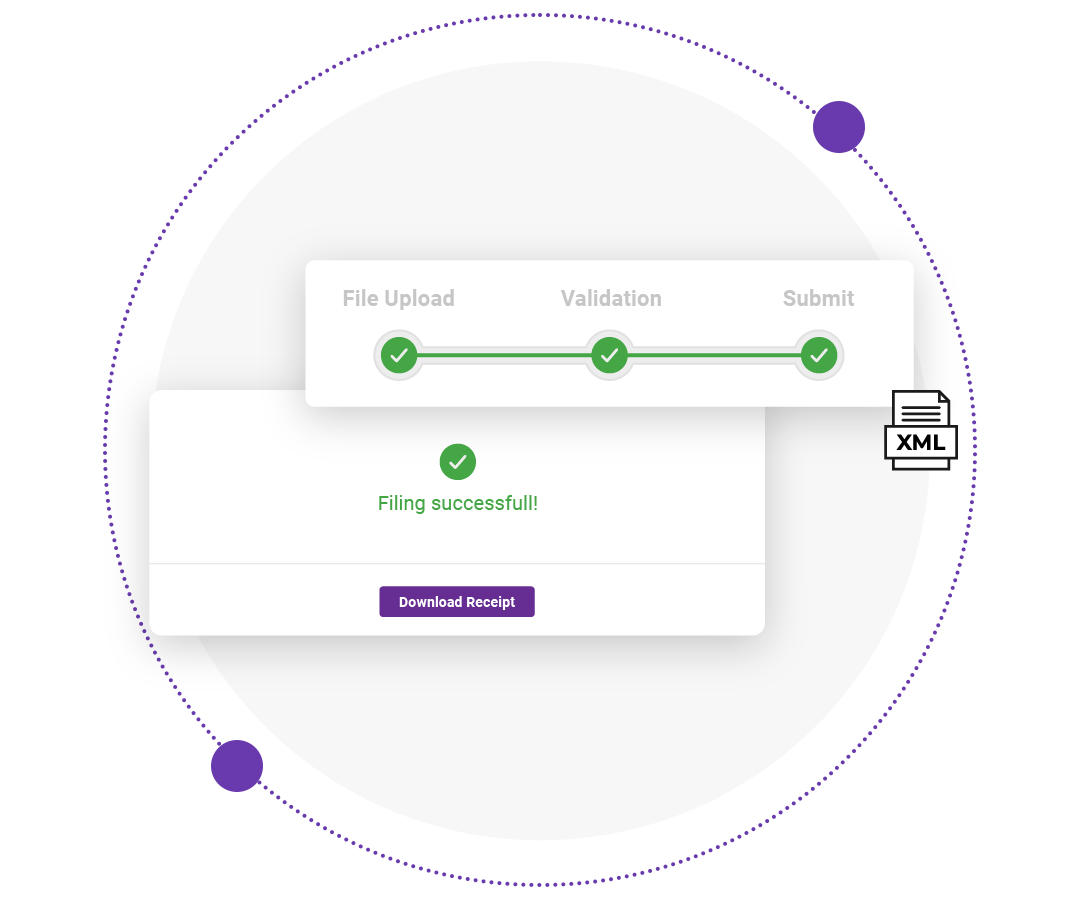

Submit your CbCR XML report

Once all the previous steps have been finalized, TPcbc allows users to use the XML for local CbCR filing in 20+ OECD Member States. For entities that report in the Netherlands, TPcbc allows direct reporting to the Dutch revenue authorities. A receipt will be generated after the report has been successfully finalized.

- Basic: CbCR report in an XML format (20+ OECD Member State formats)

- Add-on feature for CbCR filing in the Netherlands

- Visualization of data sent to the Dutch tax authorities

- Identification number of the request

- Actual XML data that was sent to the tax authorities

TPcbc is all your business needs

Scale-up your business, increase productivity, and keep your teams connected. Access more information and compare the features of our packages via the button below.

Premium

- Pay per filing per year

- Easy re-filings in subsequent years

Enterprise

- 3 Year Licence

- TaxSuite Environment

FAQ - TPcbc

What does the filing process look like?

The TPcbc application allows you to enter our portal where you can download the latest CbC MS Excel template. Once this template has been filled in, you upload your completed Excel template in the portal. The application will validate the template allowing you to proceed to the next step, the XML conversion.

Depending on the country of filing you then have the option to download the converted XML and submit it to the relevant tax authority. For filing in the Netherlands, you can use our connection with the Digipoort portal of the Dutch tax authorities within the TPcbc tool.

Which countries are supported for the CbCR XML conversion?

Outside the Netherlands TPcbc currently supports XML conversion for Austria, Bulgaria, Croatia, Belgium, Czech Republic, Denmark, England, Finland, Germany, Hungary, Ireland, Italy, Luxembourg, Norway, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden. Please let us know in case you miss a country.

Which countries are supported for the CbCR XML conversion + filing?

Within the Netherlands we support the entire process, allowing you to file your CBC report to the Dutch tax authorities.

Outside the Netherlands, we work with preferred implementers that have global coverage to ensure a smooth filing of XML files.

Is my data secure in TPcbc?

The data used within TPcbc is fully encrypted, meaning that only you are able to access your own data. After filing your CBC Report or downloading your converted XML, you are able to purge/delete your data in your own portal.

Who is doing the actual CbCR filing to the authorities?

Companies that need to file their CbC report with the Dutch tax authorities, can do this within the application themselves. Filings other than with the Dutch tax authorities can use the converted XML to do the filing manually.

I already have an excel template. Do I need to download the template again?

Yes, each year the template needs to be updated as per new requirements/changes as instructed by local tax authorities. Therefore it is critical that you download the latest MS Excel template as soon as you have access to our TPcbc portal.

Kickstart the next phase of your compliance strategy

If you have any questions about TPcbc itself, or if you would like to discuss your current compliance process, our tax and IT professionals are here to help. Book a demo/introduction meeting: