Dear Tax Director,

At TaxModel, we understand your position. You are responsible for managing your Group‘s entire tax domain; you try to keep your workforce happy while meeting deadlines, maintaining quality, and monitoring the costs. It truly is a lot of work. Within the international corporate tax domain, the most important area is transfer pricing. The BEPS Action Plan represents the most significant change ever to the international corporate tax landscape. It is an issue for all corporations that trade across borders, as well as for some that don‘t. Businesses now need to identify where they are at risk and take appropriate action.

We are now a few years post-BEPS, and your company has probably gone through all the major transfer pricing designs, implemented a global policy and you are more or less compliant with the mandatory three-tiered documentation levels. This is the period when all of your hard transfer pricing work is transitioning a routine workstream called transfer pricing compliance. But how are you coping? Your CFO may have approved spending a small fortune on tax advisors in past years, to assist you in becoming BEPS compliant, but that budget is now gone.

You and your stakeholders are fully aware that transfer pricing compliance is a routine job that should be taken care of as a commodity. Knowing all this, your painful job is determining how to change managing your transfer pricing workstreams into high-quality routine workstreams, all within a small budget. That is why TaxModel exists!

Why TaxModel?

We believe that the possibility to be in Control should be accessible and readily available. That is the soul of our vision. TaxModel‘s fundamental goal is to offer a range of solutions for managing your transfer pricing framework, while respecting your desire to take responsibility, ranging from 100% in-house work to a balanced mix of in-house and outsourced processes, all at incredible prices.

Insourcing or outsourcing?

