Calculate and comply with confidence

Pillar2 is our state-of-the-art SaaS solution that enables organisations to de-risk, simplify and optimise global Pillar Two compliance and reporting. Pillar2 strengthens tax control frameworks and streamlines reporting, ensuring organisations are compliant with OECD Pillar Two rules as well as local legislation across several jurisdictions.

Simplify and optimise your global Pillar Two processes and reporting

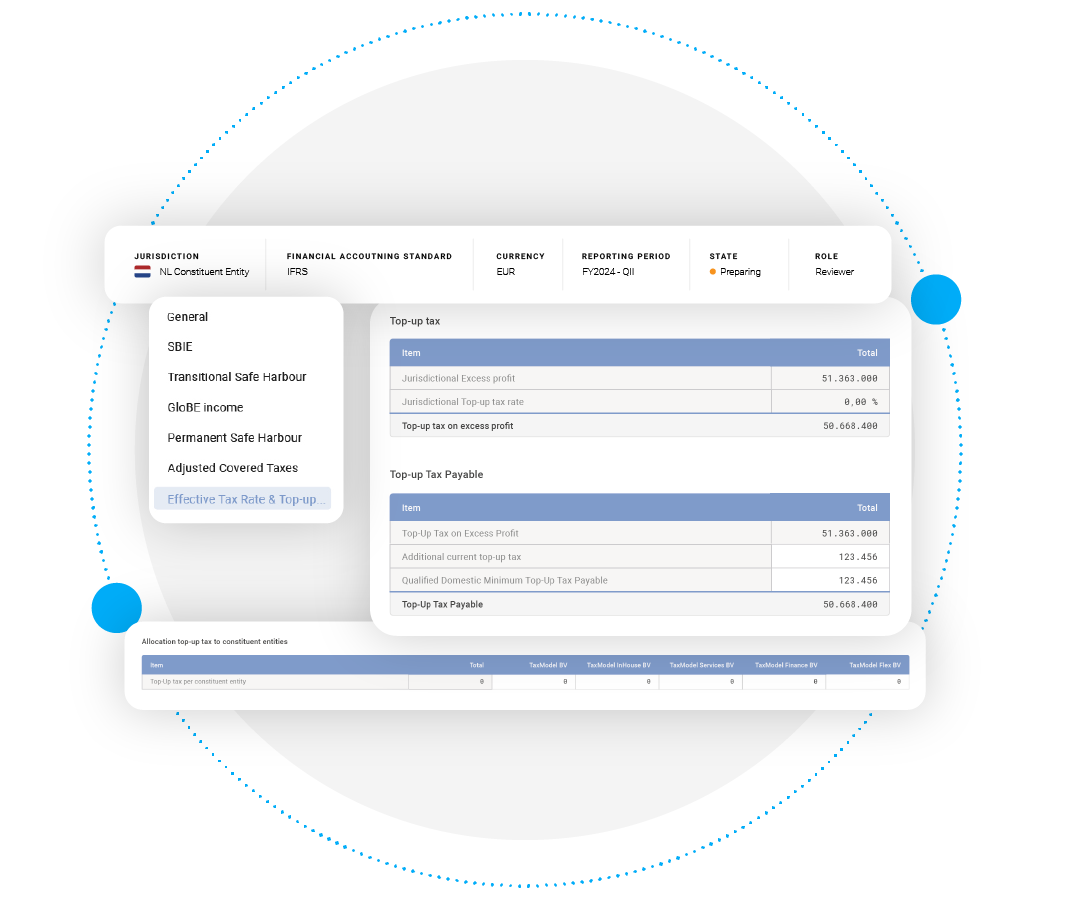

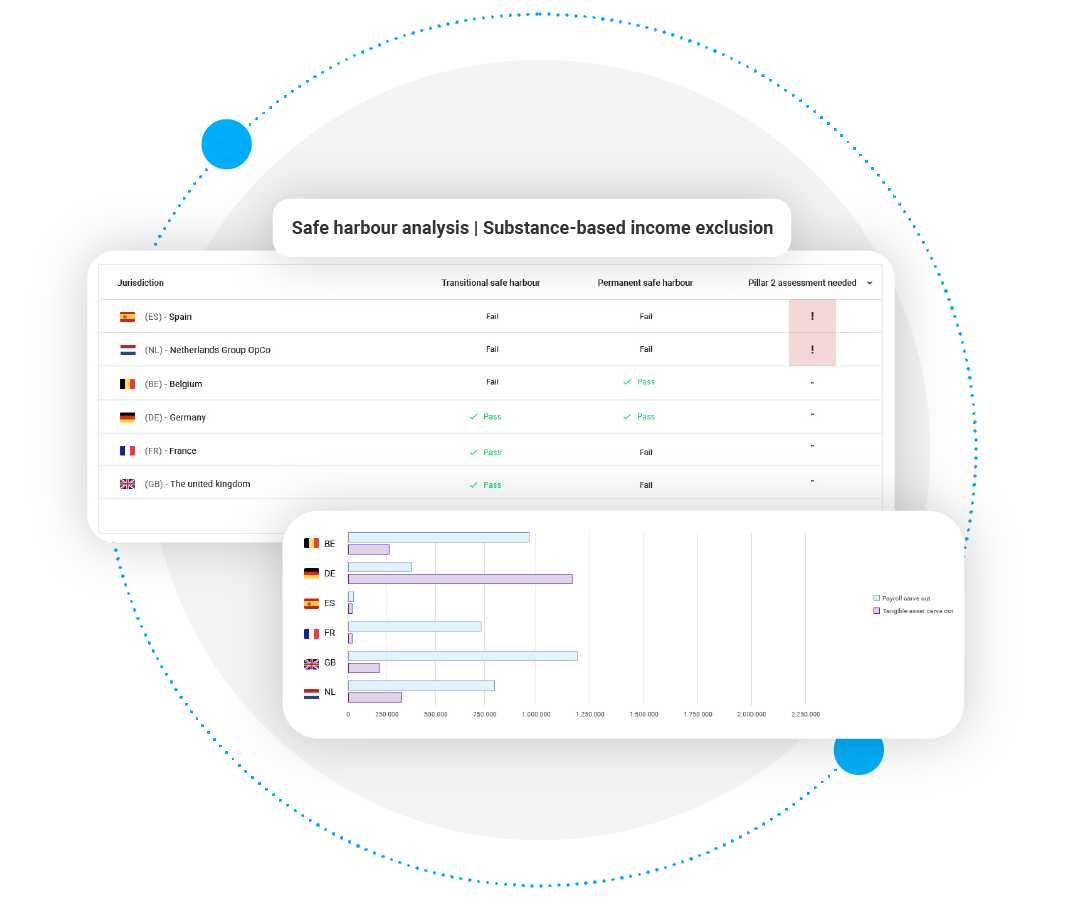

- Supports all core calculations in accordance with both OECD model rules & references.

- Ensures any top-up tax due is correct and provides auditable support for disclosures.

- It automates XML-based GIR production and will support all XML-based QDMTT returns as soon as they are published and government software systems are ready for submission.

- Data import via Excel and API allows data to be easily uploaded from centralised systems or local operations, saving time and reducing errors.

- Extensive dashboard helps you monitor tax positions and deadlines.

- GenAI powered tax data insights for better informed decisions.

- Uses role-based access control (RBAC) with the principle of least privilege.

- All data is stored securely, based om your preference, in the UK or EEA, within our MS Azure environment.

- Enables collaboration with stakeholders including 3rd party advisers, wherever they are located.

- Unrivalled customer support, underpinned by in-house experts with up-to-date Pillar Two tax technical content.

Comply with OECD Pillar Two rules and local legislation

- Automates calculations, enhancing accuracy and compliance, and minimising the risk of errors.

- Full audit trail provides visibility of all changes made, including notes, user names, and time stamps.

- Jurisdiction tracker shows if QDMTT, IIR or UTPR are in force and is kept up-to-date.

