As we continue innovating and building to improve your experience in using TaxProof, we are delighted to announce the release of several new features. These enhancements are part of our ongoing commitment to provide you with the tools necessary to achieve precise and compliant tax reporting.

Book-to-book reconciliation: align group and local GAAP in TaxProof

Aligning financial data from local GAAP numbers to group GAAP has always been challenging, often leading to discrepancies in tax provisioning. Previously, it was impossible to reconcile group numbers back to local numbers within TaxProof, resulting in difficulties and inconsistencies. To address this problem, we have introduced a new feature in TaxProof that allows you to reconcile group GAAP numbers to local GAAP numbers.

This new functionality enables book-to-book reconciliation within TaxPack. To use this feature, simply enable the book-to-book sheet in the TaxPack setup. Once activated, you can reconcile numbers by providing local GAAP values for existing group GAAP numbers or by adding permanent and temporary differences between group GAAP and local GAAP. Additionally, the bulk import function now supports book-to-book sheets. Importantly, the calculations within the book-to-book reconciliation will not impact any other sheets, ensuring the focus remains solely on reconciling the book numbers.

This enhancement streamlines the reconciliation process, reduces discrepancies, and ensures more accurate alignment between local and group financial data. By enabling precise reconciliation, you can improve the accuracy of your tax provisioning, maintain compliance, and enhance the overall reliability of your financial reporting.

