One cloud-based platform for your benchmarks

Automate the time-heavy workstreams of your Transfer Pricing benchmark practices while stepping up your process and content. TPbenchmark improves the turnaround time while ensuring consistency, quality, and audit trails.

One cloud-based platform for your benchmarks

TPbenchmark is a cloud-based software solution that automates the transfer pricing benchmarking process to reduce the turnaround time by two-thirds, as well as improving the quality of the result by ensuring consistency and audit trailing. TPbenchmark is database agnostic and is compatible with most local & global database providers.

*TPbenchmark does not provide access to a database or a database provider. The solution is focused on goods & services benchmarks.

Save up to 80% of preparation time with the AI Review Assistant

The AI Review Assistant can swiftly process large volumes of data, enabling you to analyze more transactions in less time. It provides you with intelligent insights and recommendations, empowering you to make informed decisions and optimize your transfer pricing arrangements.

- Streamline your compliance and adhere to the latest regulatory requirements. Stay compliant and minimize the risk of challenges from tax authorities.

- By automating the review process, the AI Review Assistant frees up your valuable time and resources. Focus on more strategic aspects of transfer pricing while the assistant handles the data-heavy tasks.

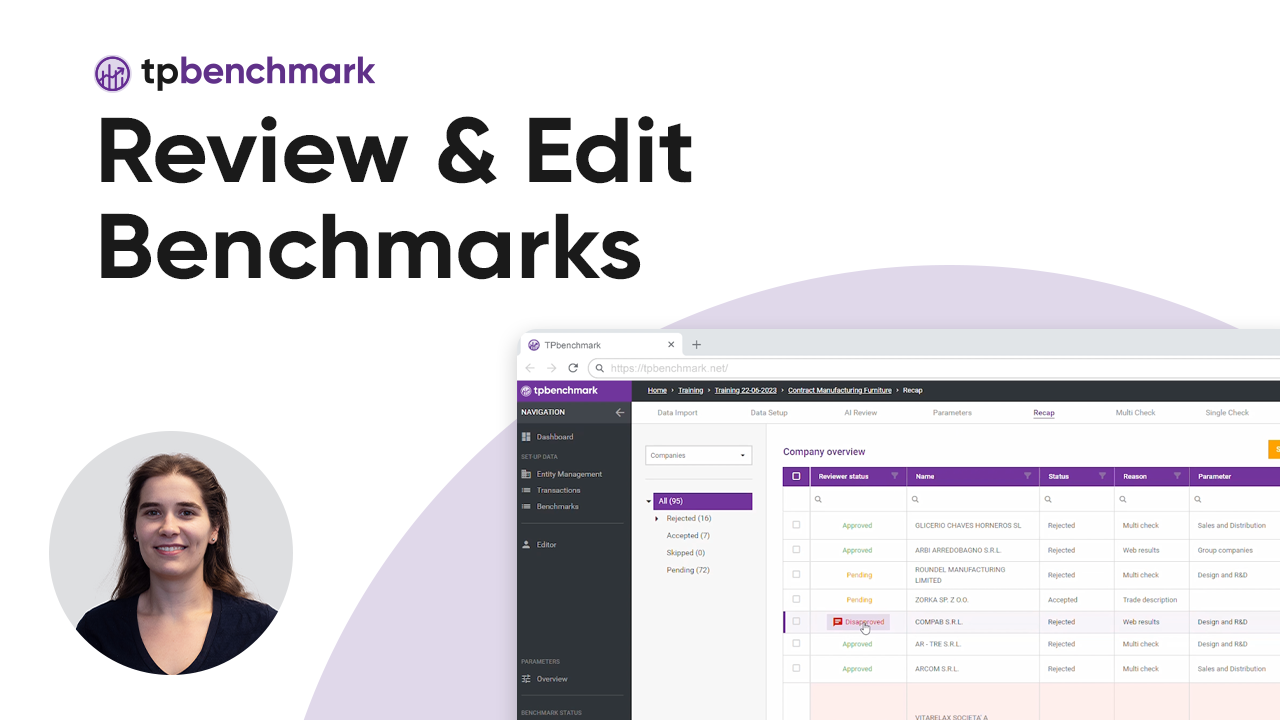

Replaces redundant and repetitive workstreams

TPbenchmark has a unique set-up for checking company websites on a single screen. The solution automatically generates the audit trail, which includes all information crucial to the user’s decision to accept or reject a company.

