A RACI matrix, also known as a Responsibility Assignment Matrix, is a powerful tool used in project management and organisational processes. It clarifies roles and responsibilities by assigning key designations to individuals involved in tasks.

In the realm of tax accounting, using a RACI matrix can significantly enhance the efficiency and effectiveness of the process. A RACI matrix can be used to clearly define roles for tasks such as data collection, tax calculation, filing returns, and compliance checks.

For instance, a tax analyst could be ‘Responsible’ for data collection, a tax manager ‘Accountable’ for ensuring accurate tax calculation, a legal advisor ‘Consulted’ for compliance checks, and the CFO ‘Informed’ about the tax filing status. This ensures clear communication, reduces confusion, and improves efficiency by ensuring that everyone is aware of their roles and responsibilities. It also helps in identifying any gaps or overlaps in responsibilities, thereby reducing the risk of tasks falling through the cracks or being duplicated.

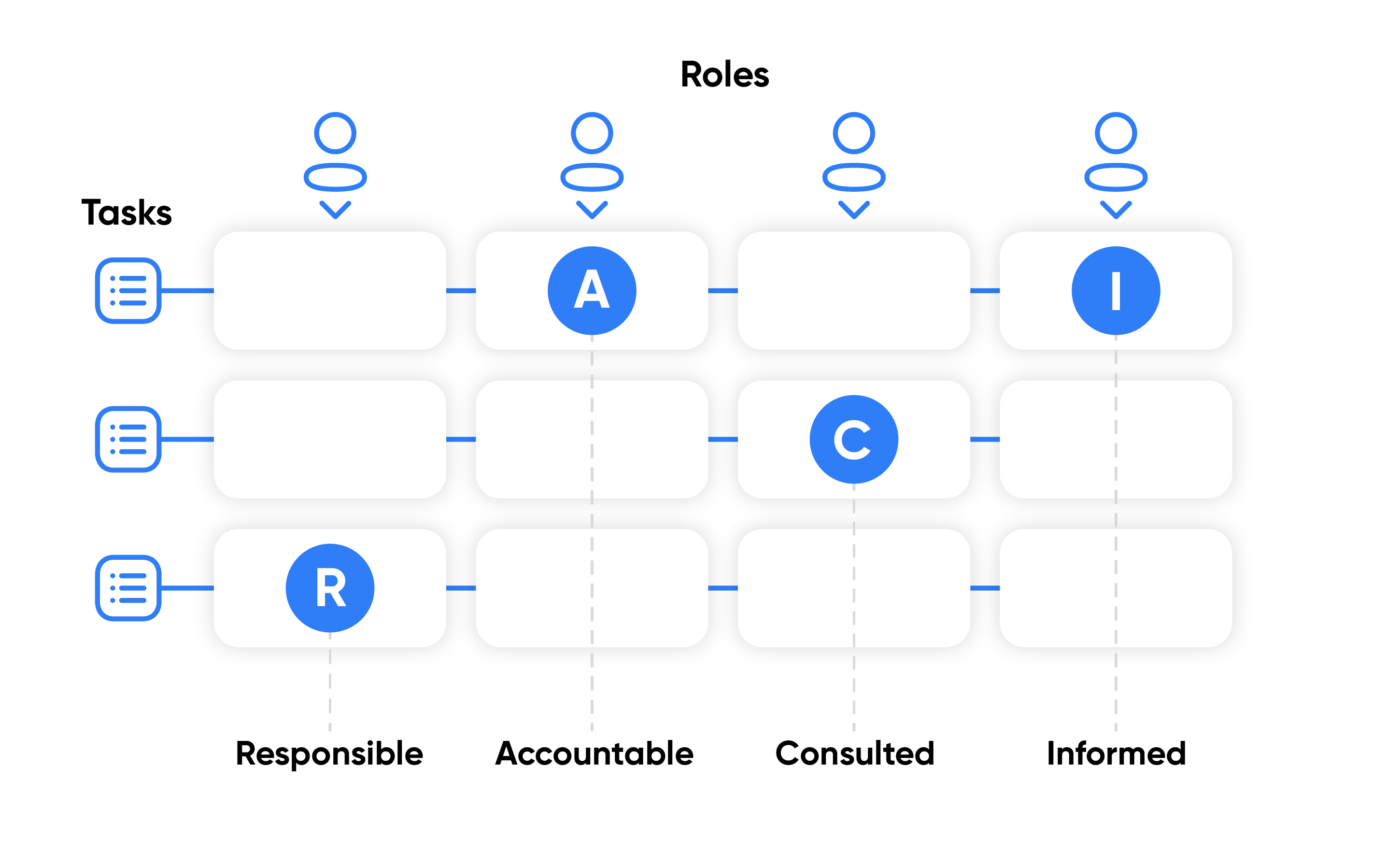

Understanding the RACI Matrix

The RACI matrix is a responsibility assignment chart that clarifies roles and responsibilities in a project or process.

- Responsible (R): Those directly performing the work.

- Accountable (A): The person overseeing the task and ensuring expectations are met.

- Consulted (C): Experts providing input or advice.

- Informed (I): Stakeholders who need updates but aren’t directly involved.

How to apply a RACI matrix to a tax accounting process?

