Explore the latest blogs on direct tax, product news, updates and more!

resources

Blogs

Trending

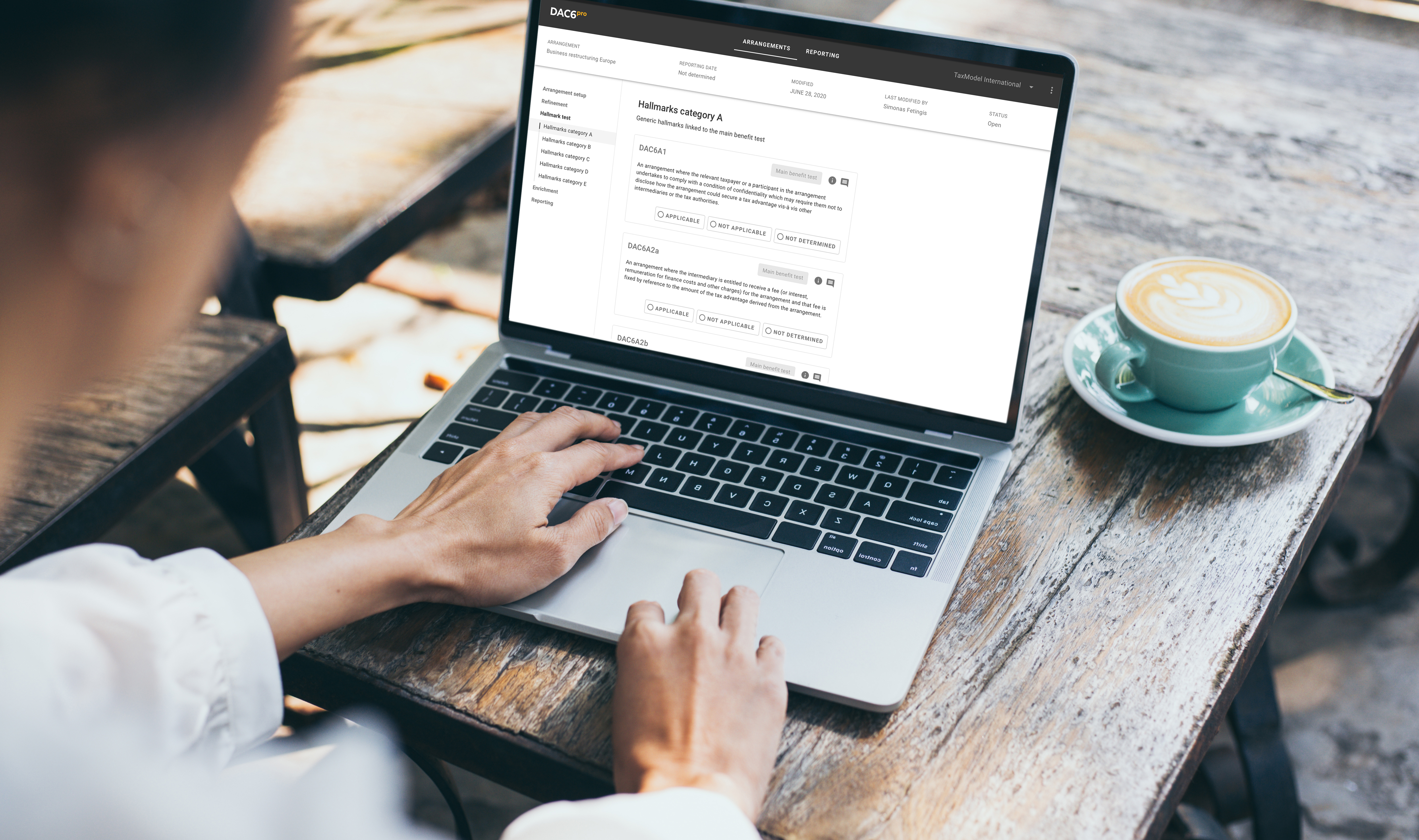

The DAC6 hallmarks and the main benefit test

A cross-border arrangement becomes reportable only if certain characteristics or features are present, referred to as ‘hallmarks.‘ Since most EU Member States have transposed definitions of hallmarks into their domestic…

Transfer pricing is all about substance – Preparing a segmented P&L analysis

How to prepare a segmented P&L analysis? As per Chapter V, Annex II of the OECD Transfer Pricing Guidelines, multinationals should provide financial information and allocation schedules showing how the…

Better understand the mechanics of the PillarTwo/GloBE Rules? Download the simplified version of the examples from the OECD Commentary!

On March 14th, 2022, the Organization for Economic Co-operation and Development (OECD) released its Commentary on the Pillar Two Model Rules (the "P2 Commentary"). The Commentary on the GloBE Rules…

Latest release notes

TaxProof : Enhanced feature release

TaxProof is evolving! We’re thrilled to unveil three new features in TaxProof. These enhancements reflect our ongoing dedication to providing you with the tools necessary for precise and compliant tax…

TaxProof: Review taxpacks in group currency

Reviewing tax provisions entered in local currency can be complex and time-consuming, as it requires a deep understanding of FX rates to identify potential material discrepancies, trends, and anomalies. This…

Latest transfer pricing news

10 obvious reasons why intermediaries should start the digitalization process now

The rapid shift towards digital tax administration is adding to the urgency for both intermediaries and multinationals to transform their workstreams from manual to digital. Tax authorities are increasingly exchanging…

FAQs | Webinar | Benchmarking with AI: Challenges and Successes

FAQs: Benchmarking with AI: Challenges and Successes After our successful interactive transfer pricing webinar : Benchmarking with AI: Challenges and Successes, this blog post answers the questions asked by…