On March 14th, 2022, the Organization for Economic Co-operation and Development (OECD) released its Commentary on the Pillar Two Model Rules (the “P2 Commentary”). The Commentary on the GloBE Rules provides tax administrations and taxpayers with guidance on the interpretation and application of those rules. The Commentary is intended to promote a consistent and common interpretation of the GloBE Rules, which will facilitate coordinated outcomes for both tax administrations and MNE Groups. In the Commentary, the intended outcomes of the rules are explained and the meanings of certain terms are clarified.

Together with the Commentary, the OECD has released a separate document prepared by the OECD Secretariat that contains a series of examples illustrating the application of specific provisions in Chapters 2 through 7 of the Model Rules (the “Illustrative Examples”). The numbering of these Illustrative Examples is consistent with the relevant provisions of the GloBE Rules, as well as the Articles in the Commentary on the GloBE Rules Articles. However, the Illustrative Examples do not form part of the Commentary. Additional Illustrative Examples may be developed and published in the future, in order to illustrate the application of the same or other aspects of the GloBE Rules and to add to the explanations given in the Commentary.

To better understand the mechanics of the GloBE Rules, we have translated most of the Illustrative Examples, as well as some of the descriptive examples from the Commentary, in a uniform simplified format that includes a number of comparisons between the treatment of income and losses under:

- Local tax rules

- Tax accounting rules (e.g. IFRS/IAS12)

- GloBE rules

From this comparison, we believe it will be easier to understand how the GloBE Rules link to the tax accounting data points.

Click on the button to download your Excel file!

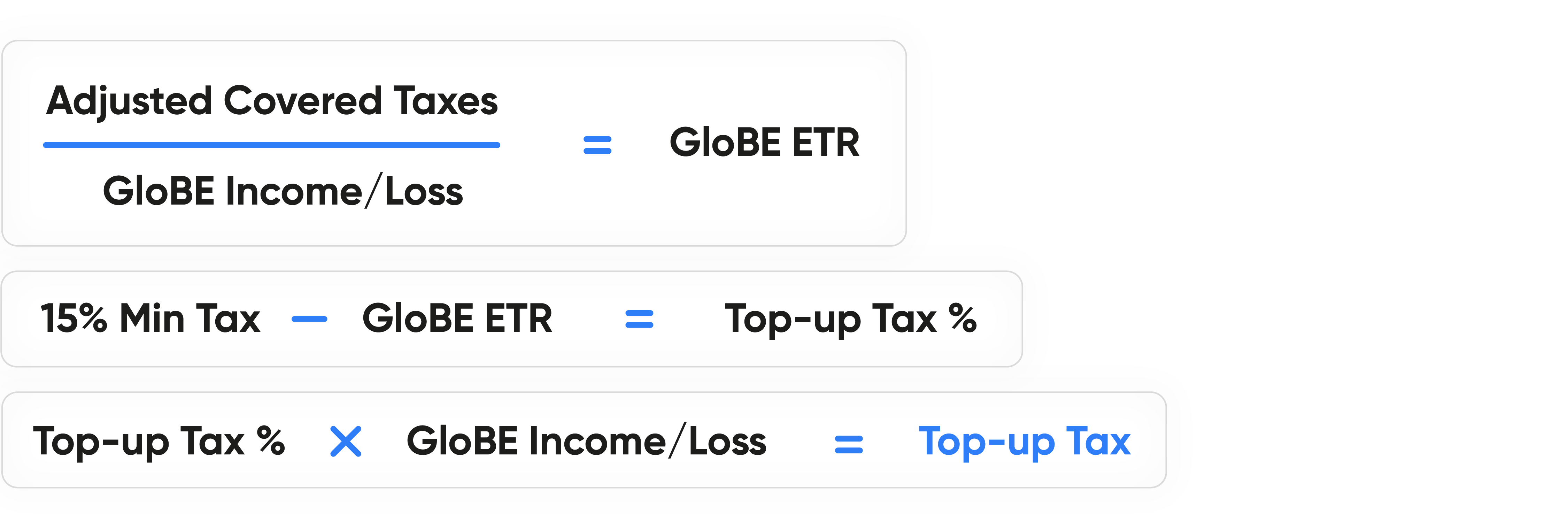

In addition to the relations with the tax return and the tax provision, in the simplified examples we show how the GloBE effective tax rate (“GloBE ETR”) is calculated as well as the Top-up Tax. In all the simplified examples, we have assumed that the excess profit is equal to the GloBE Income/Loss (i.e. we have not considered substance-based carve-outs). This means that the GloBE ETR and the Top-up Tax are calculated as follows:

Part 1 – GloBE Income/Loss = denominator in the GloBE ETR calculation

The determination of the GloBE Income or Loss is comparable to how a book-to-tax reconciliation is made for tax accounting purposes, i.e. it is done as follows:

- Take the Earnings after Tax (EAT) as per IFRS/IAS12

- Add back the IFRS/IAS12 based P&L Tax Expense

- Add back certain non-income tax items that have been expensed[1]

- Adjust for certain permanent or temporary income or loss items[2]

The GloBE Income/Loss can be compared with the actual taxable income as per the tax return and the estimated taxable income as per the tax accounting. The GloBE Income/Loss is the denominator in your GloBE ETR assessment.

Part 2 – Adjusted Covered Taxes = numerator in the GloBE ETR calculation

The next step is determining the numerator in the GloBE effective tax rate formula, or the (Adjusted) Covered Taxes.

Covered Taxes means the tax for the purposes of GloBE, which is comparable to:

- Tax amount for local tax return purposes; and

- P&L Tax Expense for financial statement purposes

The determination of the (Adjusted) Covered Taxes is very different compared to the determination as per the local tax return and as per tax accounting. The tax return typically calculates the tax by multiplying the statutory tax rate times the taxable basis (usually after offsetting any carry forward losses), and the tax accounting calculates the estimated current and deferred tax by multiplying the statutory and/or enacted tax rate times the estimated taxable income and/or movement in the temporary items.

The determination of the GloBE Adjusted Covered Taxes is done as follows:

- Net current tax as per IFRS/IAS12

- Adjustments to the current tax as per 1

- Net deferred tax as per IFRS/IAS12

- Adjustments to the deferred tax as per 3

All the adjustments are basically designed to reward substance and true economic profit, and to attack non/low substance events or structures, as well as to demotivate jurisdictions to offer harmful tax incentives.

[1] For GloBE purposes, you may also add back certain non-income taxes which are recorded as ordinary expenses, such as taxes on corporate equity or retained earnings. Taxes on payroll and sales should not be included.

[2] The mechanics are very similar to the tax accounting book-to-tax differences. However, the content can be very different. Where the book-to-tax differences are linked to the tax treatment in many different jurisdictions, the GloBE adjustments allow only the most common ones across all OECD jurisdictions.