To start with the bang: we guarantee a 50% off on any other DAC6 technology providers‘ pricing on comparable technology.

Why?

First of all because we want to contribute to a market where transparency is the standard and because we believe that tax technology should be affordable for all taxpayers and intermediaries. Secondly, because we believe in ourselves. Simply because this year will celebrate 10 years of successfully developing direct tax solutions. We know how to give you high value for your money. TaxModel is one of worlds largest standardized tax technology providers and one of the first being ISO27001 certified.

Let us explain

In line with the other EU Directives on Administrative Cooperation (DAC), DAC6‘s rationale is to increase tax transparency. It tries to reach that goal by balancing between effectiveness and minimizing burdens for taxpayers.

That is exactly what we as TaxModel also want to bring. Our dream is to minimize your burden by creating effective and user-friendly solutions within a one-stop-shop TaxSuite. We want to do that within full transparency by sharing what we do, listening to you, and be clear about what your investment is for the high added value that you get in return.

Our journey

In the first blog about pricing, we shared with you our values around pricing. Since then, we have only been strengthened in our belief that our values are unique in this market. Many competitors are applying highly volatile non-transparent pricing. This is a marketing and sales strategy based on secrecy and toying with pricing, and not focusing on added value. It is typically part of a business model around tax advisory 1.0, a thing from the past.

Our questions to such competitors are: Do you believe in your products? What kind of relationship do you want to build with your clients? In essence, saying: you are hiding, so what are you afraid of?

Some examples

Let us tell you about some examples of what we encounter in the market.

None of it is publicized, but for both taxpayers, as intermediaries, there is a wide range of prices set. Think about:

- flat fee per annum (€ 150k – €200k +) – all in / globally • prices per country per annum between € 15k and € 25k per Member State

- additional price dependencies based on the number of Arrangements, or the number of users.

- we even have indications that different prices are set for different clients within one Member State.

A lot of factors that make your investment very unpredictable and hard to monitor over time. This is even without factoring in that you will definitely need more (consulting) services because the tool does not cover your complete end-to-end process.

In other words: how do you, as a customer, know that you get the fair price? You don‘t!

What we do

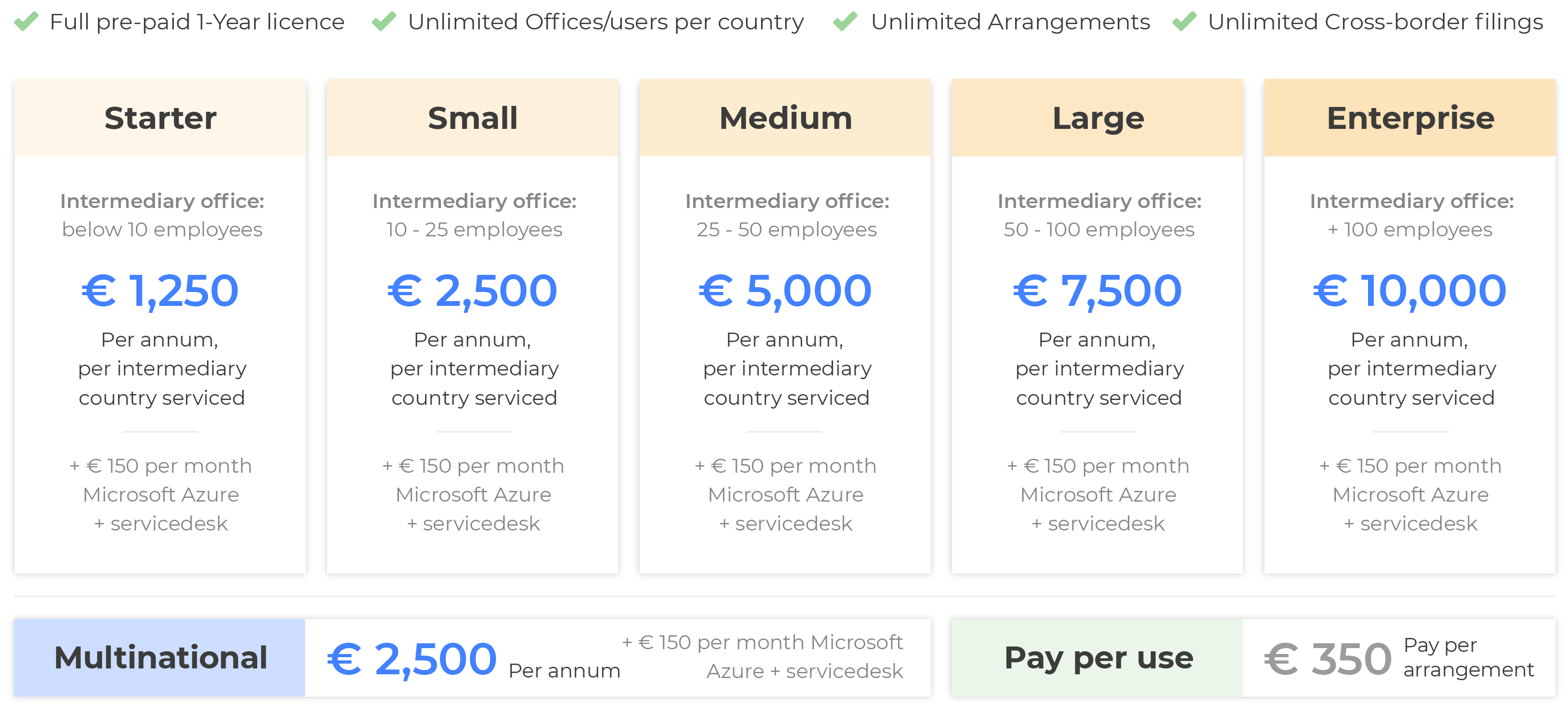

We are clear on what you can expect:

Plus: our bang! To contribute to a market where transparency is the standard, we decided to guarantee a 50% off on any other DAC6 technology providers‘ pricing on comparable technology.

To be sure that we don‘t compare apples to oranges, and creating a relationship built on mutual transparency, we need to learn the scope, the fee build-up, and the terms of your alternative proposal.

If 50% of our competitor‘s proposal is still higher than our standard price, you are free to choose the price you prefer ;-) Please keep in mind: any additional revenue, we will use to build even better our dreamed TaxSuite!

TaxModel wants to embrace a new ethos because the SaaS company of the future has nothing to hide, who wants to join our journey?

Click here to join our DAC6pro demo!

—

Check the first blog about our pricing strategy: ‘Why we decided to be 100% transparent on pricing (and why that‘s a good thing)‘ on our website, click here.