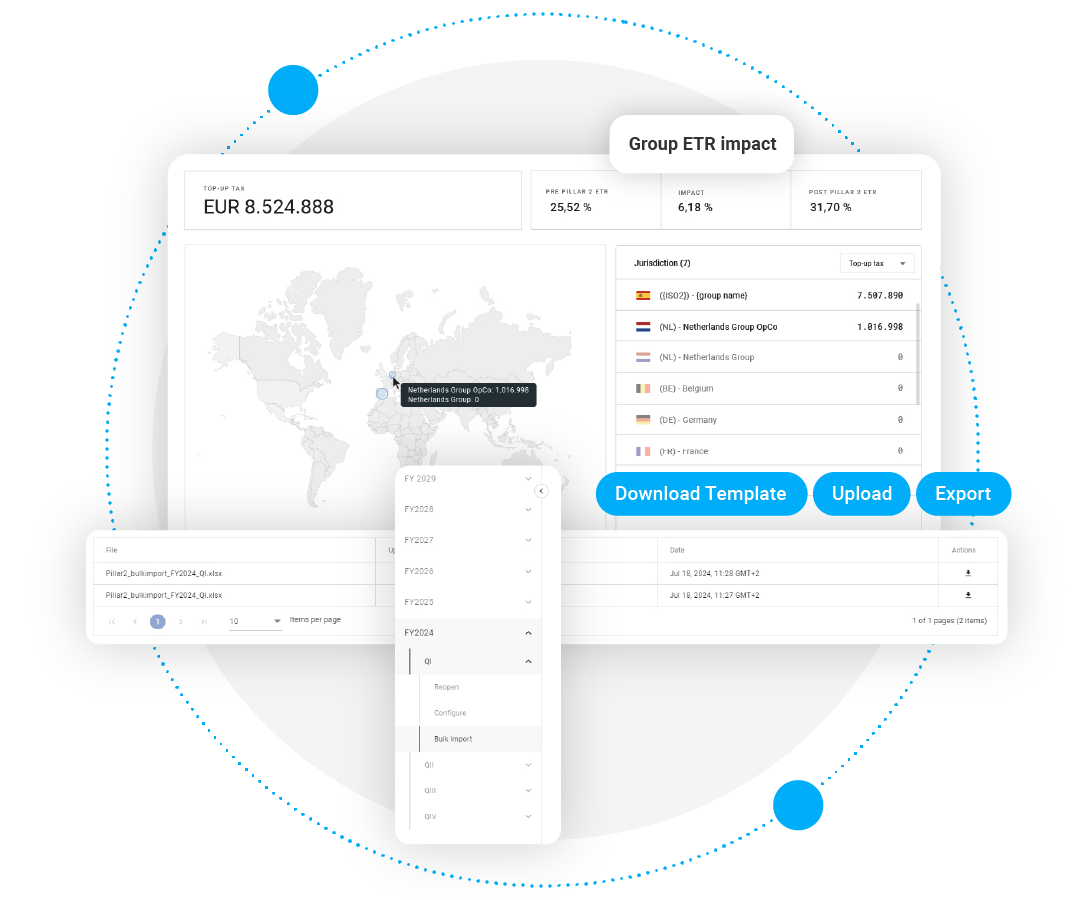

State-of-the-art Pillar Two SaaS Tax Technology

De-risk, simplify and optimise your global Pillar Two processes and reporting. Harness cloud technology to calculate and comply with OECD Pillar Two model rules and references

Integrates seamlessly for all your tax compliance

Get a single source of truth with the country-by country reporting and tax provisioning solutions on our TaxSuite platform strengthening tax control frameworks.

Collaborative software through single interface

Collaborate effortlessly with advisors and colleagues regardless of location using the same data, and depending on assigned roles; supporting you during planning, set-up, dry-run analysis, and filing phases.

Implementation tracker for QDMTT, IIR, or UTPR

See immediately if QDMTT, IIR, or UTPR are in force so it’s easy to know which rules are applied, without constantly monitoring for changes.

Embedded GenAI

Groundbreaking use of GenAI in tax tech helps uncover tax data insights for better informed decisions.

Tax Technology Experts

Developed by the same team that supports Alphatax, with unrivalled customer support and up-to-date Pillar Two tax technical content. Trusted tax logic for 30 years.

Unrivalled accuracy, clear control, and exceptional insights

Rise to the challenge of OECD Pillar Two regulations

Mitigating

risk

Assures compliance with all core calculations as per OECD model rules and references.

Creating opportunities

Automation saves time, creating operational efficiencies so teams can focus on the value add.

Generating

insight

GenAI powered tax data insights for better informed decisions.