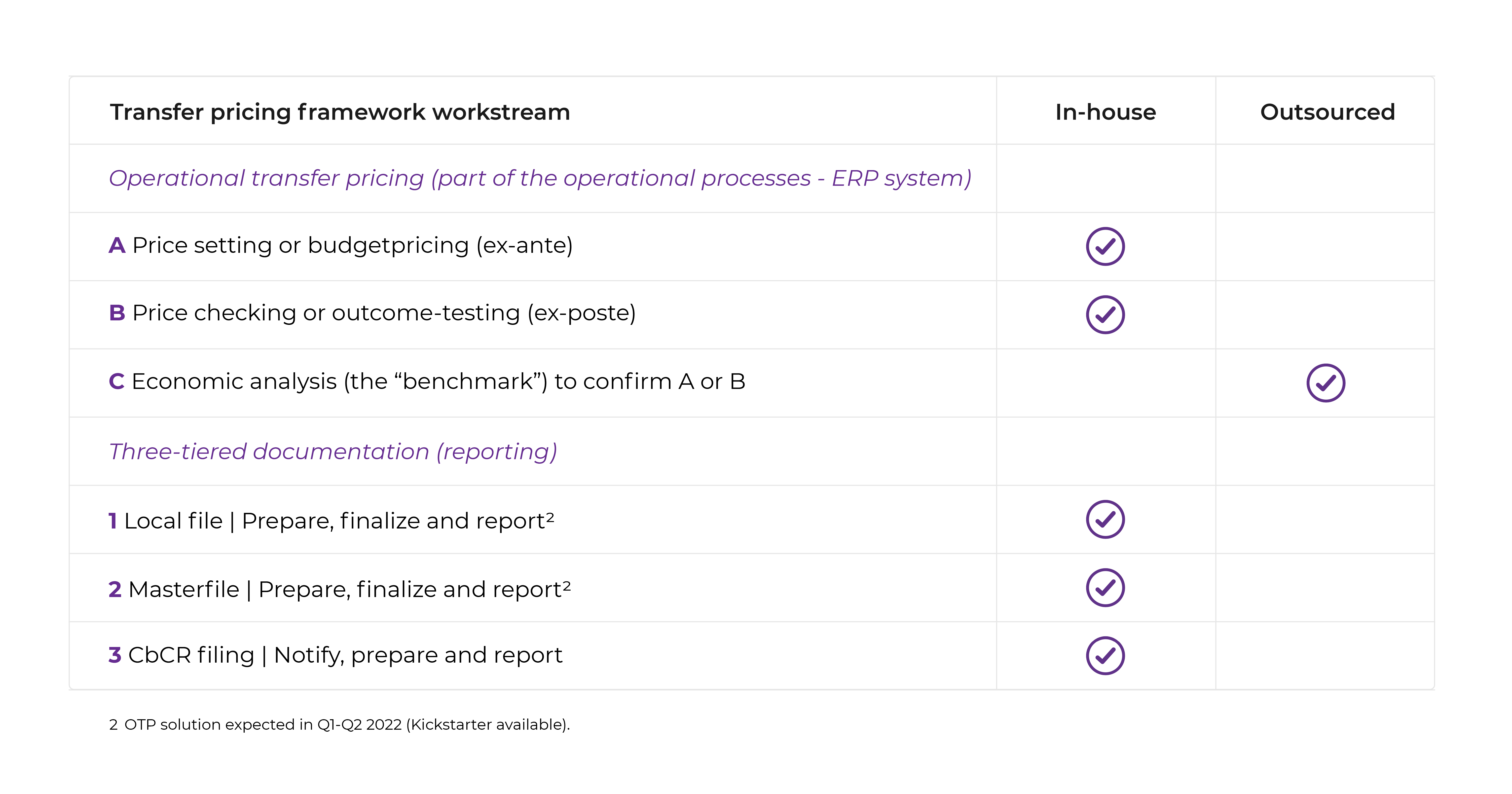

For all corporations with an in-house tax department, we believe that the ideal balance between in-house and outsourced processes should be as follows:

The rationale for the above division of work is that an in-house tax team is closest to the corporation‘s ERP system, financial data, and other relevant content for price setting, checking, and documentation. The only exception is the benchmark analysis. This workstream is almost always outsourced to third-party transfer pricing professionals. The rationale for this is that a benchmark analysis is time-consuming, requires a specific skill set, follows an atypical (non-tax) process that takes time to learn, and requires costly access to an acceptable database. The time investment, database costs, and the risk of errors combined with a limited number of benchmarks make it very logical that this workstream should be outsourced … to us.