- Confirmation of all companies exported from the database

- Live websites are shown, translated, and highlighted on a single screen

- Automated audit trails to secure proof and save time

Scrapes comparable company websites by highlighting the parameter hits

TPbenchmark works by loading the company websites into the server and making them searchable. While crawling, the user can immediately specify the search parameters. TPbenchmark then crawls the websites and trade descriptions to show the parameter hits specified by the user.

- Unique crawler functionality to scan and filter company websites

- Detailed parameter settings with a Boolean search

- Easy logging of the acceptance or rejection reasons

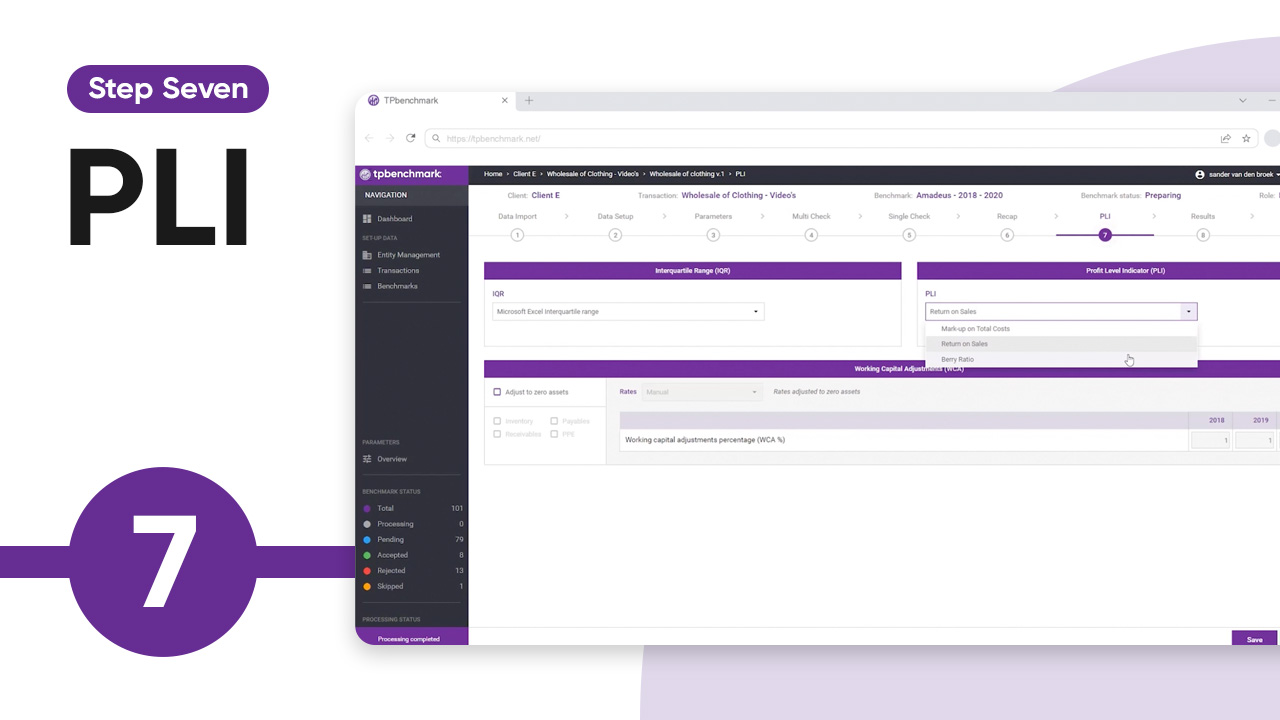