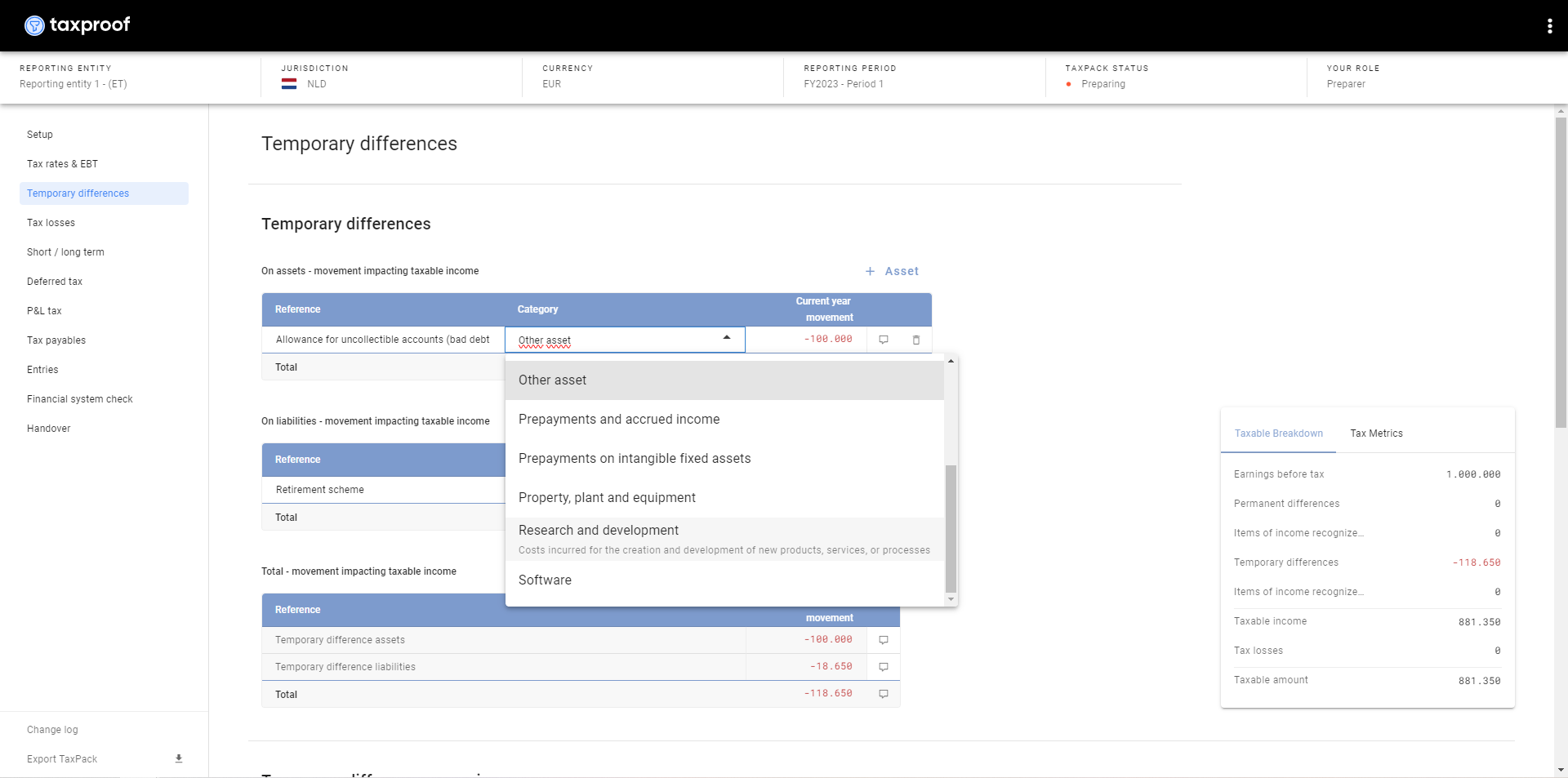

Customizable categories

Proper categorization of permanent and temporary differences is crucial for avoiding errors and penalties resulting from misclassification, ensuring the accuracy and integrity of financial reporting. Previously, users were limited to a predefined set of categories within TaxProof, which often did not cover the full range of needs for every company. To address this limitation, system admins can now set additional category options that can be utilized by all TaxPacks. Furthermore, to enhance flexibility and accuracy, it is now possible to add short descriptions to each category, helping preparers select the correct one. System admins can add new categories by navigating to the appropriate page via the dots menu at the top right.

These new features enable companies to achieve more precise categorization, reducing the risk of errors and ensuring compliance with regulatory requirements. This improvement streamlines the process, enhances the overall reliability of financial reports, and fosters greater trust and confidence among stakeholders.

