TaxModel is ISO27001 certified, INDEPENDENT, has 15+ years of in-house and international tax expertise, and wants to be the affordable alternative software provider for the Big 4. We also want to be accessible for any size multinational and service provider dealing with international tax (related) workstreams.

Our dream is to minimize your burden by creating effective and user-friendly solutions within a one-stop-shop TaxSuite. We want to do that within full transparency by sharing what we do, listening to you, and be clear about what your investment is for the high added value that you get in return.

As a tax director for a number of multinationals (TaxModel also provides in-house tax services), I have had the opportunity and pleasure to ask EY and PwC how they are going to fulfill their compliance with regard to DAC6 for my multinationals. This is what they explained to me:

As a client, you have basically three options:

- Consulting model: PwC/EY assess – subject to scope and fee – an existing or proposed scheme against the DAC6 Hallmarks.

- License model: clients take a license to PwC‘s / EY‘s DAC6 tool.

- Free of charge – no service model: in case you as the client do not want to pay anything for the DAC6 assessment, EY / PwC still does the assessment but does not disclose what they assess or report.

We assume that you as paying customer may not be very enthusiastic on the above options:

- The consulting model will – considering Big 4 hourly rates and the specialist expertise on the Hallmarks – probably be expensive and only be worthwhile for edge cases.

- The license model is not ideal because you 1) may not like the dependency on one of the large audit firms and 2) because the license fees are high.

- The free of charge – no service model also feels pretty uncomfortable, don‘t you think?

Alert: we first want to give you a wake-up call. ALL your advisors have to meet DAC6 compliance requirements. Based on their internal controls, they have to do the assessment, audit trail, and (if applicable) report. The DAC6 reporting has been designed especially for intermediaries to do the reporting with a fallback to taxpayers in the absence of an intermediary or when an in-house tax team qualifies as an intermediary.

The bottom line: please do not believe advisors saying that they are doing the DAC6 assessment on your behalf. It is THEIR compliance burden, and we believe that you – as their client – should not be separately paying for something that should already be included in their services. Plus, they are doing the assessment regardless if you pay for it or not.

We do not want to advise you what you should do, but please consider asking your advisors: Are you going to report?

If the answer is “yes,” you simply request the XML file before they report it. Why? Here‘s where we can help: we can import their XML in our DAC6pro tool and give back the full report to you for only € 350 per request, so you can check what your advisors are doing.

In addition, you could also decide to subscribe to our DAC6pro solution because:

1. You avoid the consulting model except for edge cases and stay independent from a Big 4 firm. Given the complexity of the rules and the risk of penalties, you may want to get legal advice on whether an arrangement is reportable. Generally, communications between a lawyer and client regarding legal advice are privileged and confidential (advice from tax advisors and accountants (Big 4?) is not protected!). TaxModel has a non-exclusive cooperation with the law firm Dentons who are happy to help you on edge cases so you can stay in control at any time.

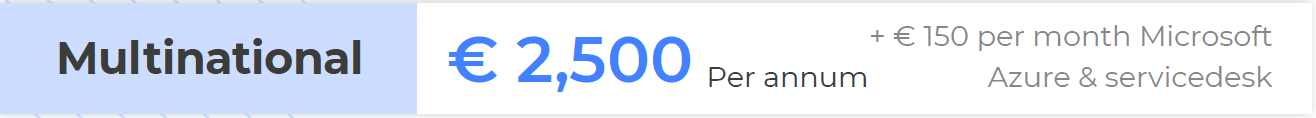

2. You have full control at minimal costs. Our subscription fee:

3. With our tool, you can invite any stakeholder for comments, advice, or feedback, i.e., full service at minimal costs. You will also be able to import XML files from other intermediaries into our solution. Our tool will tell you exactly what will or is report with regard to your arrangements

How does this sound? You can find us at dac6pro.com.

Hank Moonen,

CEO TaxModel