Start your journey to achieve maximum DAC6 compliance with minimal efforts

Are you trying to figure out how you will meet the new mandatory disclosure rules? Becoming DAC6 compliant doesn‘t need to be a headache. Discover DAC6pro; it is intuitive, simple, and brings you as fast as possible to DAC6 compliance.

During our live event, hosted by Lars Brink and Seth Geurtsen, we will demonstrate how DAC6pro solves the challenges intermediaries and taxpayers are facing when complying with DAC6.

Think of challenges like:

- How to develop a control framework to comply with the new normal: DAC6

- How to report cross-border arrangements in time

- How to centralise and store all non-reportable and reportable arrangement data

- How to comply as an international collective to DAC6 in a consistent manner?

- How to not feel overwhelmed with 28 EU member state DAC6 interpretations and deviations

Agenda

- Introduction to TaxModel

- Software vs. Manually

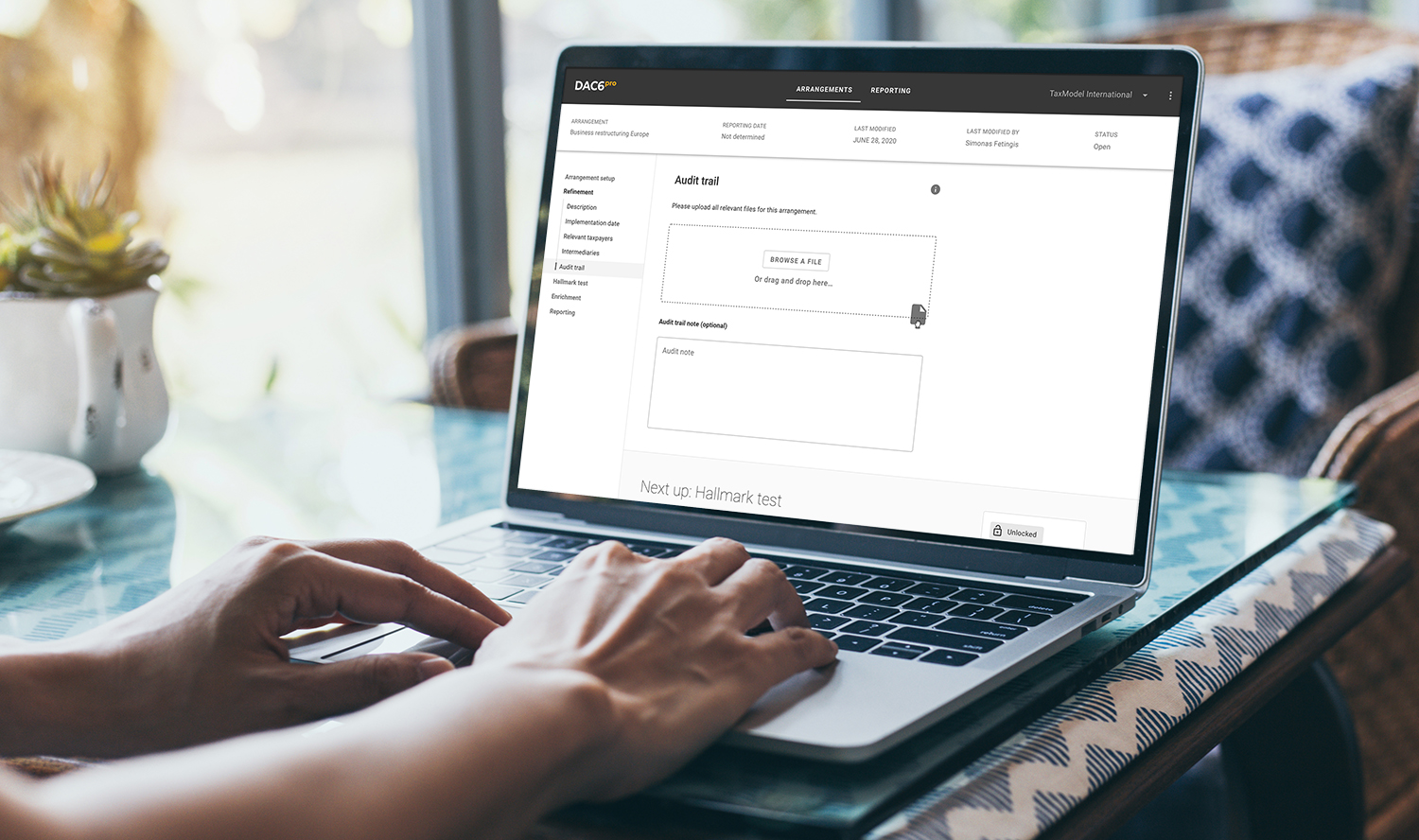

- Features/Highlights DAC6pro

- Try DAC6pro 7 days for free

- Live Q&A

Webinar Dates and Time:

- Thursday, September 10, 2020, 3:00 PM (CEST)

- Thursday, September 24, 2020, 3:00 PM (CEST)

- Thursday, October 8, 2020, 3:00 PM (CEST)

DAC6pro in a nutshell:

- Data storage/repository – to store all your reportable and non-reportable cross border transaction arrangements

- Assessment – to analyse and assess your cross border transaction. The smart-knowledge-base within the solution includes every 28 EU member-state hallmark interpretation and deviations

- Reporting – to help you report in any required format the jurisdiction (.XML, PDF, CSV)

- *add-on DAC6 enforce – to anchor, enforce, and monitor fee earners‘ actual compliance behavior

Get to know all the ins and outs of DAC6pro and join our DAC6 community. Save your seat today!

Can‘t make it? Register anyway, and we‘ll send you the recording later.