One of the hardest aspects of transfer pricing is to reconcile the financial performance of intercompany transactions with the statutory financial statements of a company. Typically, this is done by performing a segmented P&L analysis. The key challenges within this analysis are:

- Determining what financial data should be collected from your client

- Segmenting the P&L and reconciling this with the statutory accounts

- Allocating the direct and indirect costs across the segments

- Assessing/testing the performance (i.e., operational margin) per segment

- Including the right audit trail within the local file

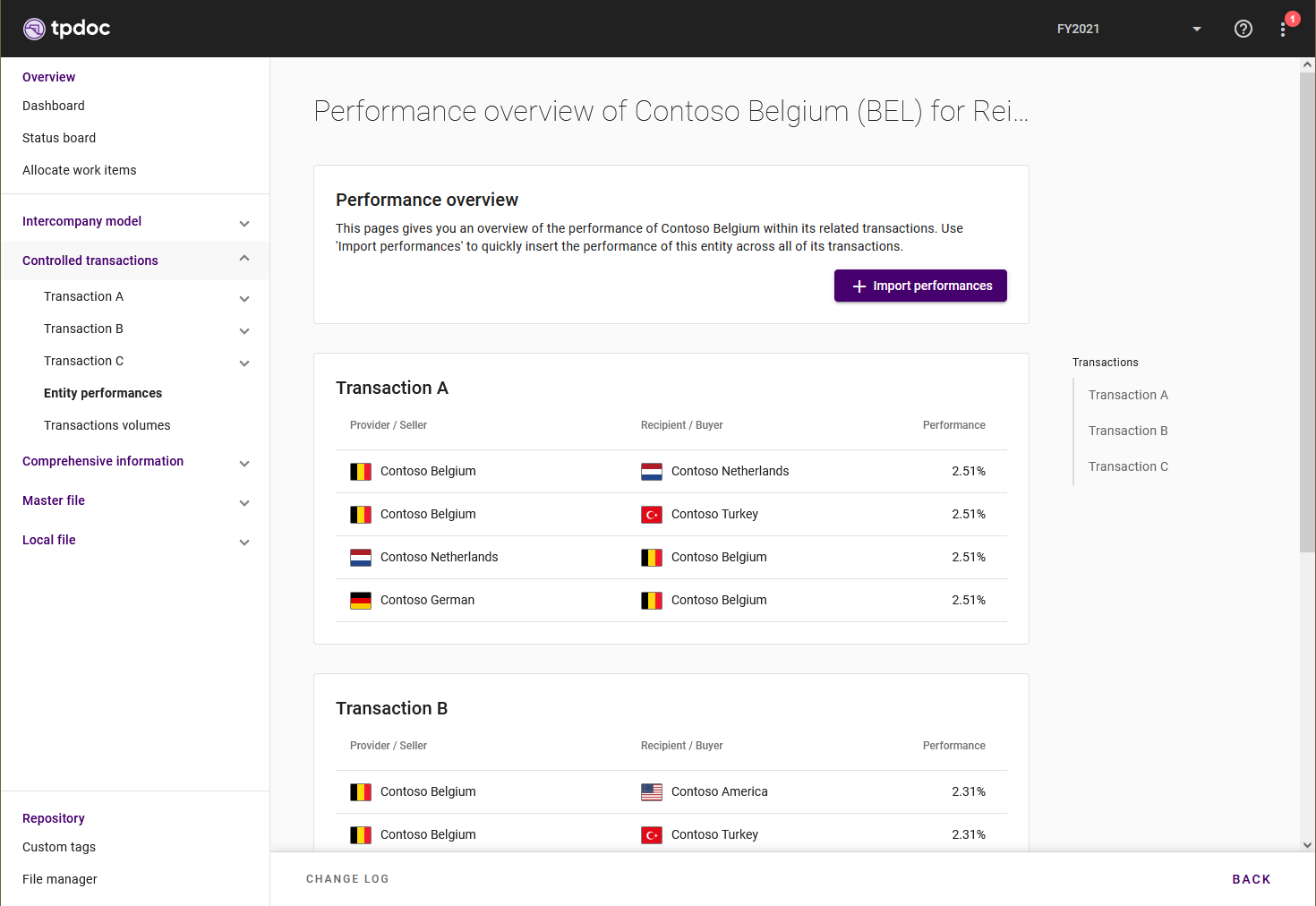

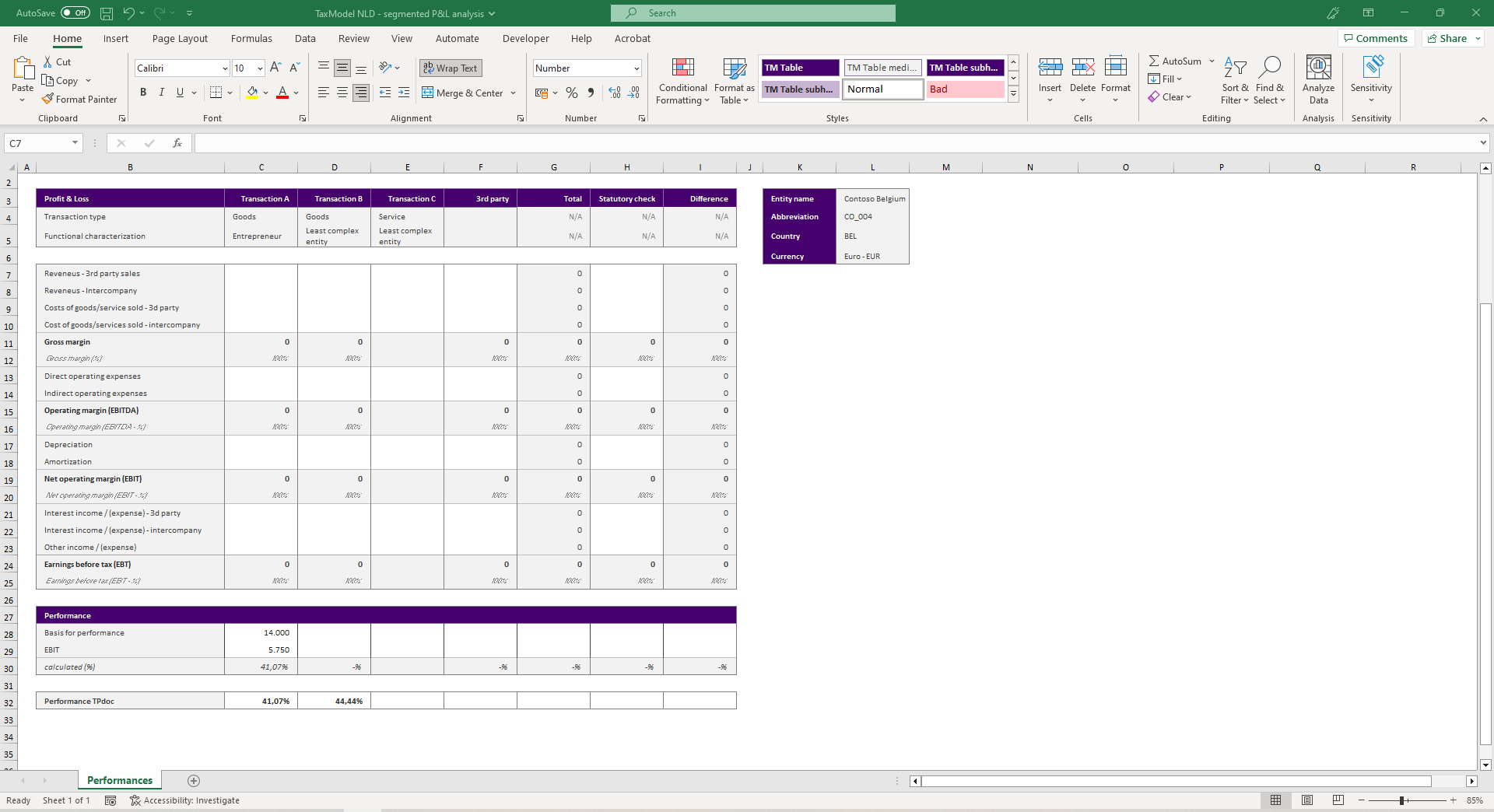

To assist you with this process, we have added a new feature to TPdoc. You can find this feature on a new page called “Segmented P&Ls” which can be found under your controlled transactions. The segmented P&L analysis can be performed on this page by downloading, enriching, and uploading an Excel file for each entity.

The segmented P&L Excel file can be downloaded from this page, and is pre-filled with the transactional information that has been entered in TPdoc. You will immediately recognize the transaction that this entity takes part in. We have also added a column to enter your third-party information, which means you can reconcile the totals with your statutory financial statements.

The enriched segmented P&L Excel file can then be uploaded back into TPdoc, to set this entity’s performance for each transaction. In addition, the file will be attached to the local file of the entity.

We hope this feature provides you with an easier way of understanding and interacting with your entities. A while ago, we conducted a webinar on this topic that might be helpful for you, so be sure to check it out! If you have any feedback, please don‘t hesitate to contact us.