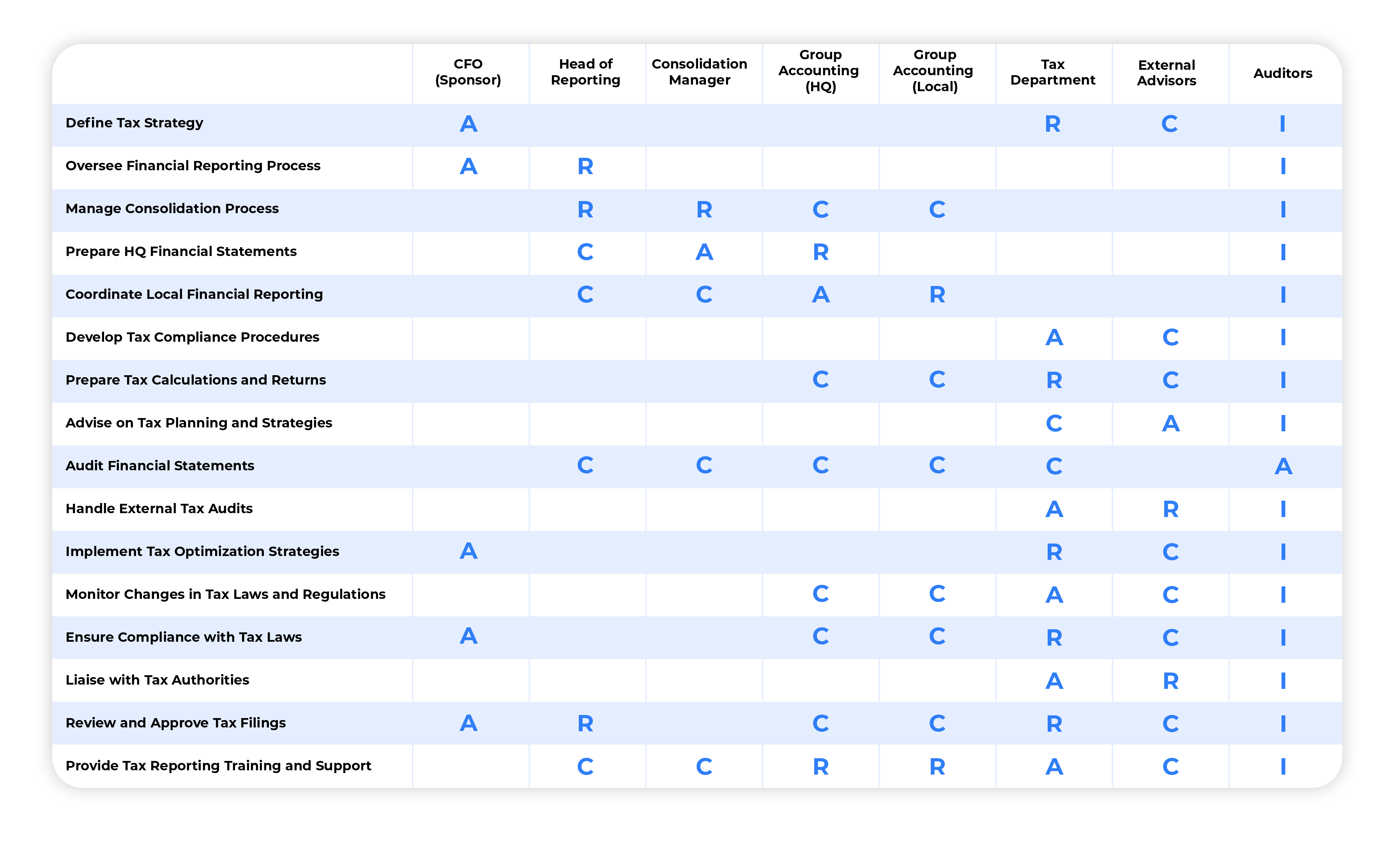

When creating a RACI matrix for group tax accounting, consider the following key points:

- Roles and responsibilities: Clearly define roles within the group. Identify who is Responsible (R) for specific tasks (e.g., tax return preparation), who is Accountable (A) for overseeing the process (e.g., Tax Manager), who needs to be Consulted (C) (e.g., legal experts), and who should be Informed (I) (e.g., auditors).

- Leadership alignment: Ensure alignment among leadership roles (e.g., CFO, Tax Director) regarding their responsibilities. The accountable person should have authority to make decisions.

- Task breakdown: Break down tax-related tasks into manageable components.

- Communication Channels: Specify how information flows. Who needs to consult whom? How will stakeholders be informed?

- Overlap and gaps: Avoid overlapping responsibilities or gaps. Each task should have a clear responsible party and an accountable person.

In tax accounting, a well-constructed RACI matrix can enhance collaboration, accountability, and risk management. Here’s how:

- Tax return preparation: Team members (R) prepare tax returns, while the Tax Manager (A) oversees the process. Legal experts (C) provide input, and stakeholders (I) stay informed.

- Compliance review: The compliance team (R) ensures adherence to regulations, with the Tax Manager (A) overseeing. Legal experts (C) and the CFO (I) are consulted and informed.

- Reconciling accounts: Accountants (A) handle reconciliation, while the Tax Manager (A) ensures accuracy. Auditors (I) and the finance team (I) play their roles.

Taking these concepts into consideration, below is a RACI matrix that we have put together to help you get started.

A RACI matrix can be a game-changer for tax accounting processes. By providing a clear roadmap of who does what, it not only streamlines the process but also enhances accountability, leading to a more robust and effective tax accounting system.

With our best-in-class tax accounting software, TaxProof, you can streamline your tax activities and gain more confidence in your data. TaxProof funnels and simplifies the key steps involved in the tax accounting process, with a built-in RACI matrix for reporting, audit trailing and consolidation, allowing you to focus on the most important part of the process: the tax position analysis.