All our courses are live through MS Teams or on location and are addressed to finance, legal, and tax/TP professionals with basic knowledge of transfer pricing.

Get up to speed quickly with our technology embedded Transfer Pricing Courses

We accelerate your digital transformation through highly enjoyable, actionable, and technology-embedded training programs. Learn everything you need to know about Transfer Pricing documentation and benchmarking in practice!

Discover our courses

TP Fundamentals & Tech Course

The Transfer Pricing (“TP”) fundamentals & tech course consists of 4 sessions for a total of 10 hours (excluding 6 to 8 hours of practice, tests). (10 PE points)

During the first day session, you will learn about the Dutch/International TP obligations, the post-BEPS challenges, and the determination and application of the TP methods. The importance of the value chain analysis (VCA) to determine how the value is generated within an MNE and the correspondence attribution of profits is also covered during the first session. In addition, by using practical examples, you will learn how to correctly support the arm‘s length remuneration of the intercompany transactions.

The course also provides an overview of the technological TP landscape during the second-day session. You will learn and experience how technology serves MNEs and intermediaries to achieve TP OECD full compliance and the best practices for the performance of benchmarking studies and the preparation of TP documentation.

Day 1 (2 ½ hours)

- What is TP and the arm‘s length principle

- TP Developments

- Post-BEPS Challenges for MNEs and Tax Authorities

- Value Chain Analysis

- Functional Analysis

Day 3 (2 ½ hours)

- Relevant aspects of the benchmarking process

- Databases

- Benchmarking Automation

- Benchmarking – Best practices

- TPbenchmark – Case Study

Day 2 (2 ½ hours)

- Transfer Pricing Methods (from practical examples)

- OECD three-tiered approach

Day 4 (2 ½ hours)

- Relevant aspects of the preparation of TP documentation

- Challenges of manual TP documentation

- Automation of TP documentation

- TP documentation – best practices – (OECD compliance)

- TPdoc Case Study

Transfer Pricing Benchmarking Course

This course is not yet available. We’re now finalizing the content and presentation.

Subscribe via the button below to get an update per email when the course is ready!

Transfer Pricing Documentation Course

This course is not yet available. We’re now finalizing the content and presentation.

Subscribe via the button below to get an update per email when the course is ready!

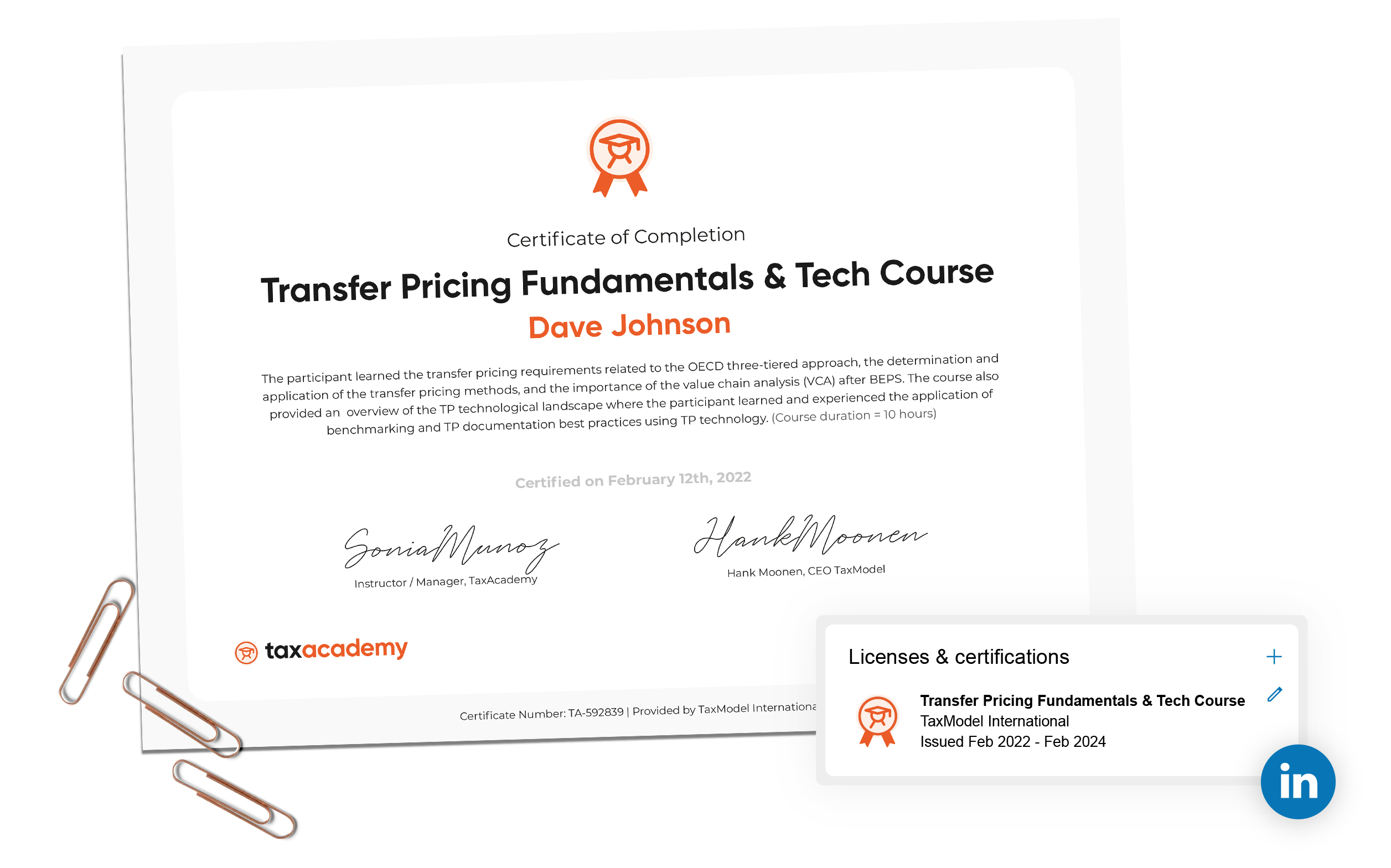

Get your TaxAcademy Certificate

Accelerate your career as a Transfer Pricing professional with expertly designed courses. Join our live lessons, complete the exam, and receive your TaxAcademy Certificate including multiple PE study points. Proudly share your certificate on your LinkedIn profile and upgrade your CV.

Why learn with TaxAcademy?

Elevate your Organisation

Accelerate your digital transformation

Learn and experience how technology helps you achieve your TP compliance goals. Get access to SaaS software tools and learn how to perform a benchmark study and how to prepare master/local files.

Elevate your Career

Improve your Transfer Pricing knowledge

Join our Tax Academy and update your TP knowledge. During our courses, you will learn by practical examples and how to apply and approach Transfer Pricing in your daily work.

Our TaxAcademy Team

Say hello to our talented team of Transfer Pricing Specialists and TPtechnology experts.

Download our training course catalog

Deep dive into our full product catalog for individuals and businesses.

Start your TP learning journey today

Accelerate your digital transformation through our highly enjoyable, actionable, and technology-embedded training programs. Sign up today and we will contact you as soon as possible to discuss the next steps!