The EU Member States are given the option to defer the time limit for the exchange of information, due to COVID-19. Explicitly, this deferral aims to address an exceptional situation and is not intended to disrupt the functioning of DAC6.

Now, Member States may take the measures necessary to allow intermediaries and relevant taxpayers to file information on reportable cross-border arrangements:

- between 25 June 2018 and 30 June 2020: by 28 February 2021

- between 1 July 2020 and 31 December 2020: by 31 January 2021

The first automatic exchange of information shall then take place by 30 April 2021. In case of marketable arrangements, the first periodic report to be made by the intermediary by 30 April 2021.

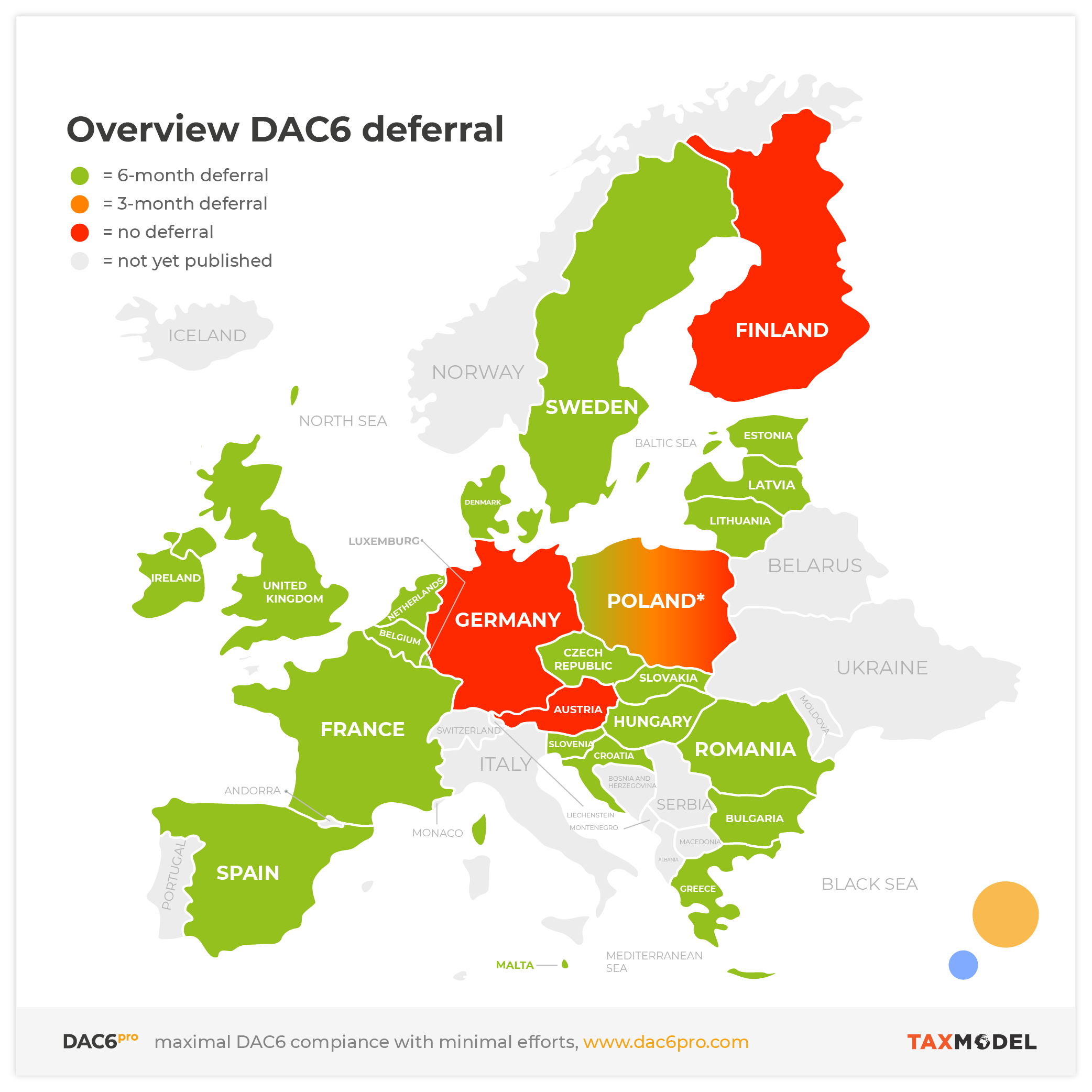

Below an overview of the EU Member States that have already made announcements.(last updated: July 27, 4:20 PM (CEST))

Other countries that have not yet completed DAC6 transposition into domestic law (such as Cyprus, Italy, Portugal, and Spain) are also expected to opt for the six-month deferral but have not formally announced their choice yet.

*Poland: deferral period depends on the role of discloser

**Austria: no deferral, but no penalties for late filing (until 31 October 2020)