Be prepared for your IFRS disclosures.

- Automated calculations of GloBE income/losses, covered taxes and GloBE Effective Tax Rate

- Standardized group GloBE Information Return

- GloBE Top-up Tax at the constituent entity, jurisdictional, and consolidation level

- Seamless integration with existing tax environment & ERP systems

The Pillar2 regulation sets out global minimum tax rules designed to ensure that large multinational businesses pay a minimum effective tax rate of 15% on profits in all countries. Our standardized affordable, cloud-based Pillar2 solution assists MNE groups and intermediaries in assisting their MNE clients in managing their Pillar2 challenges.

Pillar2 requirements for MNEs

New tax calculation and reporting obligations

- Identify, gather and process required tax data

- Digitally and securely store MNE global tax calculation data

- Traceable and trackable tax data for future year calculations

- Documented trails for potential tax authority audits

- Increased collaboration between Tax and Accounting teams

Pillar2 requires a solid tax accounting process and now is the time to get your updated processes in place. Benefit from our Pillar2 solution and be prepared for the new OECD / EU GloBE regulations!

Pillar2 features

- Ensures a seamless connection between your existing tax provisioning environment and/or ERP systems to retrieve and import files

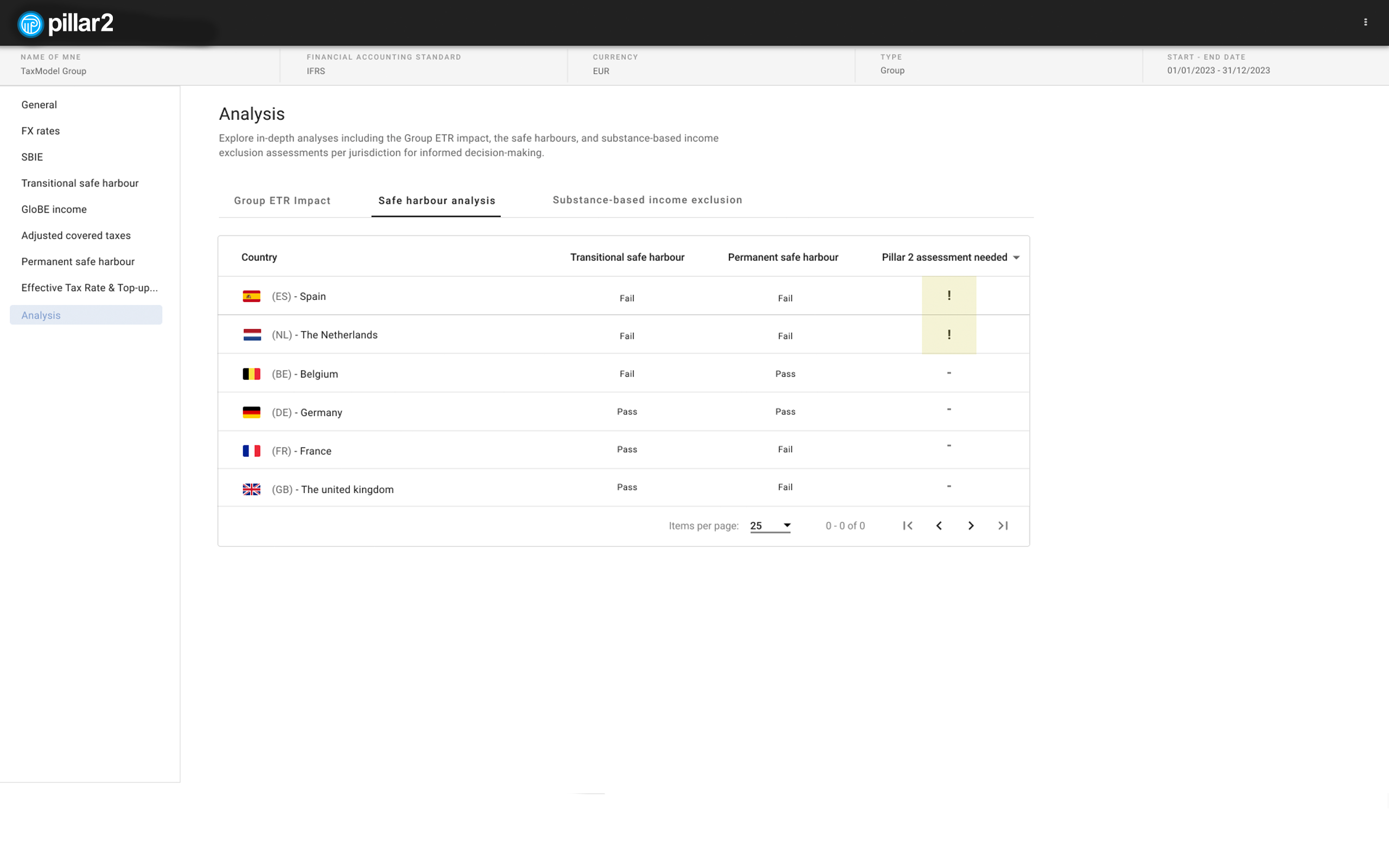

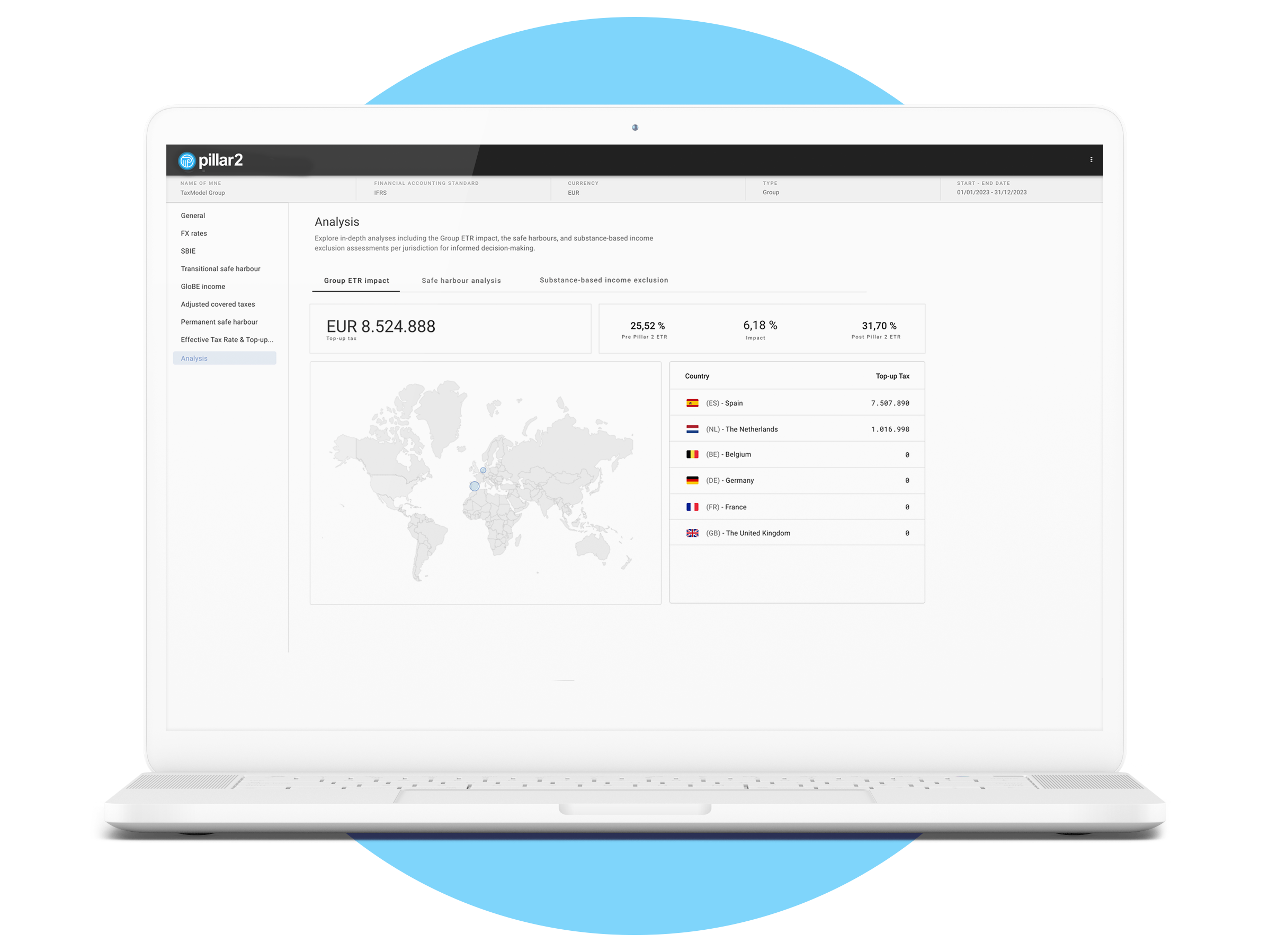

- Automated calculations of GloBE income/losses, covered taxes, GloBE Effective Tax Rate, GloBE Top-up Tax at the constituent entity, jurisdictional, and consolidation level, including safe harbor calculations

- Identification of the parent entities to which the Top-up Tax (ToT) is attributable and the offset of ToT in case several parent entities are liable for the ToT

- A standardized GloBE Information Return that provides information on the tax calculations made by the MNE group and contains the information a tax administrator needs to evaluate the correctness of a Constituent Entity’s GloBE tax liability and to perform an appropriate risk assessment, including XML compatible reports

Tax provisioning as basis for Pillar2

For MNE Groups that are also worried about not being in control of their tax provisioning process as the basis for Pillar2, we also offer TaxProof, our TaxSuite module for tax provisioning, which has been updated for collecting the new Pillar2 data points and calculating the Pillar2 impact for (IFRS or other central GAAP) reporting purposes. To know more about TaxProof, please click here.