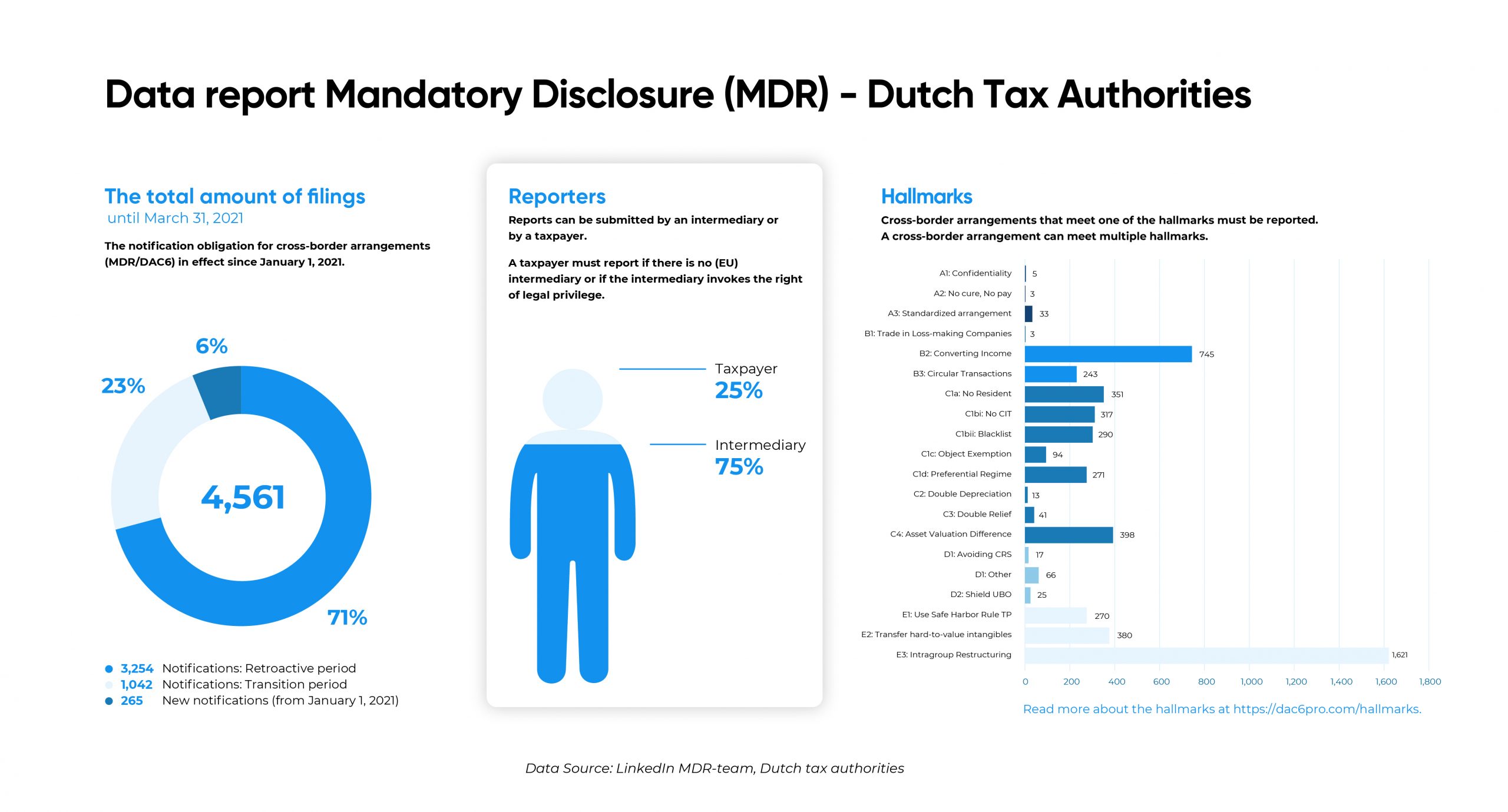

Based on feedback received from DAC6pro customers across the EU, we understand that various EU revenue authorities are evaluating the DAC6 reports. The overall sentiment is that the authorities are dissatisfied with both the volumes and the quality. For example, in the Netherlands, around 4,500 DAC6 reports were filed whereas the expectation was at least 20,000. Furthermore, the outline of the arrangements in the reports was often considered of a poor quality for making a proper assessment.

Image Source: LinkedIn MDR-team, Dutch tax Authorities

We also understand that the authorities are now preparing additional guidance and instructions for their authorized officers when using revenue information powers with regard to the DAC6 compliance of intermediaries and taxpayers. In various EU countries, revenue officers have already raised questions directly with taxpayers and intermediaries on the reports they have received.

Revenue officers are entitled to raise queries concerning the DAC6 information submitted to them. The new guidance and instructions deal with additional powers officers may exercise when they are unsatisfied with the information provided, and the procedure for requesting additional information. Additionally, officers may make a request with regard to the DAC6 assessment, administration and internal processes from intermediaries and taxpayers when they suspect a much higher volume and can ask for higher quality DAC6 reports.

The additional guidance for revenue officers sets out the requests officers may make and the orders they may seek when investigating the liability of a taxpayer. This includes requests for books, records and accounts, as well as explanations relating to DAC6 compliance. These requests can be issued to a taxpayer, and to the financial institutions or third parties connected with that taxpayer.

Do you have any questions with regard to the above article? Then schedule below a meeting with one of our experts.