- Always up to date, ensuring long-term compliance with changing Pillar Two regulations

- Provides a comprehensive view of Pillar Two data, making it easier to identify inaccuracies or inconsistencies before the information is made available to the market or tax authorities.

- Uses role based access (RBAC) to ensure the right permissions are assigned to the correct people at all times.

Automate to save time and create operational efficiencies

- Automates the offsets and allocations process, with the ability to adjust manually as needed.

- Streamlined reviews, all in one place with a structured process.

- Continuous improvement, identify new efficiencies by analysing the closing timeline.

- Helps tax teams accelerate their tax control journey, providing important data driven insights as well as increased control.

- Can be integrated with other applications on our TaxSuite platform, including country-by-country reporting and tax provisioning. Upload data once and re-use it to optimise inter-related reporting processes.

Unlock data-driven decisions to always be board-ready.

- Monitor your global tax position to easily identify and investigate any anomalies in the numbers.

- Closing timeline provides operational insights into the overall process that took place, so you can identify training needs or potential operational efficiencies.

- Easily interrogate tax data with GenAI support, create bespoke reports and uncover new operational insights.

- Create and export reports to other applications such as Excel, PDF and PowerBI (API).

- Enables scenario planning, e.g., model future periods to assess the impact of overseas expansion.

Kickstart the next phase of your compliance strategy

If you have any questions about our Pillar2 solution, or if you would like to discuss your current compliance process, our tax and IT professionals are here to help. Book a demo/introduction meeting: