Over the past months, a handful of governments issued their DAC6 technical guidances for intermediaries and taxpayers to disclose cross-border tax arrangements under the EU Council Directive on the mandatory automatic exchange of information (AEOI) in relation to reportable cross-border arrangements (DAC6).

Their guidances include:

- the requirement to encode reports with the UTF-8 format;

- data file transmissions through the mass data interface (ELMA);

- the XML schema file requirements; and

- definitions for technical identities and descriptions of total, partial, and subsequent report deliveries.

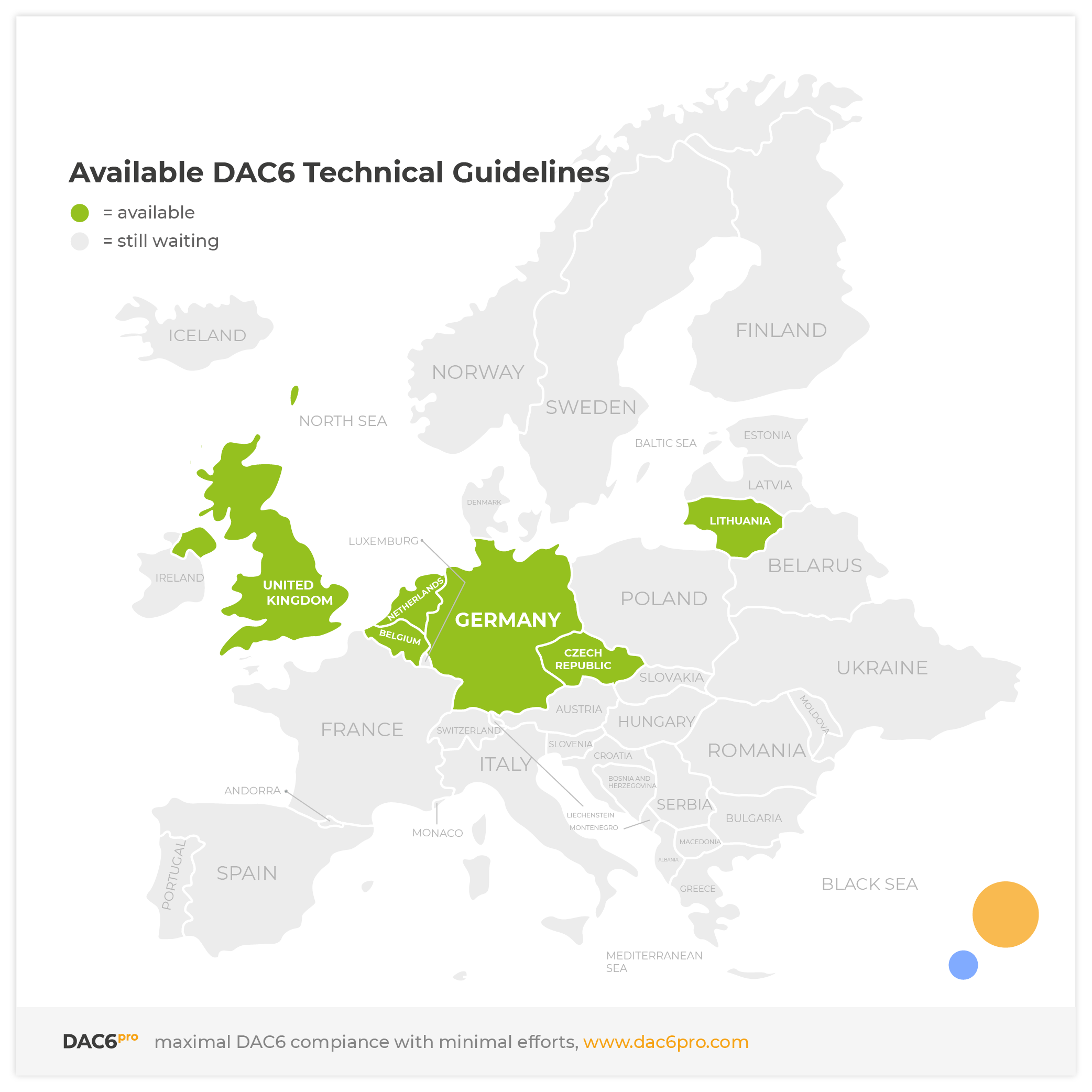

Below is a geographical overview highlighting the countries that have published their technical guidance. (last updated: June 17)

If you are interested in receiving one of the technical guidance, fill in your details in the contact form below and indicate which guidance you would like to receive.