TaxProof is evolving! We’re thrilled to unveil three new features in TaxProof. These enhancements reflect our ongoing dedication to providing you with the tools necessary for precise and compliant tax reporting.

Netting: deferred taxes and tax payables

Netting of deferred taxes (DTAs and DTLs) and tax payables simplifies financial reporting by consolidating your company’s overall tax position into a clearer, more straightforward format. etting reduces balance sheet complexity, enhances period-to-period comparability, and more accurately reflects the economic impact of tax obligations and benefits.

With this update, you can now perform netting at two distinct levels:

TaxPack Level:

- Deferred taxes: netting can be done both per line item and at the total DTA/DTL level.

- Tax payables: netting can be performed at the payable/receivable level.

Consolidation Level:

- Deferred taxes: netting is available at the total DTA/DTL level and across jurisdictions.

By default, netting is applied automatically, but you have the flexibility to override this setting and apply your own netting preferences. Please note that not all items may be eligible for netting, depending on regulatory and accounting requirements. These enhanced netting features streamline tax provisioning and planning, ensuring greater accuracy and a more precise representation of your company’s tax position.

Direct withholding taxes and undistributed earnings

Managing withholding taxes accurately is vital for compliance and financial integrity. Previously, our tool allowed users to report only on withholding tax credits, which often lacked the necessary context, making it difficult to recognize tax expenses immediately or track potential tax credits that remain unrecognized.

To address these challenges, we’ve introduced two new tables within TaxProof: one for Direct Withholding Taxes and another for Undistributed Withholding Taxes. These enhancements allow you to report withholding taxes more clearly and precisely.

-

Direct Withholding Taxes

-

Undistributed Withholding Taxes

These new tables help you efficiently manage and adjust withholding taxes directly within the tool, streamlining your tax provisioning process and enhancing accuracy. We’ve also updated the P&L and deferred pages to fully align with these new inputs. Note that any closed TaxPacks will remain unchanged and will not display the new tables or splits on the P&L page.

You can find these new features on the withholding taxes section of the tool and take control of your tax management with improved efficiency and precision—because your time and accuracy matter.

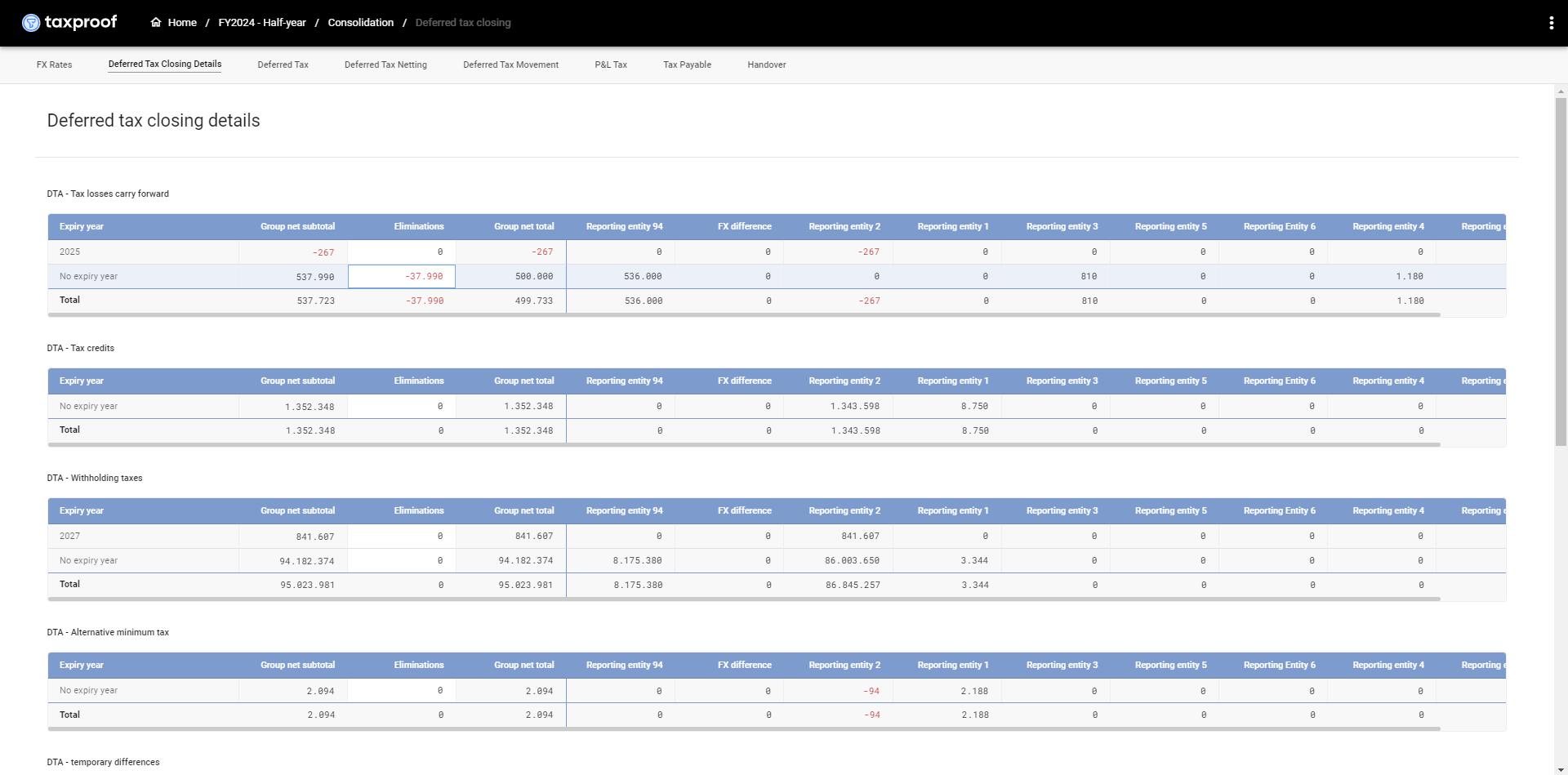

Eliminations on consolidation

At the consolidation level, it is crucial for financial statements to accurately reflect the true financial position and performance of the entire group. Our new elimination feature helps you achieve this by removing the effects of intra-group transactions and intercompany adjustments that could otherwise distort consolidated results. This enhancement improves the accuracy and integrity of financial reporting, ensuring compliance with accounting standards and providing stakeholders with a clearer view of the group’s financial health. With more reliable data, you can make informed decisions, optimize tax planning, and present a transparent representation of the group’s overall financial performance.