We are excited to announce a significant update to TaxProof, with regards to the per Line-item tracking of deferred tax assets and liabilities on the recognition/non-recognition sheet

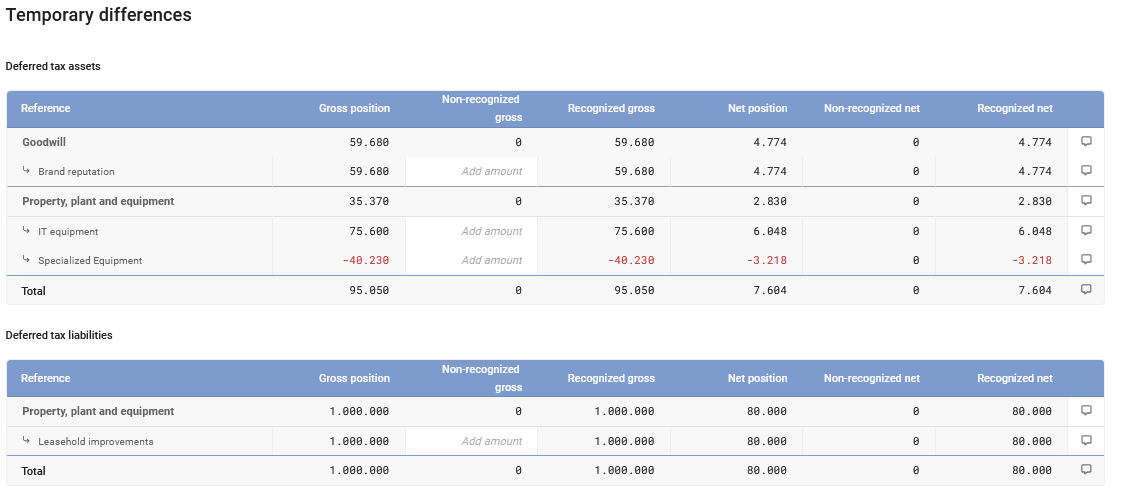

Traditionally, the recognition / non-recognition sheet grouped the deferred tax assets and liabilities by category. This could, in some cases, complicate the understanding of which specific items are non-recognized, especially when multiple items within a category are partially non-recognized.

To streamline this process and enhance clarity, TaxProof now allows non-recognition tracking on a per-item basis. This update ensures that each temporary difference is individually highlighted, providing a transparent view that aligns with best practices in financial reporting.

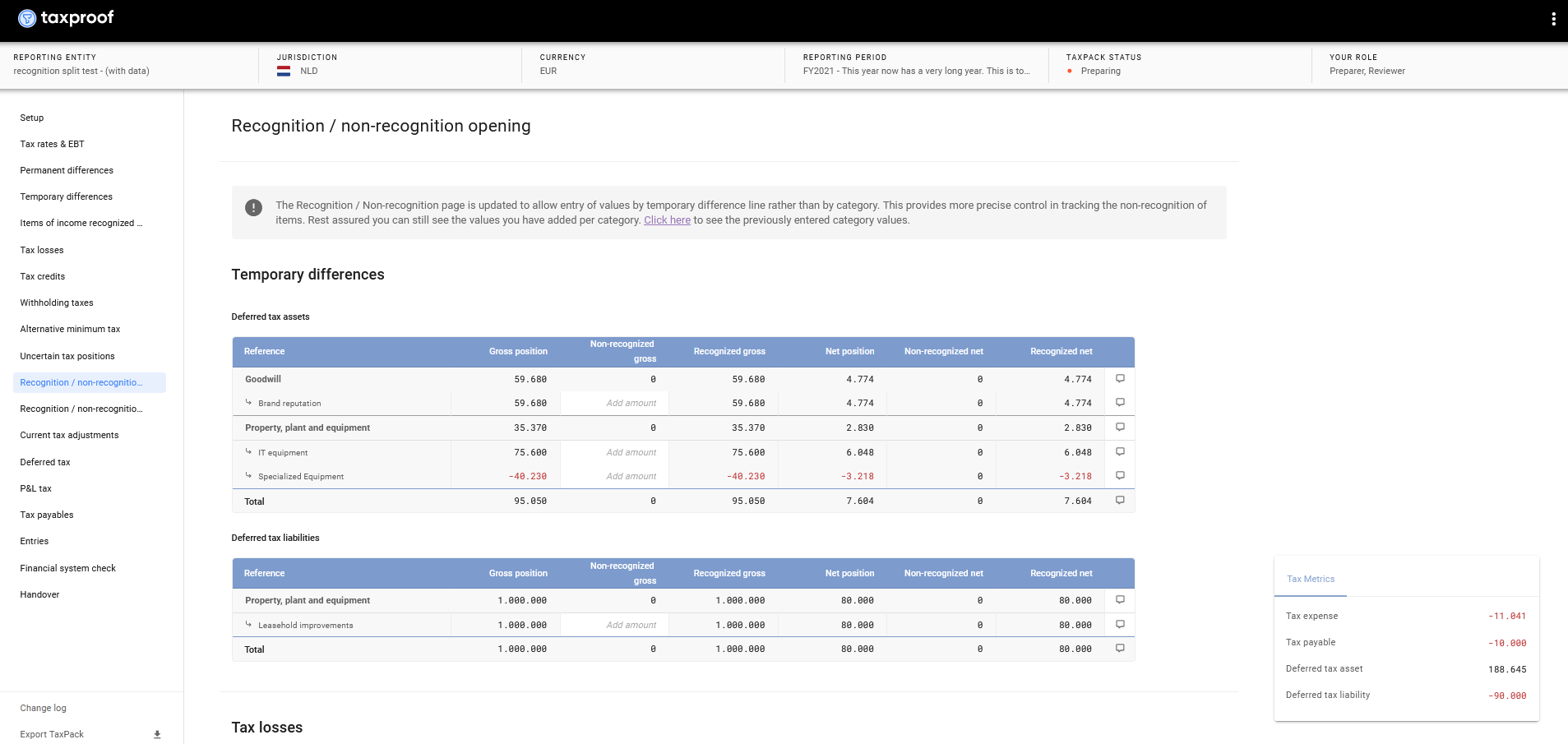

For continuity, we have maintained the existing categorization for closed TaxPacks, while open TaxPacks will automatically transition to the new detailed, item-level tracking. We have ensured that all previously entered data is securely preserved and remains readily accessible. Updated TaxPacks now feature a notification message and a link to retrieve previously entered values, ensuring smooth continuity and ease of access.

This feature lays the groundwork for upcoming functionalities, such as the ability to assign specific tax rates to each temporary difference and accurately calculate deferred taxes.