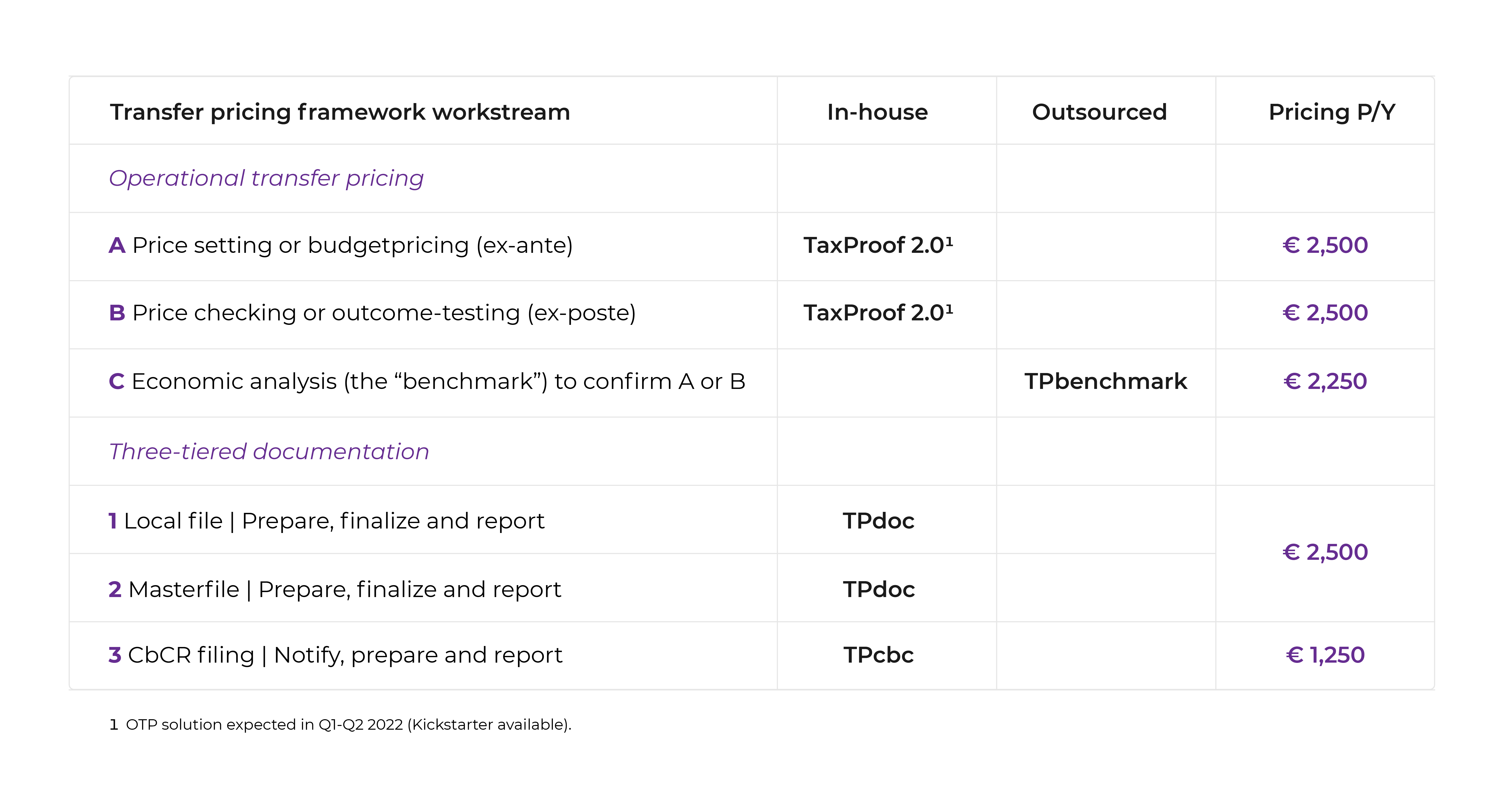

TaxModel‘s TPnext team performs benchmark services of the highest quality for multinationals ranging from very small companies to Fortune 500 corporations. Our globally unique TPbenchmark solution allows us to be 100% transparent in all steps of the benchmarking process, which we can then show you! Our benchmark studies are both accurate and flexible; we assist small multinationals up to Fortune 500 companies, and we process data from all top-tier data providers. Our technology, combined with our highly skilled workforce, provides the best benchmark studies at accessible pricing.

It may be that the size of your multinational does not justify a dedicated investment in an in-house tax department. If you do not have the luxury of in-house tax resources, TaxModel is there to support you with all workstreams by working closely with your finance department and local controllers.

What is your ideal way to achieve control?

Manually, technologically or mixed?

Most multinationals with in-house departments perform their transfer pricing compliance work manually, using Word or Excel. The biggest hurdles for corporations aiming to move away from manual to technology-based solutions are the fear of disrupting the existing processes, the time investment (for training and change management), and the costs. Again, that is why TaxModel exists! We have built transfer pricing technology that is the least disruptive, saves time, and is available at incredible prices.

Below we have outlined, for all corporations with an in-house tax department, the technology (in purple) that we would like to embed in your transfer pricing workstream:

Join our journey.

At TaxModel, we believe that the highest quality tax technology should be affordable for all multinationals, whether they are large or small. Besides our quality, clients also appreciate the transparency of our tools and pricing as well as our customer service. Our aim is to make you successful, and we invite you to join us on this journey.

Get to know in our webinar how TPnext can service you with maintaining your documentation and benchmarking activities. Or learn how you could perform these activities yourself, using our solutions: TPdoc, TPbenchmark & TPcbc.