The European Union (hereinafter the ‘EU‘) has expanded the scope of its Directive 2011/16/EU on Administrative Cooperation in the field of taxation. With the aim of strengthening tax transparency, Directive (EU) 2018/822 is the sixth amendment of the EU Directive on Administrative Cooperation and is therefore referred to as ‘DAC6‘. DAC6 responds to the recommendations of Action 12 of the OECD/G20 Base Erosion and Profit Shifting (‘BEPS‘) project regarding the Mandatory Disclosure Rules (‘MDR‘).

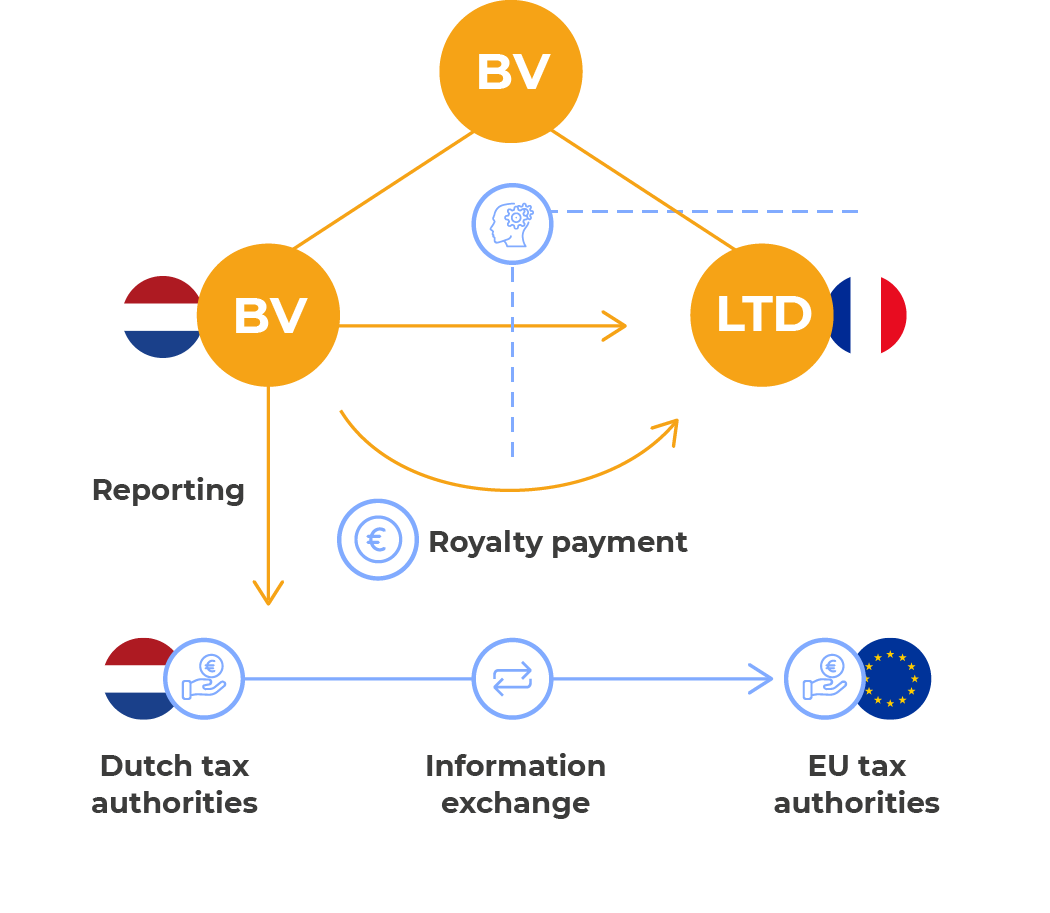

In short, DAC6 directs the EU Member States to transpose a mandatory disclosure regime into their domestic law. This includes a reporting obligation for intermediaries and taxpayers in relation to their reportable cross-border arrangements and mandatory automatic exchanges of information between the EU Member States.