We can help you prepare for FY23 IFRS reporting requirements on Pillar 2!

Pillar 2 Impact Analysis Support

The IFRS Board requires multinational groups to prepare Pillar 2 disclosures (under IAS12) for fiscal years starting on or after the 1st of January 2023.

Our objective is to help you prepare the FY23 Pillar II IFRS impact analysis for your multinational group. We will help deliver content for the IAS12 disclosures for your FY23 year-end close.

TaxModel’s Pillar 2 Impact Analysis Program includes assessing your current state tax provisioning process and, if and to the extent needed, we can assist with developing a solid tax accounting process. As part of our Pillar 2 Impact Analysis, we will advise you and, if interested, offer a permanent solution for future Pillar 2 compliance during 2024.

Pillar 2 Impact Analysis Support - Highlights

- Set up reporting entities and constituent entities in TaxModel’s Pillar 2 Impact Analysis Solution (based on your list of all legal entities, permanent establishments, and legal ownership chart with ownership percentages)

- Link Pillar 2 Impact Analysis Solution to your Excel based or data exported tax reporting packs (tax provision) of all reporting units as per IFRS

- Link Pillar 2 Impact Analysis Solution to Excel based IFRS consolidated trial balances (P&L and balance sheet) of all reporting units, including the opening and closing positions of tangible assets plus payroll costs

- Comparison of outcomes from TaxModel’s Pillar 2 Impact Analysis Solution with any prior Pillar 2 analysis you may have

- Identification of Pillar 2 data points

- Provide recommendations around Pillar 2 and tax reporting weaknesses, missing audit trails, etc

Program Exclusions:

– Opinions or advice around tax positions or Pillar 2 positions taken by multinational group

– Full integration with multinational group’s financial accounting systems

Pillar 2 Impact Analysis Support | Pricing

- One time program fee

*All prices are subject to an engagement and the general terms of TaxModel. Additional discounts may apply when purchased in combination with our transfer pricing and DAC6 solutions

Unsure where to start or want to learn more about the Pillar 2 offers?

Book a meeting with one of our tax technology experts.

Register today!

Pillar 2 Impact Analysis Solution

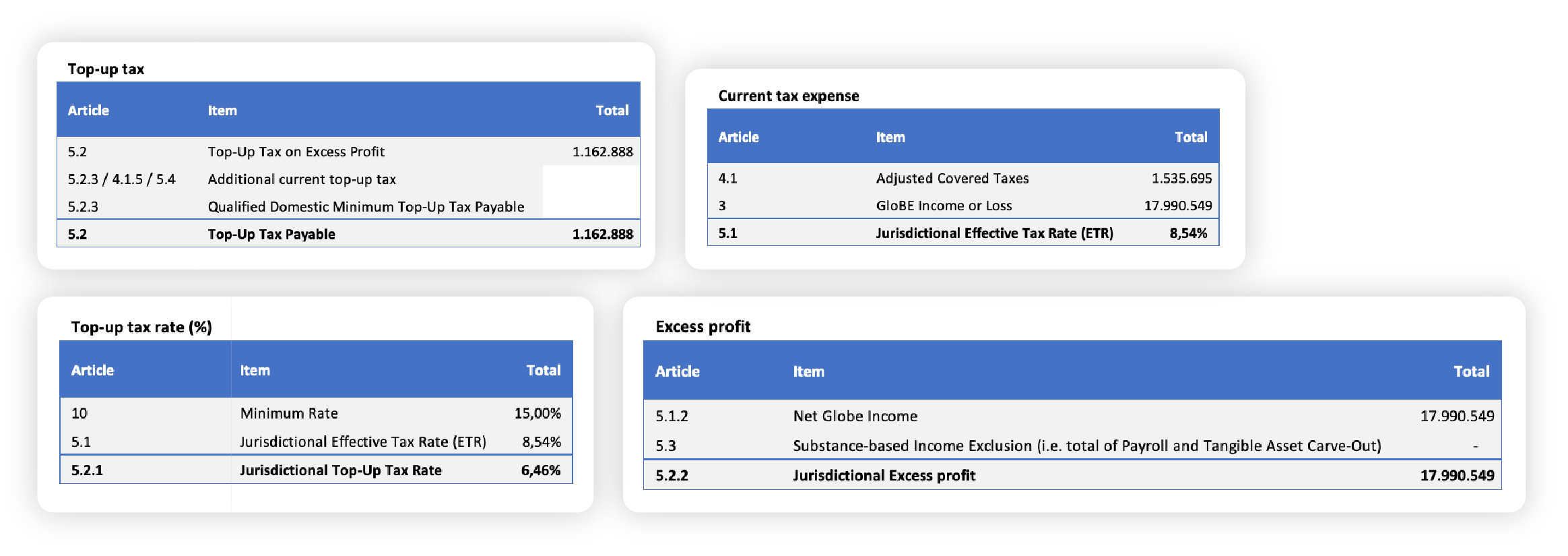

Need a comprehensive solution that covers the core flow of the Transitional Safe Harbour Tests and the Top-Up Tax Calculations to meet the IFRS Pillar 2 reporting requirements for FY23?

Our solution is designed for multinationals to perform an IFRS-compliant Pillar 2 Impact Analysis for FY23.