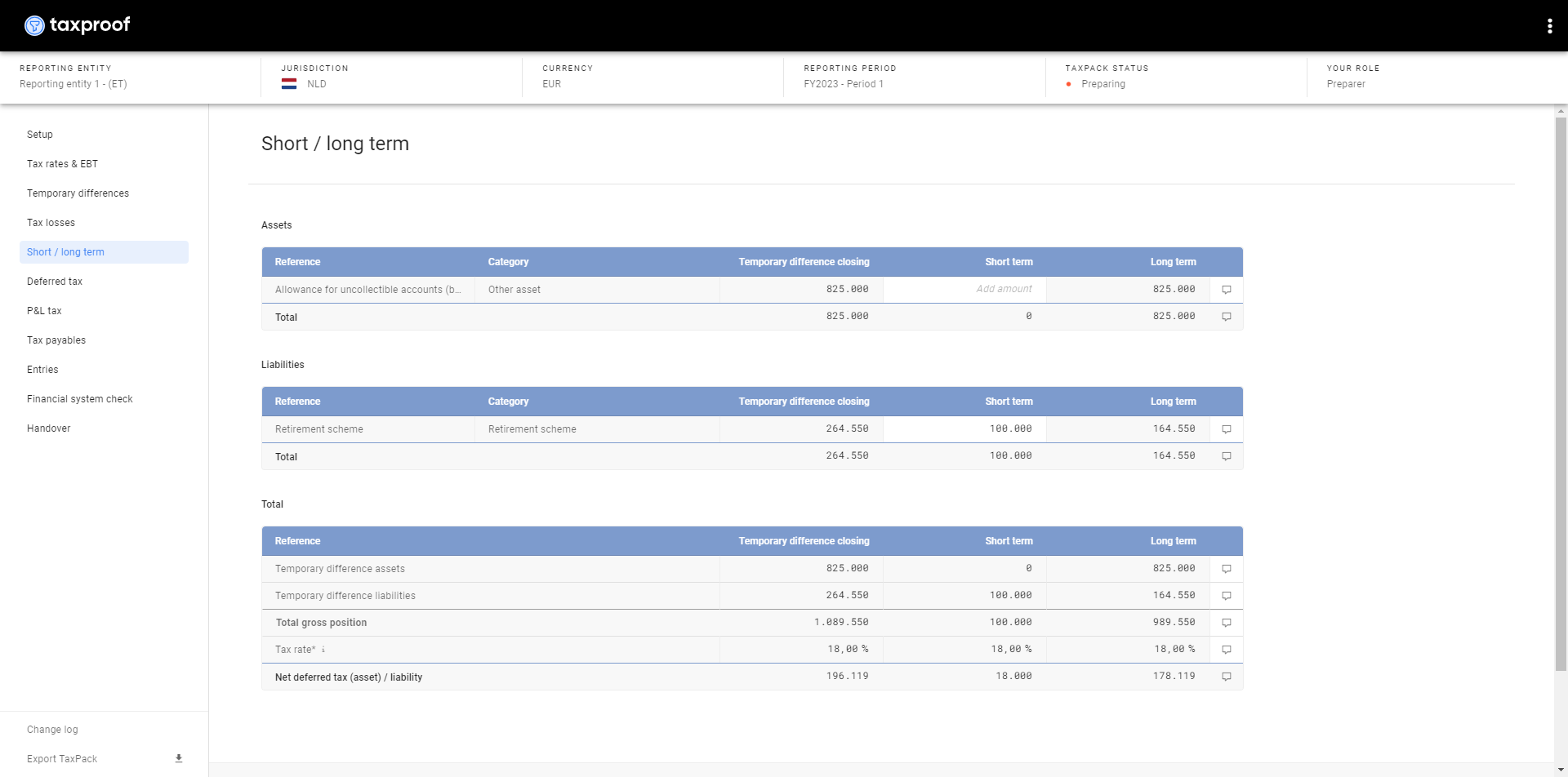

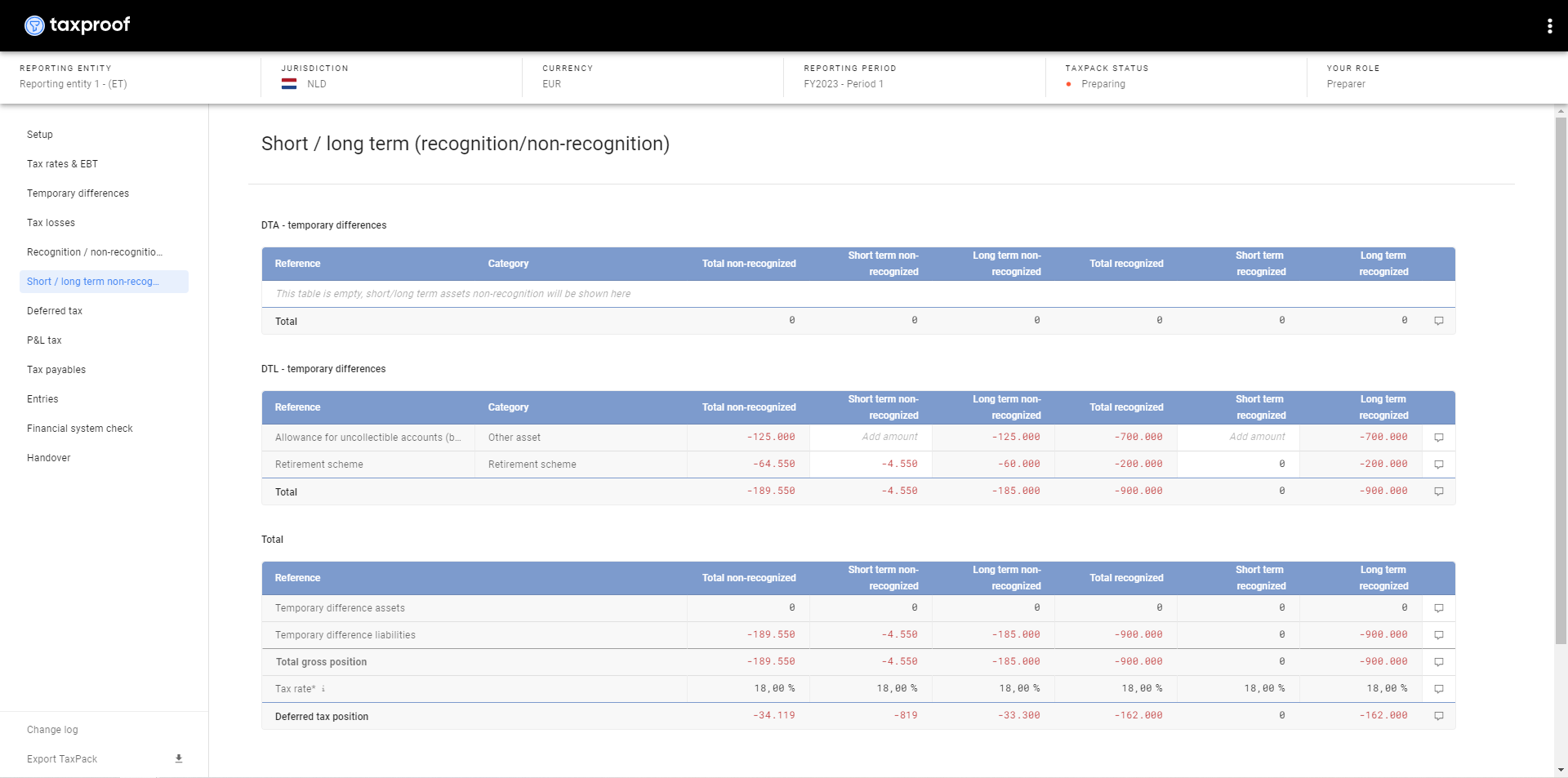

Short and long term classification

Ensuring compliance with accounting standards and maintaining financial stability requires accurate tracking of short-term and long-term deviations. This precision helps companies meet their tax obligations without unexpected shortfalls, ensuring liquidity and operational stability while proactively managing potential tax burdens. To assist in this, TaxProof allows you to activate a short/long-term sheet.

This new functionality can be enabled by system admins under system settings and will apply to all active TaxPacks, leaving closed TaxPacks unaffected. The short/long-term sheet defaults to classifying all items as long-term, but you can now specify which portions belong to the short-term category. Additionally, when the recognition feature is enabled, you can determine which parts of recognized and non-recognized items fall under the short-term classification.

By providing a clear and flexible way to manage these classifications, this update helps you achieve precise categorization, reduce the risk of errors, and ensure compliance with regulatory requirements.

