Are you paying your fair share of taxes post-COVID? (Tax)Proof it!

Can you explain the difference between the cash tax rate and the effective tax

rate at the group level AND for each country?

(Tax)Proof it!

Dear CEO,

Did you carve out some time to analyze your financial statements with your CFO and, even better, did you analyze your company’s tax gap? If the answer is yes, are you satisfied with what your analysis unearthed? As mentioned in my previous blog, all answers are or should be in your company’s financial statements. Are you ready for some help on the second tax accountability question: “Can you explain the differences between the cash tax rate (CTR) and effective tax rate (ETR) at the group AND country levels?”

The video below shows a typical breakdown of a multinational’s tax position according to its P&L. The sections highlighted in blue calculate the cash tax rate % – i.e., the percentage when dividing Current Tax by Earnings Before Tax. The effective tax rate % is found when dividing P&L Tax Charge by Earnings Before Tax.

The cash tax rate indicates how much (of Earnings Before Tax) of the actual tax (in tax accounting terms, “Current Tax”) should be paid to the relevant local tax authorities for the period in scope. The cash tax rate is not often referred to as an essential metric, which in my view is a missed opportunity because:

The cash tax rate is the best indicator of the actual tax costs during a period.

If you believe that “cash is king”, cash tax is an essential metric since tax payments often eat more than 20% of your earnings. Private equity-held companies attribute a higher value to the cash tax rate (compared to effective tax rate). Why? Lower tax costs mean higher cash levels that lower the net debt position. When measured against EBITDA, net debt is an essential metric for PE investors and banks (banks often include a debt/EBITDA target in the covenants for business loans, and a company must maintain this agreed-upon level or risk having the entire loan become due immediately).

The cash tax rate is affected by all tax events, permanent and temporary, and offers a better “health score” of your company’s tax control framework.

For example, a cash tax rate that is materially lower than a country’s statutory tax rate may indicate the existence of material losses, high tax depreciation, tax incentives, dividend income, and other situations. These items may require extra attention to understand whether losses relate to incorrect transfer pricing, how long specific incentives last, how aggressive your tax policy is, etc. On the other hand, a cash tax rate that is materially higher than a country’s statutory tax rate may indicate non-deductible costs such as interest costs or (partially) unacceptable provisions for bad debt, obsolete stock, reorganizations, and the like. These items may require extra attention to understand whether the group’s financing structure is effective, whether provisions are commercially overstated or made too quickly, or whether your tax policy is too prudent, among other causes.

The effective tax rate measures the size of the company’s total income tax expense (relative to its Earning Before Tax) for the period in scope. Although the effective tax rate is considered an important metric, I believe it undermines a solid tax control framework and leads to an attitude of indifference with regard to cash tax:

The effective tax rate is an important metric for the Earnings Per Share (EPS).

Companies whose stock is listed assign a higher value to the effective tax rate (compared to the cash tax rate). Why? Stock exchanges are infatuated with EPS. If a company beats its estimates, its stock price is pushed higher even though earnings are easily manipulated by different accounting methods and/or by hiding or delaying expenses. Taxes also play a significant role in the final EPS. A company with a 25% tax rate one year and paying 20% the next will create the illusion that growth has exceeded expectations when, in fact, the business did nothing but get a tax break. The opposite is also true: A company paying 20% in taxes and then 25% the next year will obviously report lower EPS, and the market consensus will be that the business is slowing down.

The effective tax rate is not affected by tax events of a temporary nature.

It is a common misconception that all tax events affect the effective tax rate. As long as tax rates are constant over time, events with a temporary tax effect (i.e., reverse over time) do not affect the effective tax rate. Consequently, companies that are more focused on EPS, and less on cash, typically exert less effort to try to understand tax events that are temporary in nature since they do not see the value in that from an investor‘s perspective. Similarly, although having to wait to claim a loss is not ideal from a tax perspective, it will not affect the firm’s effective tax rate. In contrast, permanent differences and tax credits do affect the firm’s effective tax rate as well as non-recognition of losses, whether positive or negative.

