What will the tax landscape look like post-COVID? Tax accountability starts with tax accounting

Can you explain the income tax payable position on a balance sheet and the movement from the (tax payable) opening balance to the closing balance for a fiscal year? Does this apply for the entire group and country by country?

(Tax)Proof it!

Dear CEO,

Have you analyzed the differences between your company‘s cash tax rate and effective tax rate? If so, was this all clear? As I mentioned in my previous blog, all the answers are or should be found in your company‘s financial statements. Are you ready for some help with the third tax accountability question: “Can you explain the income tax payable position on a balance sheet and the movement from the (tax payable) opening balance to the closing balance for a fiscal year? Does this apply for the entire group and country by country?”

The quickest proof that you are “paying your fair share” – in my view – can be found in the build-up of your tax payable/receivable position and this tells a lot about the health score of your tax control framework. In my view, it is worthwhile to ask for an overview by quarter of the cash tax paid and an explanation of the material differences (for both the entire group and for some of your group‘s main entities).

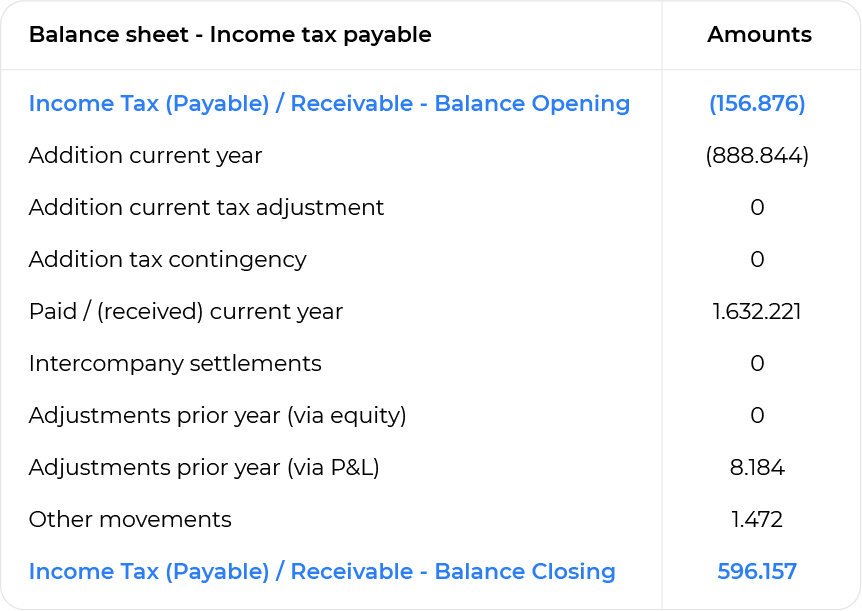

The below picture shows the typical build-up of a company‘s tax payable position as per the balance sheet. Let‘s assume that this is the position of one of your group‘s larger entities, as follows:

The opening position states an amount (156,876) as the tax payable to the tax authorities at the start of the accounting period. Small amounts payable/receivable indicate that the estimates are close to the reality. Large amounts payable/receivable in the opening position may indicate that the company‘s yearly estimates are not in order (i.e., they are overstated/understated) and this may upset your company‘s treasury department and other stakeholders that value a healthy cashflow.

(888,844) is the income tax payable that estimated for the current accounting period. This amount is found by taking the statutory tax rate times the estimated taxable income, as per the tax return.

Current tax adjustment refers to other income tax items, such as withholding taxes (e.g., interest, dividends, royalties, etc.) and tax credits (e.g., R&D credits), which are directly offset against the tax amounts and not against the taxable income. In the example below, there are zero adjustments in this accounting period.

Tax contingency refers to the risks that have been identified during the accounting period. For example, your in-house department or advisor has just identified that a certain tax strategy implemented during the period – or the risk level on an older tax strategy – has been moved up to a “more likely than not” level. Although such risks do not represent an actual cash out, your auditor requires you to take the most prudent approach and consider such a risk as equal to an actual cash out. Please note that a zero (as in this example) does not mean that there is no tax contingency. It may only indicate that there has been no movement during this period. Therefore, please double-check this matter, and please check any significant tax advice implemented for this entity and whether there has been a DAC6 analysis.

Paid / (received) refers to the actual cash flow to or from the tax authorities. In our example, 1,632,221 has been paid to the tax authorities. Am I surprised by this level of cash-out? Are you surprised? Why is this the case? Because both the opening position and the estimate for the period do not justify this level of cash out. In my humble opinion, this is worth a discussion with the local FD or controller.