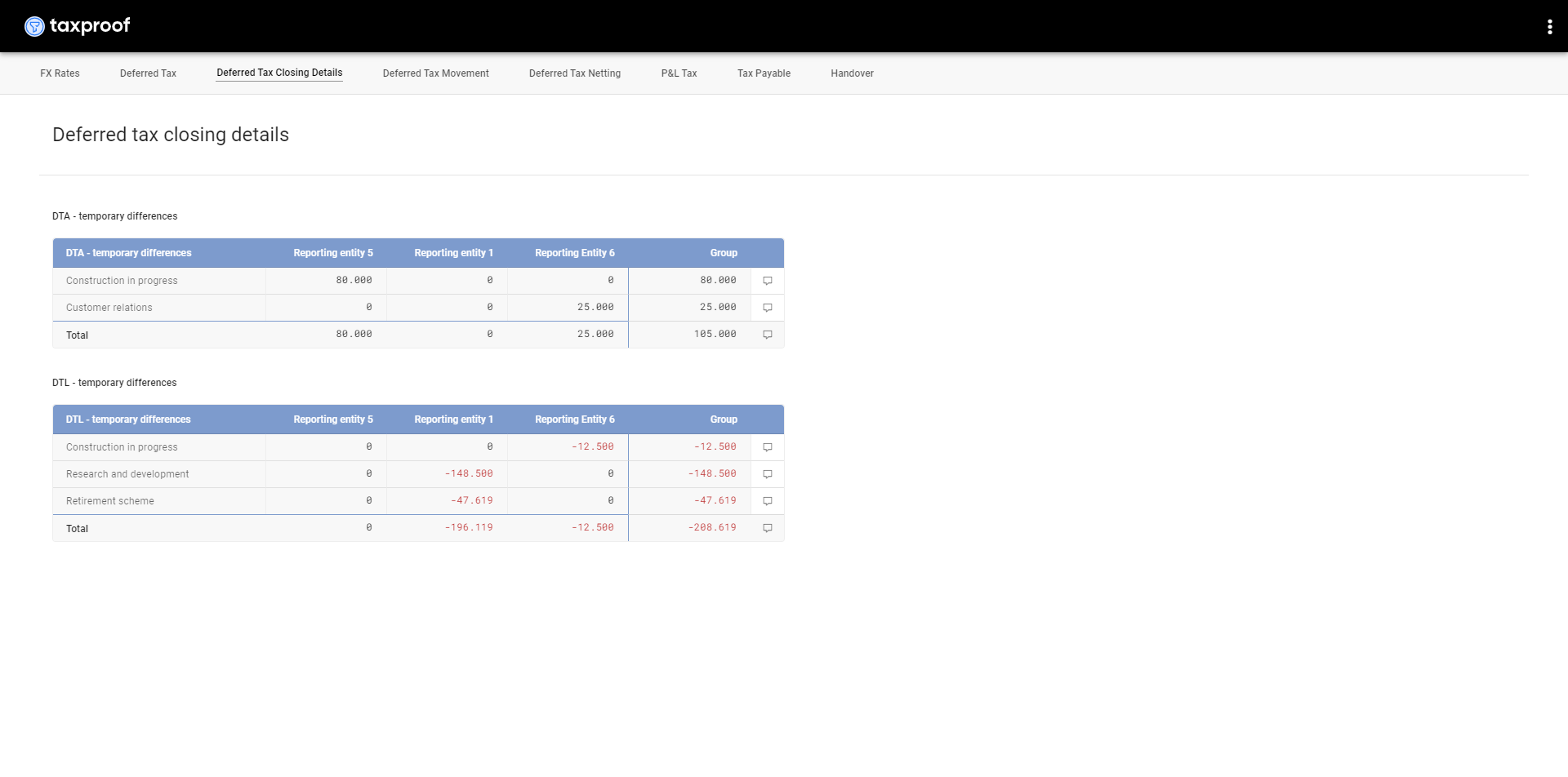

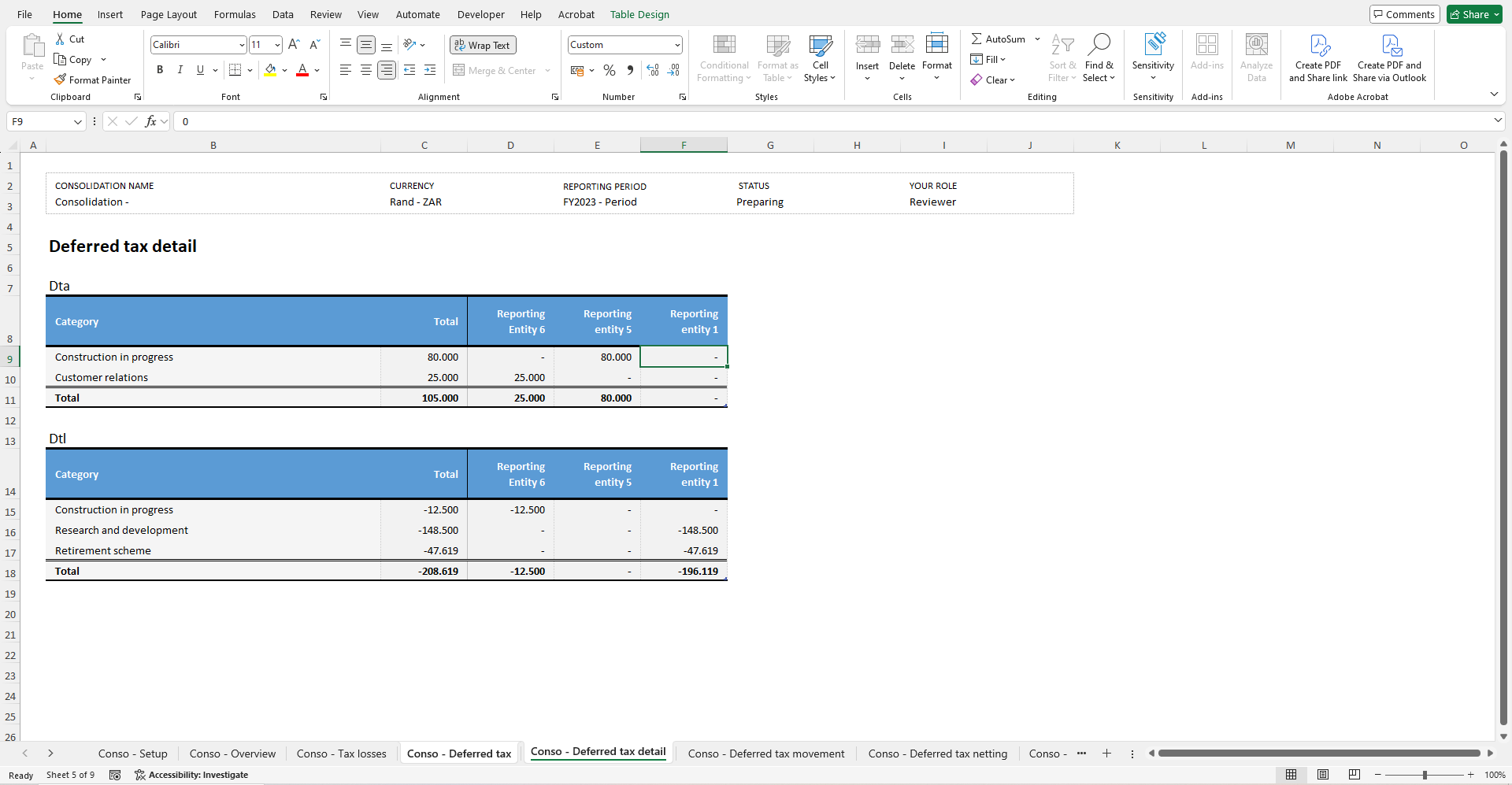

Deferred tax analysis and closing

Understanding the deferred tax movements at the consolidation from opening to closing balance is crucial for accurate financial reporting and tax compliance. To address this need, we have introduced two new pages in TaxProof: the Deferred Tax Movement overview and the Deferred Tax Closing Details. These new features are designed to provide deeper insights and enhance your ability to manage deferred taxes effectively.

Deferred tax movement

The Deferred Tax Movement overview helps you understand the consolidation of deferred tax movements from the opening, through the movement, to the closing balance. This overview shows how different TaxPacks are impacted by various movements, offering a comprehensive picture of the closing position.

Deferred tax closing details

To further assist your investigation, the Deferred Tax Closing Details page zooms in on the closing balance, displaying the different categories impacting it and their effects on each TaxPack. This detailed view allows you to analyze and understand the specific factors influencing your deferred tax positions, ensuring you can manage and report them accurately. With this granular level of detail, you can identify potential discrepancies, understand the underlying causes of tax movements, and make more informed decisions.

In addition to these new pages, we have also updated the export functionality to include the new insights provided by the Deferred Tax Movement and Deferred Tax Closing Details pages. This enhancement allows you to export comprehensive and detailed reports, further simplifying your tax reporting process.

These new pages and the updated export feature streamline your tax reporting process, reduce errors, and provide a comprehensive understanding of your tax positions. By consolidating all relevant information in one place, you can save time and reduce the complexity of managing deferred taxes. This ultimately fosters greater confidence and accuracy in your financial reporting, ensuring compliance with regulatory requirements and enhancing the trust of your stakeholders.

Set individual tax rates for temporary differences

Ensuring precision in tax provisioning is essential for maintaining the integrity of a company’s financial reporting. Recognizing that each temporary difference may have its own tax rate is critical for precise deferred tax calculations, reflecting anticipated changes in tax legislation, and aligning with global accounting standards, which mandate that deferred tax assets and liabilities be measured using the tax rates expected to apply when the temporary differences reverse. In the past, achieving this precision was impossible within TaxProof. However, with the latest update, it is now possible to set individual tax rates for each temporary difference.

To use this feature, create a temporary difference and navigate to the detailed screen. Under the movements section, you now have the option to apply a different tax rate.