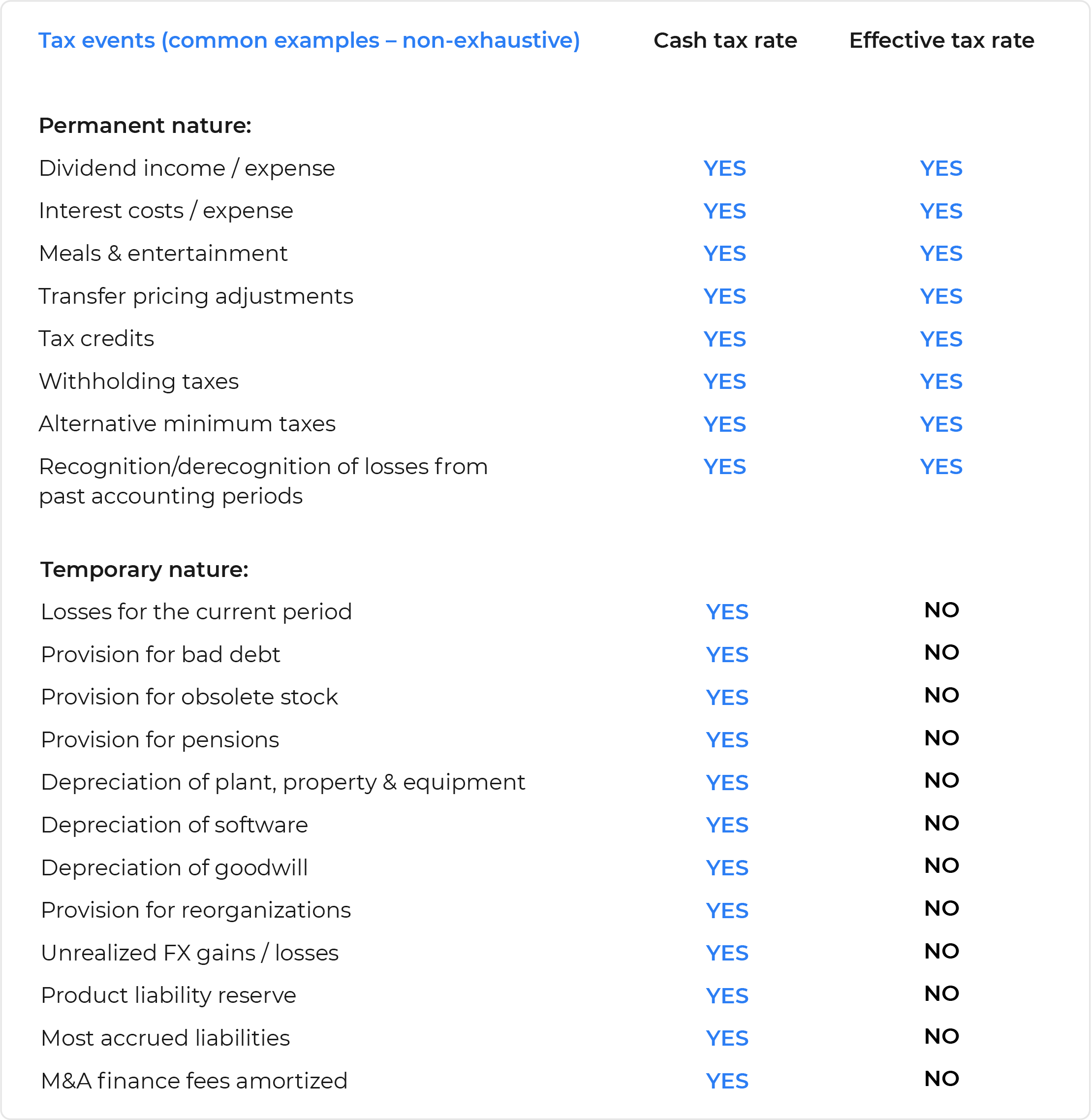

In summary, when you are analyzing the differences between the cash tax rate and the effective tax rate, you must be aware of the following:

Hopefully, you now see that the effective tax rate only tells part of the story when it comes to key tax events that are within your control framework and does not say anything about paying your fair share. What‘s even worse is that the effective tax rate metric increases focus on shareholder value (the “holy” EPS), instead of checking/monitoring whether you are paying your fair share. Also, it doesn‘t exactly motivate you to optimize your cash position…

By now, you hopefully have a better feel for how to answer the question, “Can you explain the difference between the cash tax rate and the effective tax rate at the group level AND at the country level?” I am already happy if – out of all of the above – the only thing you remember is that “Cash (tax rate) is King!”

Need help? TaxModel is contributing to the creation of a transparent tax world. We are building TaxProof 2.0, a standardized tax accounting solution that is accessible and affordable for any size company!

So, dear CEO, make sure your company pays its fair share of taxes and be transparent about it! That‘s the only way to prove that you are a socially responsible corporate entity!

Good luck!

Hank Moonen

CEO/Founder TaxModel International

www.tax-model.com

Previous blog...

Subscribe to receive the next articles per mail

Join our journey to a more transparent tax world. Sign up and stay up-to-date on the latest developments around TaxProof 2.0.