If you are assigned as a preparer you can open the arrangement to start the preparer workflow, the DAC6 assessment, and complete preparations for the arrangement filing

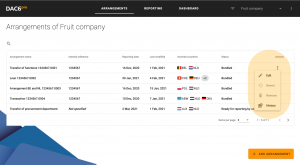

In the top navigation bar, you can find information about the following: the arrangement you are working on, reporting deadline date, last modification date, and the status.

The menu on the left will extend if it appears that the arrangement is cross-border and no tax types are applicable. You can use the menu to swiftly navigate to other sections of DAC6pro.

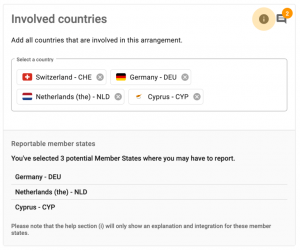

Please note that the i icon will provide access to the DAC6 knowledgebase; here, you will find general DAC6 interpretations, explanations, and deviations in the national legislation. In each section, this icon is available to support you in your decision-making process.

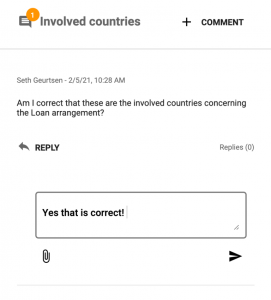

Next to the knowledgebase, you will find the chat functionality. Click + COMMENT to raise a question and initiate a dialog with the stakeholders in an arrangement. You can also use the chat function to store proof of your notification or to time stamp your report inquiry. Select the paperclip icon if you wish to store certain documents. Every comment and file is stored at the section level, i.e., the comments made in the Involved countries section are stored in that section.

If you have selected the wrong arrangement for the assessment, click on Arrangements, in the top menu next to Reporting and Dashboard, or navigate to the arrangement overview by clicking on the DAC6pro logo.

Everything you enter will be automatically saved in your DAC6pro account. Every section, i.e., each step/question, is a DAC6 reporting requirement and will be exchanged with the tax authorities. It is therefore necessary to provide information for each required field, if available. Once you set the “Disclosing country”, the system will automatically update itself in line with the Tax Authority‘s XML schema and will inquire about additional data, when necessary.

+ COMMENTS and + EXPLANATIONS are only used for internal purposes and are never included in the XML or PDF export.