We noted that there are a number of intermediaries (mainly accounting firms, law firms, and boutique firms) that already developed an in-house solution for their DAC6/MDR compliance. These solutions have however no XML conversion/reporting feature, the reason being that this is an ongoing IT effort. One would need an IT team that can program and maintain the compatibility with the various tax authority portals as well as updates/changes to these portals.

But there is good news for these intermediaries …

TaxModel will start offering a new service, DAC6xml-as-a-service. The service will allow users to easily convert and report single or multiple arrangements for multiple countries into one (or more) XML file(s). These can be used to file all these arrangements in one go for multiple tax authorities.

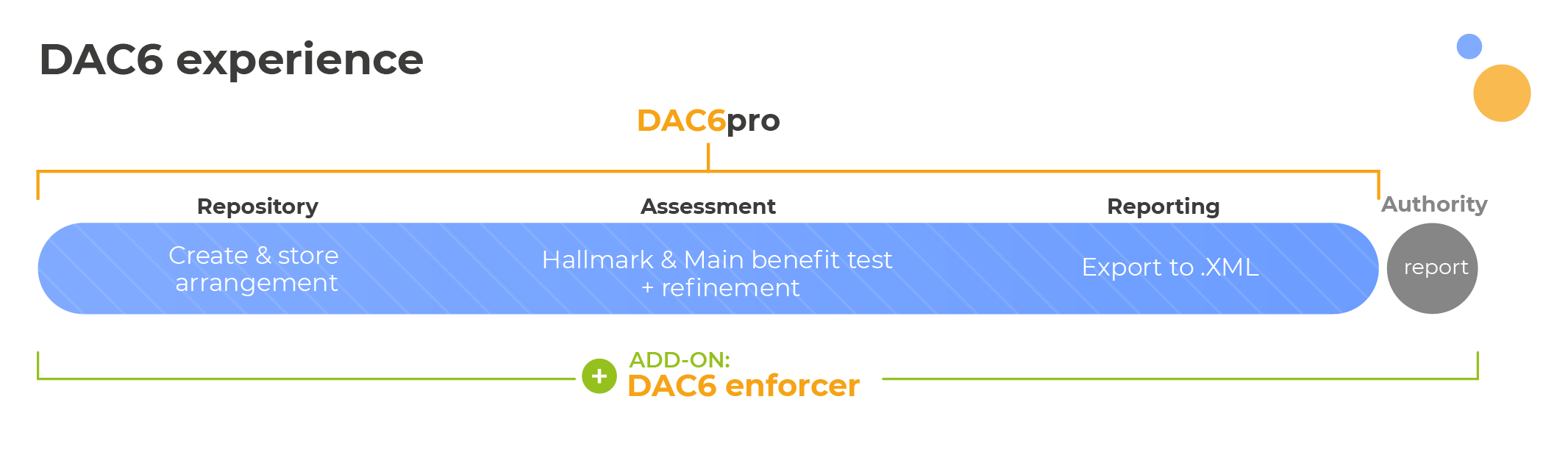

We will offer this conversion and reporting feature as a separate service (API) besides our DAC6pro solution, allowing users that already have a DAC6 compliance tool to integrate their data with this particular service.

To the extent that EU countries‘ XML technical guides are reasonably aligned with the EU Directive on Administrative Cooperation, we will ensure that our DAC6 XML converter is ready and kept up to date for MDR/DAC6 reporting in the EU Member States.

—

Interested in learning more about this DAC6xml-as-a-service?

Please contact us at [email protected]