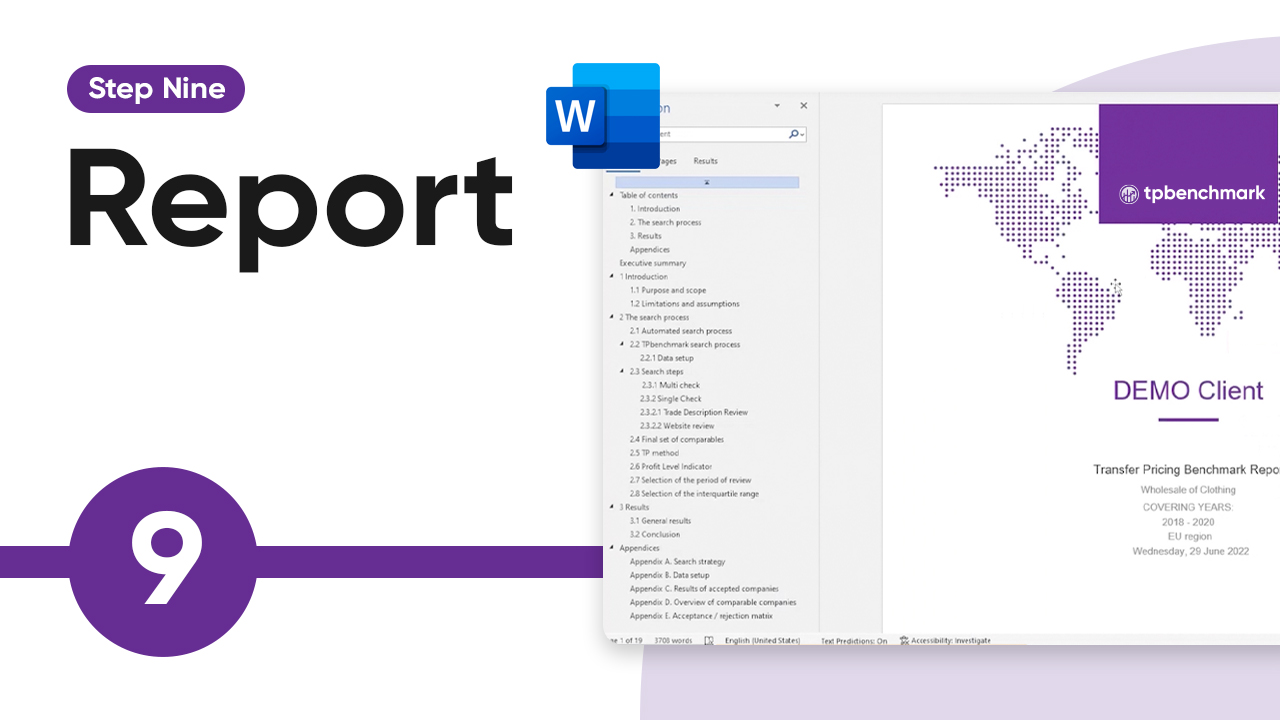

Formula-driven results analysis and built-in reporting

TPbenchmark calculates the margin a company has achieved based on the TP method, Profit Level Indicators, and working capital adjustments (if any). The summary will show you the interquartile range, as well as the maximum and minimum results for the fiscal years selected. With TPbenchmark, you can build and export the transfer pricing benchmark report in your own desired format.

- Calculatory functions to calculate all the relevant results for your analysis

- Summary presentation of the results for review purposes

- Full reporting functionality, including a Word plug-in

TPbenchmark Product Videos

Watch our detailed demo videos that showcase TPbenchmark’s key features and benefits.