Intercompany settlements refer to any settlements between entities that are part of a tax unity. It is important to understand that the tax payable belongs to the centralizing entity (within a tax unity) that has the actual (legal) liability towards the tax authorities. The other entities settling with this central entity only have a “normal” payable/receivable position, and should therefore always report a zero-opening position and a zero-closing position. The example below shows an entity that is not part of the tax group, as both the closing and the opening position are not 0 and there are no settlements. The opposite is also true: if you know an entity is part of a tax group and you see this example, the bookings are not correct and this is worth a different discussion.

Prior year adjustments are also useful to understand. These relate primarily to differences from the last period‘s estimates or tax audit adjustments. Recurring major differences can tell you something about the quality of the estimates, while a one-off material event indicates something has happened that is worth your attention. In our example, the prior year adjustment seems less material (0 and 8,184).

Other should state any unclarified non-material items. Obviously, the material amounts should never have the “Other” label. If the material amounts are labeled “Other” you should be worried, as this indicates weak controls or a cry for help…

The Closing position is the add-up of all the before and, in our example, the resulting receivable for the tax authorities of an unbelievable 596,157 … are you wondering where this story ends? Ask your CFO

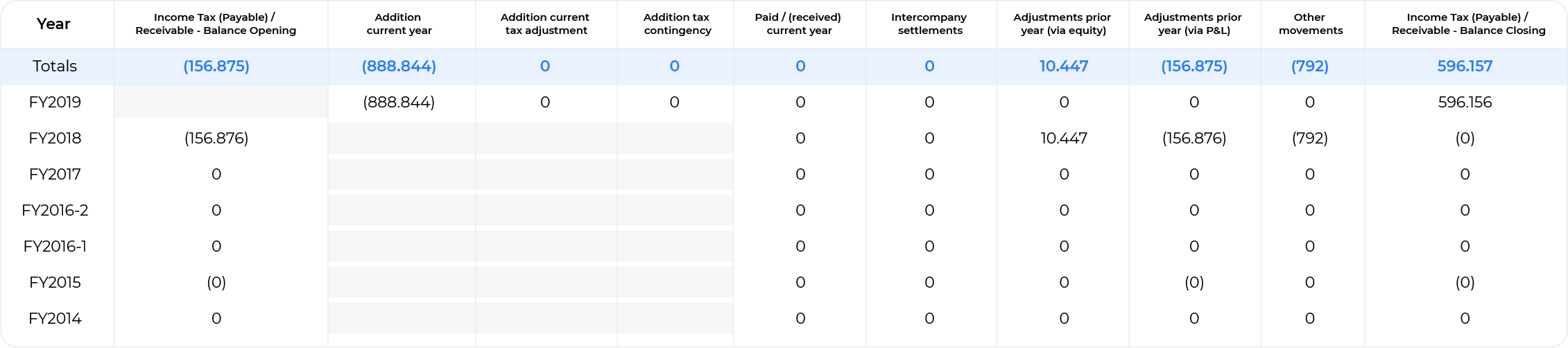

I would like to add a final note on the tax payable /(receivable) position that is worth remembering. One would expect that the tax payable /(receivable) position is the easiest one to follow, as you just need to follow the money. However, in practice, this position is often blurred with unknown historical positions or even tax payments that should not be in the tax payable /(receivable) position, as they relate to non-income taxes (e.g., VAT, wage tax, etc.). My position is straightforward: any item in this position must be (legally) linked to an actual income tax liability or income tax claim. If the liability or claim cannot be supported by sufficient proof, there is only one possibility… release it! A lot of EPS-interested stakeholders do not like this, as it affects the tax in the P&L and thus the effective tax rate. In order to ensure that it becomes crystal clear whether the tax payable /(receivable) positions are contaminated, we can flip the tax payable /(receivable) position from a vertical to a horizontal view and add the accounting periods beneath.

Click on the image

This period layering enforces users to explain the tax payable /(receivable) position per accounting period.

If a position does not move in a given period or multiple periods, it should be clear that something is off.

Hopefully, you now have a better understanding of how to answer the question: “Can you explain the income tax payable position on a balance sheet and the movement from the (tax payable) opening balance to the closing balance for a fiscal year? Does this apply for the entire group and country by country?”

I am happy if – out of all of the above – the only thing you remember is that it should be easy to Follow the money in the tax payable /(receivable) position!

Need some help? TaxModel is contributing to a more transparent tax world. We are building TaxProof 2.0, a standardized tax accounting solution that is accessible and affordable for companies of every size!

So, as the CEO, ensure your company pays its fair share of taxes and be transparent about it! This is the only way to prove that you are a socially responsible corporation!

Good luck!

Hank Moonen

CEO/Founder TaxModel

Hank Moonen

CEO/Founder TaxModel International

www.tax-model.com

Previous blog...

Subscribe to receive the next articles per mail

Join our journey to a more transparent tax world. Sign up and stay up-to-date on the latest developments around TaxProof 2.0.