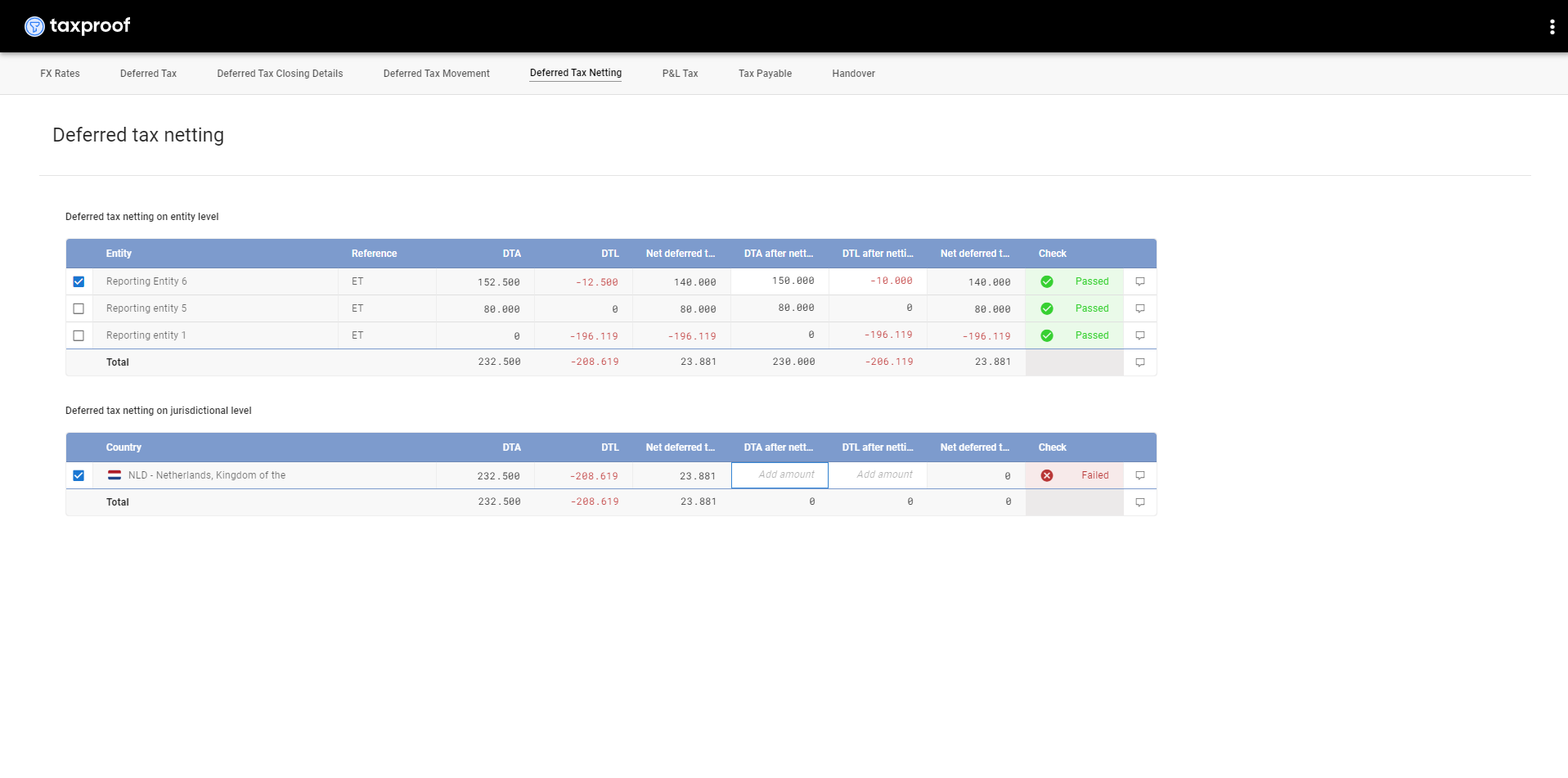

Netting of deferred taxes

Accurate financial reporting and compliance with accounting standards often require the netting of deferred taxes, a process that can be complex and time-consuming. To simplify this process, we have introduced a new feature that allows for the netting of deferred taxes directly within TaxProof. Here are the criteria for netting under the two major accounting standards:

IFRS (IAS 12)

- Legal Right: There must be a legally enforceable right to offset.

- Same Authority: Deferred tax assets and liabilities must relate to income taxes levied by the same taxation authority.

- Same Entity or Group: Deferred tax assets and liabilities must relate to the same taxable entity or different entities in the same group intending to settle on a net basis or simultaneously.

US GAAP (ASC 740)

- Legal Right: There must be a legally enforceable right to offset.

- Same Jurisdiction: Deferred tax assets and liabilities must relate to the same tax jurisdiction.

- Same Entity: Deferred tax assets and liabilities must relate to the same taxable entity.

- Classification: All deferred tax amounts are classified as noncurrent.

Previously, this netting process was done outside of TaxProof, meaning that not all your tax provisioning work could be done in one tool. We have now added an option to net deferred taxes per entity and per jurisdiction within the software. By default, the system assumes that all deferred taxes can be netted. However, if based on your interpretation, certain deferred taxes cannot be netted, you can easily override this by clicking on the checkbox in front of the item. To ensure data integrity, we have introduced a verification column to confirm that the netted totals match.

You can access this new feature within the consolidation section, where a new page has been introduced. Additionally, the netting results are included in the consolidation export.