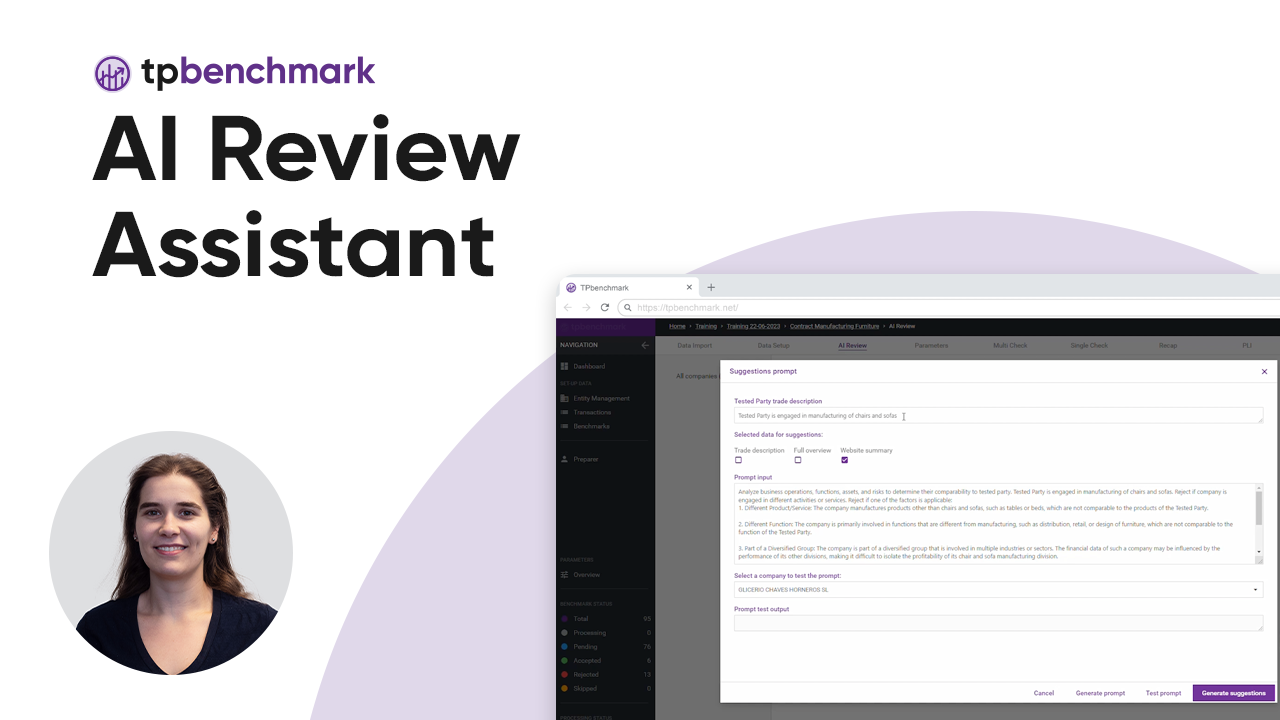

AI Review Assistant

Automate and accelerate the review of your TPbenchmark data ensuring greater accuracy.

Segmented PLI analysis

Perform segmented PLI analysis within TPbenchmark

TPbenchmark reports

Generate automated reports that are 100% OECD compliant

Watch more

Watch the complete demo video series on our Youtube channel.

TPbenchmark has the features your business needs

Scale-up your business, increase productivity, and keep your teams connected. Access more information and compare the features of our packages via the button below.

*TPbenchmark does not provide access to a database or a database provider. The solution is focused on goods & services benchmarks.

Premium

- Upto 50 benchmarks per year

- Unlimited users

- Standard benchmark template

- In-tool training & onboarding

- Standard support

- Security essentials

Enterprise

- All of Premium

- Over 50 benchmarks per year

- Bespoke templates

- TaxAcademy training

- Premium support

*Excluding 3rd party comparable company database and translation costs

Kickstart the next phase of your compliance strategy

If you have any questions about the TPbenchmark solution, or if you would like to discuss your current compliance process, our tax and IT professionals are here to help. Book a demo/introduction meeting: