Pillar 2 elections explained

In this blog series we explain the Pillar 2 elections as prescribed in Global Anti-Base Erosion Model Rules.

Pillar 2 election to spread capital gains

The aggregate Asset Gain election, as per article 3.2.6 of the GloBE Rules, allows an MNE Group to spread net asset gains and net asset losses on sales of local immovable, tangible assets over the current year and the previous four years and to match net asset gains with net asset losses. The intention is to avoid volatility in the GloBE ETR calculation that could arise if one-off net asset gains or net asset losses reflected in the financial accounts flowed into the Pillar Two GloBE income or loss calculation. According to OECD Pillar 2 Commentary, this election is made if no tax is associated with the net asset gain. Simply put, the election lets MNE Groups spread their profits from selling certain local immovable properties. This rule helps avoid big drops in their GloBE ETR (due to a significant net asset gain being exempted from tax), triggering significant top-up taxes, which would not (or to a lesser extent) have happened if the profits were realized over a longer period.

Examples of local immovable property

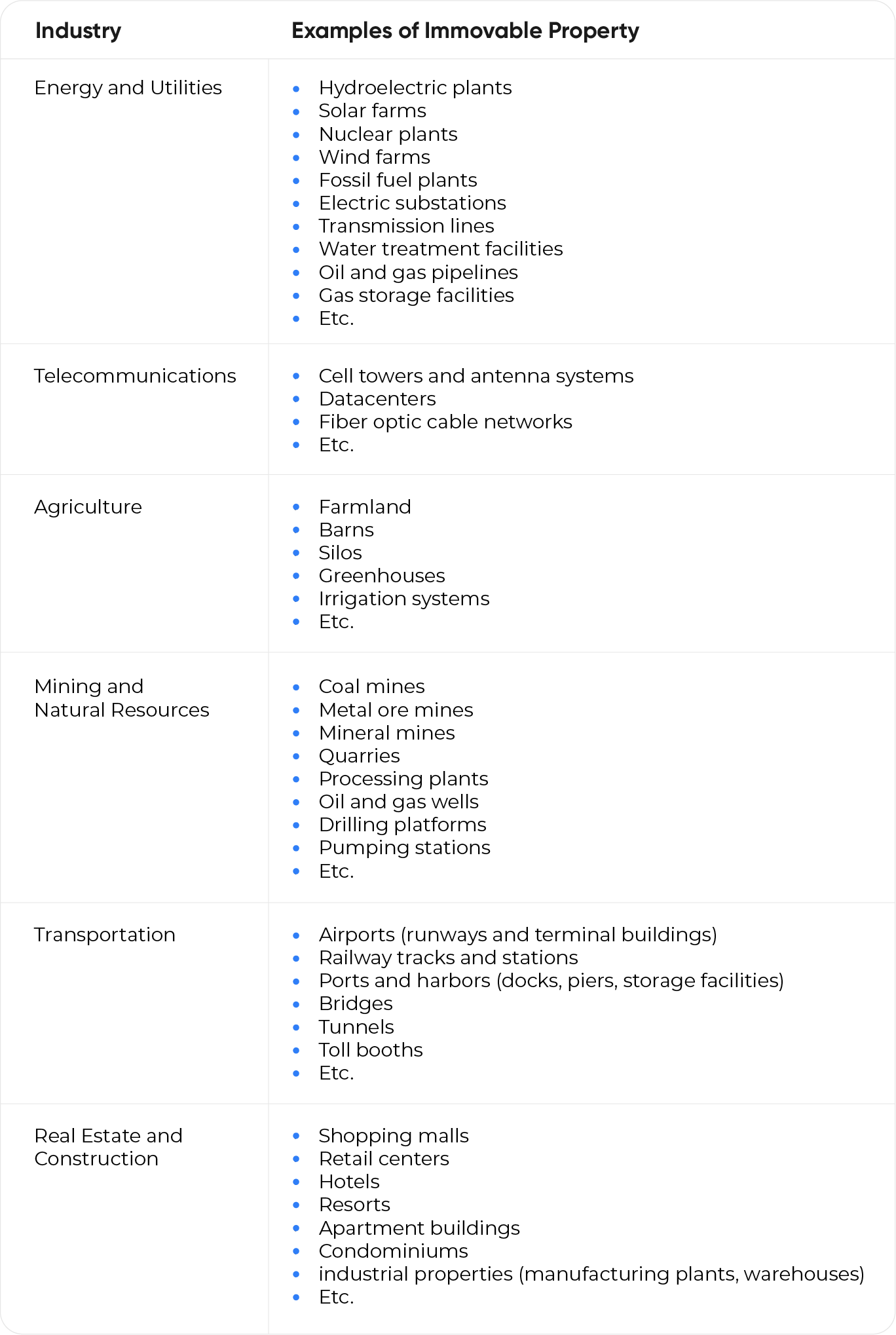

Under International Financial Reporting Standards (IFRS), there isn’t a specific exhaustive list of immovable property. However, immovable property is typically related to tangible assets that cannot be easily moved or relocated. In the context of IFRS, such assets are mainly classified within the categories of Property, Plant, and Equipment (PPE) and Investment Property.

Here are some examples of immovable property under IFRS:

Please note that this list is not exhaustive, and the examples provided may only cover some possible immovable property types within each industry. Additionally, some immovable properties may fall under multiple categories or industries.

How does the rule work?

The election works by allocating the total net asset gains from all sales of immovable, tangible assets in the jurisdiction (aside from intra-group transfers) to any net asset losses starting with the earliest year first (i.e., the fourth year before the year of the election). If there are no net asset losses or the net asset loss is insufficient to cover the gain, the remainder is carried forward and offsets against the next year.

If any net asset gain remains after offsetting net asset losses, it is evenly pro-rated over the 5 years and allocated to constituent entities based on their share of the total net asset gain in the election year.

An example

XYZ N.V. realized a loss on tangible net assets of € 5,000,000 in 2026. In 2028 it realized a net asset gain of € 25,000,000 on tangible assets. It made a Pillar Two GloBE election to carry back the gain in 2028.

Any covered taxes included in the tax expense in the financial accounts must be removed from adjusted covered taxes for Pillar Two GloBE purposes if an election is made.

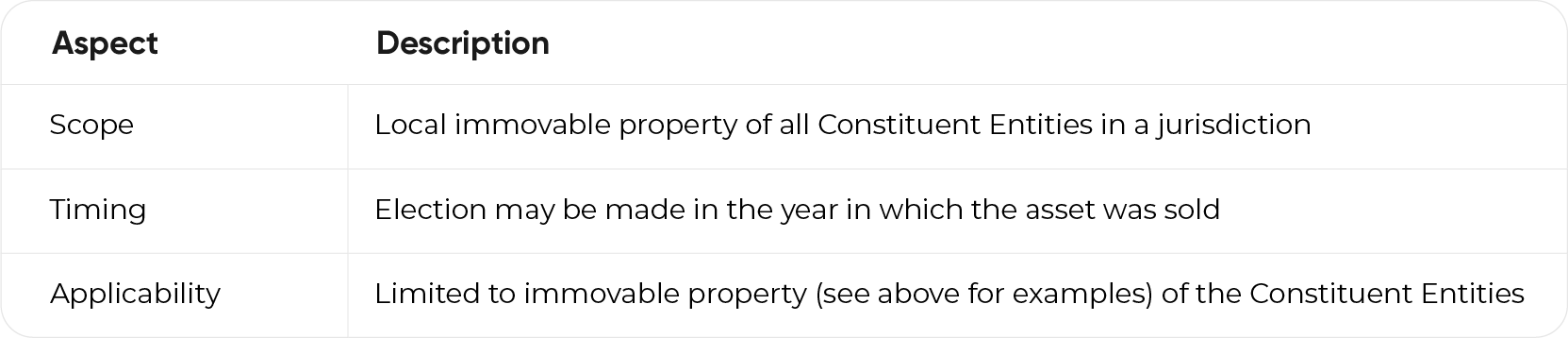

Specifics election

What needs to be clarified is whether the election requires 4 lookback years, i.e., is 2028 the first year this election can be made, or is it allowed to spread the gain over, e.g., over a period of 2 or 3 years?